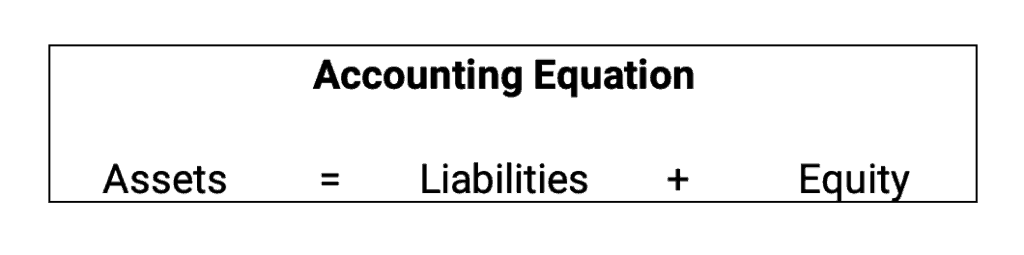

The accounting equation is: Assets = Liabilities + Equity. A company’s balance sheet shows this equation. The accounting equation is the basis for double-entry accounting.

This is Chapter 2 in Principles of Accounting. This chapter includes:

- Recording Business Transactions

- Debits and Credits Explained: An Illustrated Guide

- What is the Accounting Equation?

- Financial Statements: A Beginner’s Guide

- Recording Business Transactions YouTube playlist

For all the chapters, see The Ultimate Guide to Learn Accounting.

Contents

5 types of accounts

In accounting, there are five types of accounts. Every organization has these accounts, and these are the basic building blocks of the accounting system. The five categories of accounts are:

- Assets are economic resources that the company owns.

- Liabilities are company debts, or what the company owes. These are claims on the assets by the creditors.

- Equity is the net worth of the company or the claims on the assets by the owners. It is calculated as assets – liabilities = equity. Equity is also called stockholders’ equity. Equity is the net worth of the company.

- Revenues occur when the company receives assets from selling a product or service.

- Expenses occur when the business consumes or uses up assets.

Accounting Equation

The accounting equation is: Assets = Liabilities + Equity.

All assets are financed by either debt or equity. The more debt a company has, the less the owners’ equity.

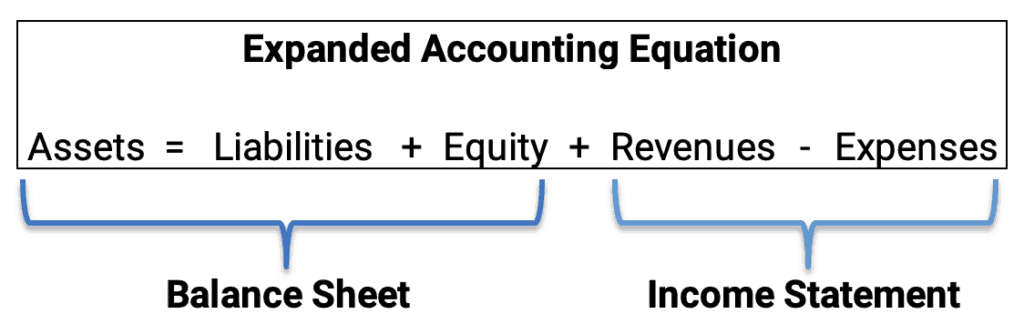

Equity has several components that are used in the expanded accounting equation. Equity includes common stock, revenues, expenses, and dividends. Note that expenses and dividends subtract from the equity.

Financial Statements

There are four financial statements that each company prepares. The four financial statements are:

- income statement: revenues minus expenses equal net income or net loss

- balance sheet: lists all the assets, liabilities, and equity of a company

- cash flow statement: cash inflows and cash outflows

- statement of owners’ equity: shows the changes in equity on the balance sheet

Income Statement

The income statement shows the profitability of the company. The format of the income statement is revenues – expenses = net income (or net loss).

Net income is also called net profit or net earnings.

The income statement is also called the profit & loss Statement, the P&L, or the earnings statement.

Revenues and Expenses are called income statement accounts or temporary accounts because these accounts are only for each year.

Balance Sheet

The balance sheet shows the company’s financial position. The format of the balance sheet is assets = liabilities + equity.

This formula is the accounting equation. The balance sheet is also called the statement of financial position.

Assets, liabilities, and equity are called balance sheet accounts or real accounts because they go on the balance sheet and because the accounts continue longer than one year.

Accounting equation for Apple, Inc.

On the Apple, Inc. financials, the accounting equation is shown on the balance sheet.

| Apple, Inc. | 2022 Balance Sheet (in millions) |

|---|---|

| Assets | $352,755 |

| Liabilities | $302,083 |

| Equity | $ 50,672 |

So, for Apple, the 2022 balance sheet shows the accounting equation of $352,755 = $302,083 + $ 50,672.

Accounting equation tutorial

This accounting equation tutorial shows a simple problem to show the accounting equation.

Cash Flow Statement

The cash flow statement gives the summary of all the company cash inflows and cash outflows for a period. This helps managers understand the increases and decreases in cash.

Two Goals of Every Business

There are two basic goals for every business:

- Solvency

- Profitability

Solvency is the ability to pay debts when they are due. If the company cannot pay its debts, it will not survive to have the ability to generate profits and fulfill its mission. Solvency is always an important goal for every business.

Every company must be solvent with the ability to pay its debts on time. This is always an immediate goal of every company. The company will fail quickly if it cannot pay its employees, suppliers, and creditors.

| Business Goal | Financial Statement |

|---|---|

| Solvency | Balance Sheet & Cash Flow Statement |

| Profitability | Income Statement |

Profitability is the ability to generate a profit. Profitability is long-term sustainability.

Each company needs to be profitable to continue in business in the future. Profitability is a long-term goal. A new business will close quickly if the company is insolvent, but may survive several years before the company makes a profit.

Three Goals of Financial Reporting

There are three goals of financial reporting. Financial reporting provides information about a company’s:

- Financial position—the company’s assets, liabilities, and equity.

- Cash inflows and outflows—the company’s cash receipts and payments.

- Operating Results—the company revenues and expenses and profitability.

The goals of financial reporting relate directly to three of the company’s financial statements. See the table below.

| Financial Reporting Goal | Financial Statement |

|---|---|

| Financial Position | Balance Sheet |

| Cash Flows | Cash Flow Statement |

| Operating Results | Income Statement |

Jeff Mankin teaches financial literacy and Excel. He is the founder of Finally Learn.