The first step in financial reporting is recording business transactions. The business transactions are first recorded as journal entries.

The goal of financial accounting is to issue financial statements.

This is Chapter 2 in Principles of Accounting. This chapter includes:

- Recording Business Transactions

- Debits and Credits Explained: An Illustrated Guide

- What is the Accounting Equation?

- Financial Statements: A Beginner’s Guide

- Recording Business Transactions YouTube playlist

For all the chapters, see The Ultimate Guide to Learn Accounting.

Contents

Financial statements

The steps to issue financial statements include:

- Identify business transactions.

- Record transactions in the journal. The journal lists all the transactions for the period.

- Post journal information to the ledger. The ledger shows the account balances for every account during the period.

- Prepare the trial balance from the ledger account balances. The trial balance lists all the account balances to prepare for the financial statement.

- Prepare the financial statements.

The three basic financial statements are:

There are four financial statements that each company prepares. The four financial statements are:

- income statement: revenues minus expenses equal net income or net loss

- balance sheet: lists all the assets, liabilities, and equity of a company

- cash flow statement: cash inflows and cash outflows

- statement of owners’ equity: shows the changes in equity on the balance sheet

Five Types of Accounts

Accounting is a system of accounts. All transactions are classified into specific accounts.

In accounting, there are five types of accounts. Every organization has these accounts, and these are the basic building blocks of the accounting system. The five categories of accounts are:

- Assets

- Liabilities

- Equity

- Revenues

- Expenses

Assets

Assets are economic resources owned by the business. They are expected to provide economic benefits in the future. Assets go on the balance sheet.

Every organization has many different assets. Here are a few of the most common assets:

- Cash

- Receivables

- Inventory

- Supplies

- Prepaid expenses

- Invesstments

- Equipment

- Buildings

- Land

Cash

The cash account shows the balance of the company’s cash, including currency, coins, checking accounts, and savings accounts.

Receivables

Account receivables are promises to pay a specific amount by a certain date. Accounts receivable are given by a buyer to a seller in a sales transaction. To the seller, accounts receivable is an asset. It is the right to receive cash in the future.

Notes receivables are written promises made to a lender by a borrower. It includes a specific amount, a certain date, and usually interest.

Inventory

Inventory includes items that the business sells for profit. Ford would include cars in its inventory until they are sold.

Supplies

The supplies account includes office supplies that are used in the business.

Prepaid expenses

Prepaid expenses are payments of an expense in advance. Some transactions, like insurance or rent, require cash to be prepaid before the start of the service. These amounts are assets until they are used up.

Prepaid insurance occurs when a business prepays for an insurance policy for 6 months. It is an asset that will be used over the life of the policy.

Prepaid rent is recorded when rent is prepaid for several months. If a business pays 12 months rent at the beginning of the year, it is an asset that has value for a year.

Investments

Investments include financial securities, including stocks, bonds, and other securities.

Short-term investments are called marketable securities. Long-term investments are simply called investments.

Equipment

Equipment includes the cost of office or factory equipment used in business operations.

Buildings

Buildings include the cost of a factory, office building, store, or warehouse.

Land

Land includes the cost of real estate used in the business.

Liabilities

Debts that the company owes are known as liabilities. They are also called payables. Liabilities are claims on the business assets by creditors. Liabilities go on the balance sheet.

Common liabilities include:

- accounts payable

- notes payable

- accrued liabilities

- unearned revenue

- bonds payable

Accounts payable

Accounts payable are promises made by buyers to pay a specific amount by a certain date. They arise from a customer buying from a seller in a sales transaction. To the buyer, accounts payable is a liability because it is money owed to the seller. To the seller, this is an asset called accounts receivable.

How to remember Accounts Receivable vs. Accounts Payable:

Receivables are the right to receive cash at a later date and are an asset.

Payables are the obligation to pay cash in the future are are a liability.

Notes payable

Notes payable are a written promise to pay a debt, usually with interest, on a specific date. Notes payable are a liability for the borrower. To the lender, it would be an asset called notes receivable.

Accrued liabilities

Accrued liabilities are amounts owed that increase over time. They will be paid at a later date. These accrued liabilities include:

- Taxes Payable

- Wages Payable

- Interest Payable

Unearned revenue

Unearned revenue occurs when a customer prepays for goods or services. The company promises to provide the goods or services at a later date or a refund of the money. Unearned revenue is a liability until the company provides the goods or services.

Bonds payable

Bonds are long-term debt instruments. Companies issue bonds for long periods up to 30 years. Bonds are long term liabilities.

Equity

Equity is the claim on the assets by the owners of the business. It can be calculated as Assets – Liabilities = Equity.

Equity can also be called owners’ equity, stockholders’ equity, or shareholders’ equity. Equity goes on the balance sheet.

Stockholders’ equity includes two sections:

- contributed capital

- retained earnings

Contributed capital

Contributed capital is the amount given to the company by owners in exchange for shares of stock. Assets, usually cash, increase and equity increases. Contributed capital is also called paid-in capital.

Contributed capital includes the following accounts:

- common stock

- preferred stock

- additional paid-in capital

Retained earnings

Retained earnings are the accumulation of all previous years’ net income minus all the annual dividends. For a single year, retained earnings increase with net income minus dividends.

Dividends are a distribution of earnings (net income) to stockholders. Dividends reduce retained earnings.

Revenues

Revenues occur when a company receives assets when it sells a product or service. These revenues may be in cash or another asset.

Revenues are also called sales or income. In accrual accounting, revenue is recognized when it is earned. Revenues are shown on the income statement.

Types of revenues include:

- service revenue

- sales

- interest revenue

- rent revenue

Service revenue

Service revenue or fees earned occur when a business sells a service and receives cash, receivables, or other assets.

Sales

Sales occur when a business sells a product and receives cash, receivables, or other assets. They are also called sales revenue.

Interest revenue

Interest revenue happens when investments pay interest. For example, a note receivable may pay $100 interest. Interest revenue would increase by $100.

Rent revenue

Rent revenue is earned when an asset is leased to a customer. It could be an office building. The owner receives rent revenue.

Expenses

Expenses occur when assets are consumed. This is through cash payments or by consuming assets. Expenses are decreases in assets or economic benefits. Expenses are shown on the income statement.

Typical expenses include:

- cost of sales

- rent expense

- salaries expense

- wages expense

- interest expense

- income tax expense

Cost of sales

Cost of sales, or cost of goods sold, is the cost of providing goods and services to customers.

Rent expense

Rent expense is a payment to rent assets like an office, cars, or equipment.

Salaries expense

Salaries expense are payments to employees that are paid annual salaries.

Wages expense

Wages expense are the payments to employees that earn hourly wages.

Interest expense

Interest expense is the cost of borrowing money. The loan, notes payable, is a liability but the extra amount paid is the interest.

Income tax expense

Income tax expense is for income taxes paid to the government.

Debits and Credits

Accounting begins with recording business transactions. Accounting uses a system called double-entry accounting. Here are the rules for double-entry accounting:

- each transaction affects at least two different accounts

- the debits and credits must equal

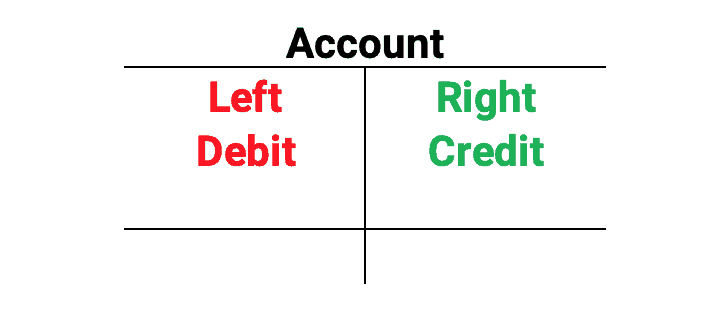

An account is shown as a T-account, which looks like a capital T. The T-account always has the name of the account, a left side, a right side, and a balance. The left side is called the debit side. The right side is the credit side.

Each account has a left, or debit, side and a right, or credit, side. From now on, we will not say left or right, but we will say debit or credit. Debits and credits are opposites, like pluses and minuses.

If the debits in an account are greater than the credits, the difference is a debit balance. If the credits are larger than the debits, then there will be a credit balance.

The advantage of using T-accounts is that every account has rules to increase and decrease the account. Here are the rules for each of the five types of accounts.

Balance sheet accounts

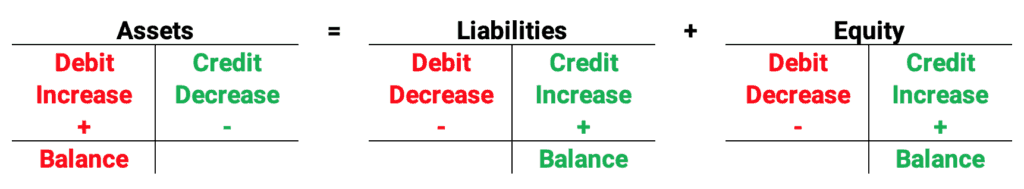

Assets increase by debits (left side) and decrease by credits (right side) to the account. If the debits are larger than the credits, the account will have a debit balance. Assets have normal debit balances.

Liabilities decrease by debits (left side) and increase by credits (right side) to the account. If the credits are larger than the debits, the account will have a credit balance. Liabilities have normal credit balances.

Equity decreases by debits (left side) and increases by credits (right side) to the account. Equity accounts have normal credit balances.

Income statement accounts

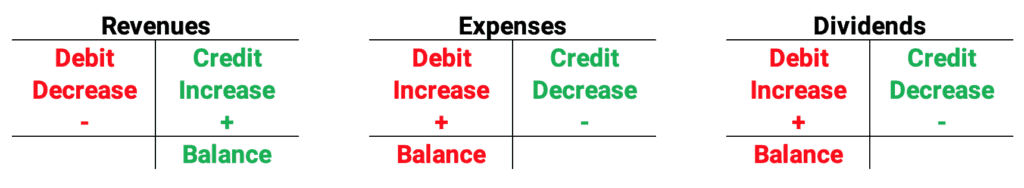

Revenues decrease by debits (left side) and increase by credits (right side) to the account. Revenues have credit balances as a normal balance.

Expenses increase by debits (left side) and decrease by credits (right side) to the account. Expenses have debit balances as a normal balance.

Divdends account

Dividends are a contra equity account which means that it is the opposite of equity and its balance reduces equity. They increase by debits (left side) and decrease by credits (right side) to the account. Dividends have debit normal balances.

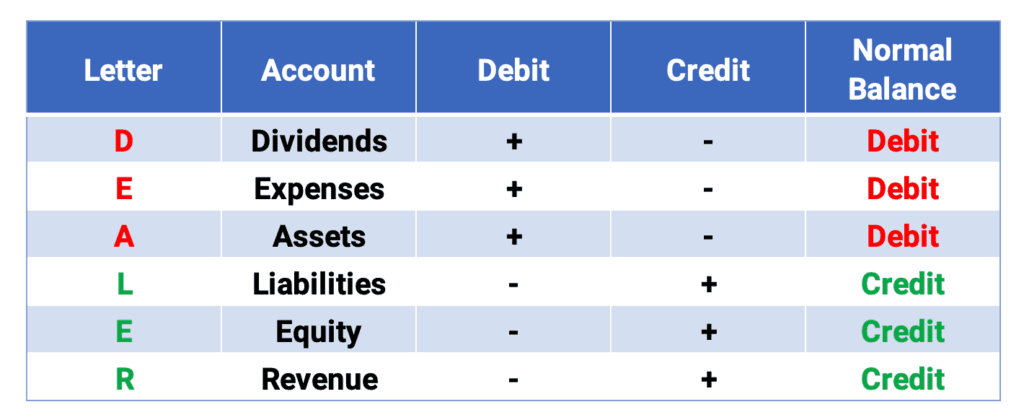

DEALER to remember debits and credits

To summarize the rules of debits and credits, look at the following summary. You should memorize these rules. They are always true in recording every transaction.

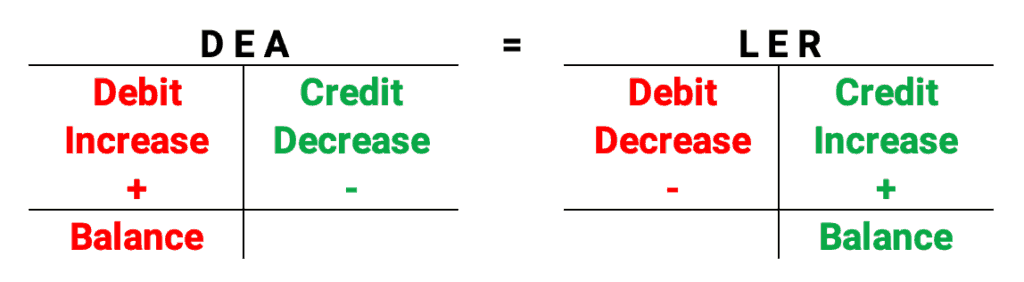

An easy way to remember is the word DEALER. DEA accounts increase with debits. LER accounts increase with credits.

Here are two ways to remember the debit and credit rules. First, here is a table with the DEALER accounts.

Recording business transactions tutorial

Here is a simple diagram with the DEA accounts and the LER accounts.

For more details on debits and credits, see Debits and Credits Explained: An Illustrated Guide.

Journal entries for business transactions

We use the debit and credit rules to record business transactions. These are called journal entries.

All the transactions are recorded in a journal. A journal shows all the transactions.

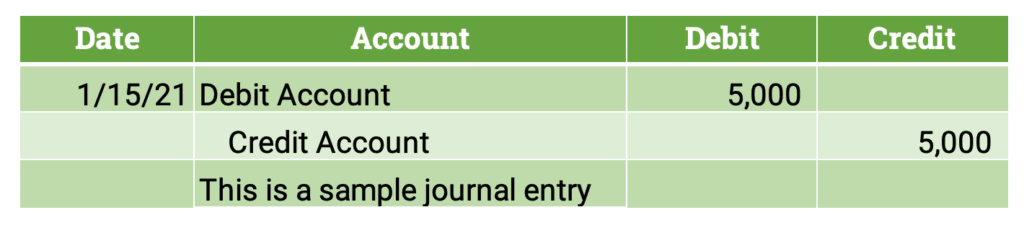

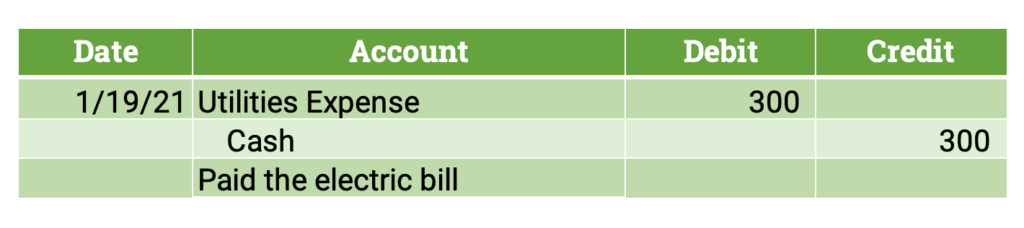

Sample journal entry

So, a journal entry is a way to record business transactions. The following example shows a sample journal entry:

Here are some tips for making journal entries for business transactions.

- Record the date in the date column.

- Debit accounts go before all the credit accounts.

- Indent and list the credit accounts to make it easy to read.

- Record the amounts in the appropriate debit or credit column.

- Adding a description below is optional to help explain the transaction.

Recording business transactions example

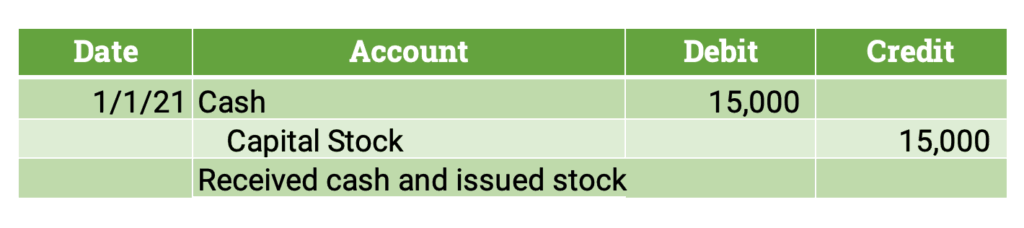

1. Issuing stock for cash

To begin, let’s assume John Andrews starts a new corporation Andrews, Inc. He gives the company $15,000 cash. Andrew receives shares of stock from the company.

Remember, a transaction always affects at least two different accounts. What accounts should we include in this transaction?

Cash is an asset and capital stock is equity. So, we need to follow the rules for assets and equity. So, cash increases for the business. Also, the equity increases for Andrews, Inc. See the journal entry below:

Because cash increases, it takes a debit because it is an asset. Since stock is equity, it increases with a credit.

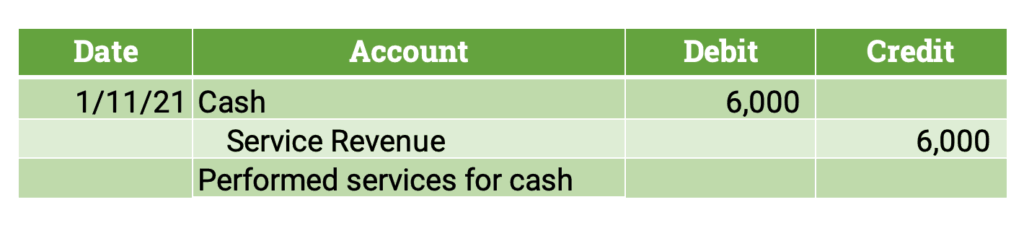

2. Cash revenue

Andrews, Inc. performs services for clients. The company receives cash of $6,000. What two accounts should we use?

The business receives an asset, cash. Also, it earns revenue because it sold a service. So, we need to use cash and service revenue. For example, see below:

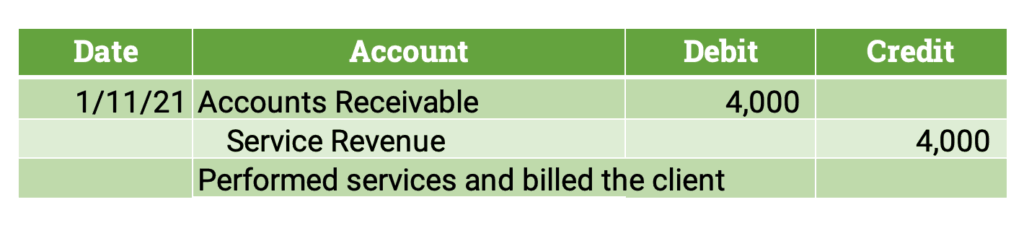

3. Revenue on account

Next, Andrews, Inc. performs more services for clients. The company bills the clients $4,000. What two accounts should we use now?

The business receives an asset, accounts receivable. Also, it earns revenue because it sold a service. So, we need to use accounts receivable and service revenue. Assets increase with a debit and revenues go up with a credit. Therefore, the journal entry is:

So, here is a question. What is the total revenue for Andrews? It is a total of $10,000. However, only $6,000 is in cash because the other $4,000 is still owed to Andrews.

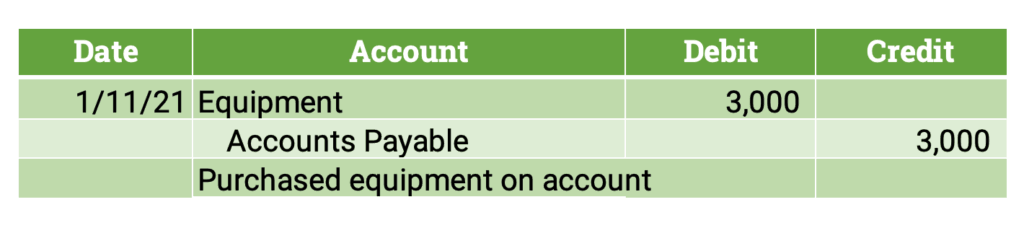

4. Buying an asset on account

Next, assume Andrews purchased equipment for $3,000. However, it did not pay cash but instead purchased on credit. The debt is owed in 30 days. So, what two accounts are affected?

First, equipment is an asset. Also, the debt is a liability. The liability is called accounts payable. So, any payable is a liability.

Assets increase with a debit. Also, liabilities increase with credits. So, the entry is easy:

5. Paying an expense

Next, assume Andrews received an electric bill for $300. When it pays the bill, what accounts are affected?

Of course, cash goes down. Also, the other account is an expense. Remember, expenses consume assets. So, this is an expense. Cash is an asset that decreases. Let’s call the expense Utilities expense. It is an expense that goes up.

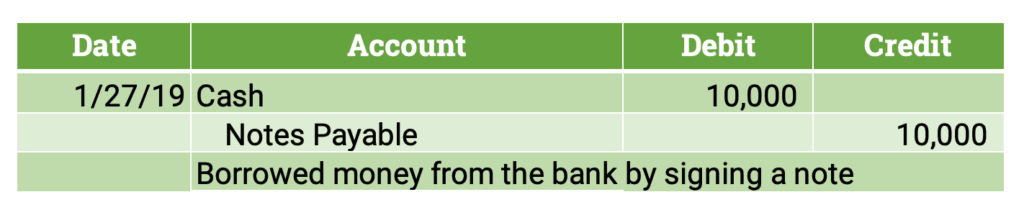

6. Borrowing from the bank

Last, assume Andrews borrowed $10,000 from the bank. The company signed a note for 3 years. What accounts are affected?

First, cash is an asset that goes up. That requires a debit. Second, the debt is recorded in notes payable. That is a liability that also goes up. This requires a credit.

Journal entries explained tutorial

The goal: financial statements

Debits and credits are the systems used to record transactions. However, this is just the beginning of the accounting system. The goal of accounting is to produce financial statements. These financial statements summarize all the many transactions into a useful format.

The following shows the order of the accounts in the accounting system.

- Assets

- Liabilities

- Equity

- Revenues

- Expenses

The balance sheet includes assets, liabilities, and equity. It shows the accounting equation. Remember dividends would reduce the equity shown on the balance sheet.

The income statement includes revenues and expenses. Revenues minus expenses equals either net income or net loss. If revenues are higher, the company enjoys a net income. If the expenses are larger, the company has a net loss.

The four financial statements are:

- income statement

- balance sheet

- statement of owners’ equity

- cash flow statement

Comprehensive problem: Ace Consulting

To show how the accounting process works, we are using the Ace Consulting problem for several videos.

Journal entries tutorial: Ace Consulting

This tutorial shows the Ace Consulting problem to record journal entries. This video tutorial shows:

- journal entries using the general journal

- calculating the accounts balances in the ledger

- preparing the trial balance

Trial balance example: Ace Consulting

Accounting Chapters

Here are the accounting chapters in The Ultimate Guide to Learn Accounting:

- Introduction to Accounting

- Recording Business Transactions

- Adjusting Entries and the Accounting Cycle

- Merchandising Activities

- Inventory and Cost of Goods Sold

- Time Value of Money

- Cash and Internal Control

- Receivables

- Long-Term Assets

- Current Liabilities

- Long-Term Liabilities

- Corporations

- Statement of Cash Flows

- Financial Statement Analysis

- Managerial Accounting

- Job Order Costing

- Process Costing

- Activity Based Costing

- Cost Volume Profit Analysis

- Variable Costing

- Master Budgets

- Standard Costing

- Performance Measurement

- Relevant Costing

- Capital Budgeting

See also Accounting Sample Exams.