Receivables are amounts due from another party. Accounts receivable occur when products and services are sold on credit Bad debts are uncollected accounts.

This is Chapter 8 in Financial Accounting. This chapter includes:

For all the chapters, see The Ultimate Guide to Learn Financial Accounting

Contents

Receivables

Receivables are promises to pay from another entity. Receivables are assets on the balance sheet. There are several types of receivables:

- accounts receivable

- notes receivable

- interest receivable

Receivables can either be current assets or non-current assets. Any receivable due in one year or less is classified as a current asset. Receivables due after one year are shown as non-current assets in the investments category.

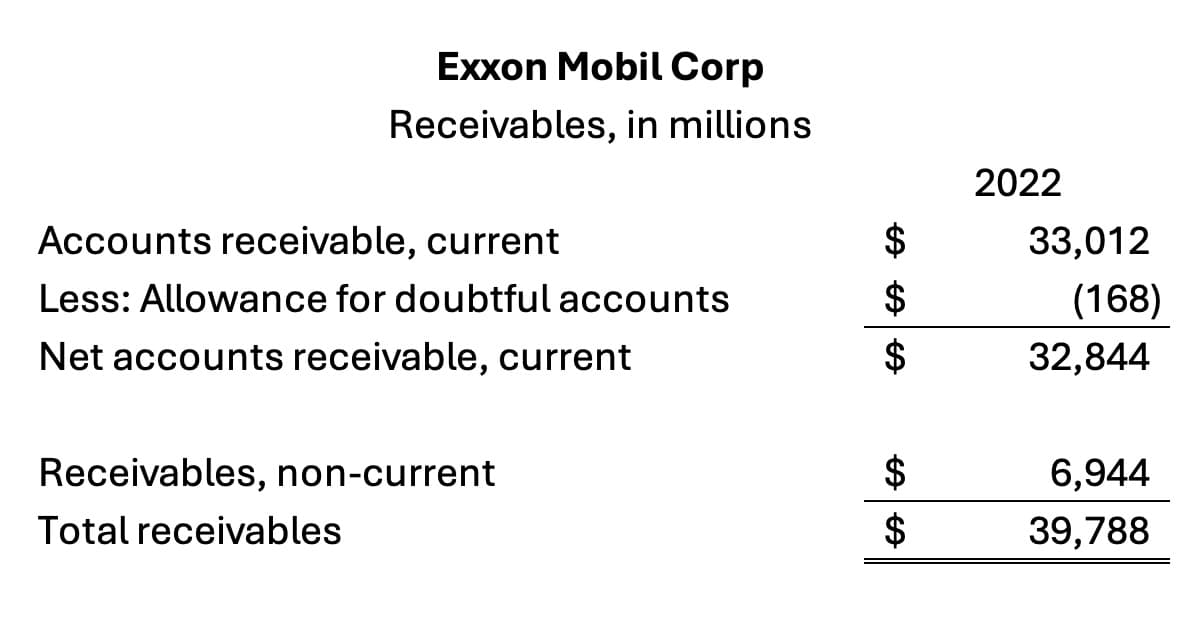

For example, Exxon Mobil Corporation had the following receivables on its balance sheet in 2022:

The balance sheet data shows current receivables of $32.8 billion and non-current receivables of $6.9 billion. The bad debts estimated by Exxon Mobil were $168 million. Source: Morningstar.com.

Accounts receivable

Accounts receivable occur when a company provides goods or services on credit. These accounts receivable from credit sales are called trade receivables.

Accounts receivable are current assets because they are typically due in 30 to 60 days.

Accounting for bad debts

Accounts receivable should be recorded at the amount the company expects to collect. This amount is called the net realizable value.

For example, if the accounts receivable balance is $50,000 but the company expects that $1,000 will not be paid, the net realizable value is $49,000. The $1,000 represents bad debts or uncollectible accounts.

There are two methods to account for bad debts:

1. Allowance method

2. Direct write-off method

Allowance method

To ensure accurate financial reporting under GAAP, companies must estimate uncollectible accounts. This shows the estimated value of the receivables.

The advantage of the allowance method is that it writes off accounts during the period of sale. So, the matching principle is satisfied with the bad debt expenses occurring in the same period as the sales revenue.

Companies use the allowance method to estimate bad debts. The allowance method uses historical or economic data to estimate bad debts. Bad debts are accounts unlikely to be paid by customers.

The estimate of bad debts is used to create an allowance for doubtful accounts that reduces the net realizable value of accounts receivable.

The estimate of bad debts is recorded as an expense on the income statement. The allowance for doubtful accounts is a contra-asset on the balance sheet.

There are two methods to estimate uncollectible accounts under the allowance method.

- Percent of sales method

- Percent of accounts receivable

The percent of sales method focuses on the income statement and the bad debt expense.

The percent of accounts receivables method is also called the aging of accounts. Older accounts have a higher probability of being uncollectible.

Direct write-off method

In the direct write-off method, there is no estimate. Accounts receivable are only written off when they are uncollectible.

This method does not adhere to generally accepted accounting principles (GAAP) because it violates the matching principle.

The direct write off method is allowed under tax rules.

Notes receivable

Notes receivable require formal written agreements called promissory notes.

Notes receivable are promises to pay a sum at a future date with specified interest. These notes are more formal documentation of the debt.

To calculate a note’s interest, there are three variables:

- Principal

- Interest rate

- Time period

Promissory notes pay simple interest. The simple interest formula is:

I = PRT

or

Interest = Principal x Rate x Time

For example, assume a $40,000, 6-month note pays 9%. The variables will be:

P = 40,000

R = 9% or .09

T = 6/12 (6 months out of 12)

The interest will be I = $40,000 x .09 x 3/12 = $1,800.

At the maturity date, the maturity value will be the principal plus interest, or $40,000 + $1,800 = $41,800.

Accounting Chapters

Here are the accounting chapters in The Ultimate Guide to Learn Accounting:

- Introduction to Accounting

- Recording Business Transactions

- Adjusting Entries and the Accounting Cycle

- Accounting for Merchandising Activities

- Inventory and Cost of Goods Sold

- Cash and Internal Control

- Accounting for Receivables

- Accounting for Long-Term Assets

- Accounting for Current Liabilities

- Accounting for Long-Term Liabilities

- Corporations

- Statement of Cash Flows

- Financial Statement Analysis

- Managerial Accounting

- Job Order Costing

- Process Costing

- Activity Based Costing

- Cost Volume Profit Analysis

- Variable Costing

- Master Budgets

- Standard Costing

- Performance Measurement

- Relevant Costing

- Capital Budgeting

- Time Value of Money

See also Accounting Sample Exams.

Jeff Mankin teaches financial literacy and Excel. He is the founder of Finally Learn.