Contents

What is Revenue?

Revenue is income from selling a product or service. A company earns revenue when it receives an asset for selling to a customer. The asset could be cash, accounts receivable, or other assets. Revenues are also called sales.

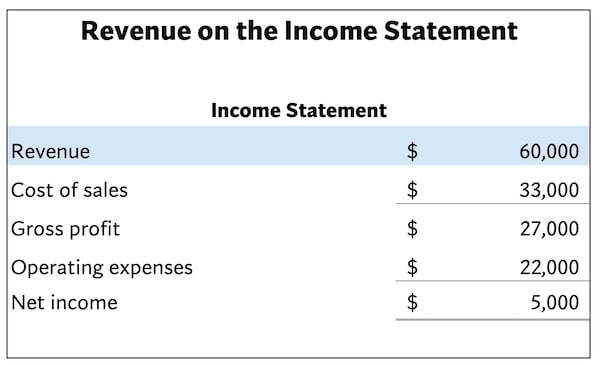

Revenue goes on the company’s income statement. Total revenue is called the top line because it appears first on the income statement. All the expenses are subtracted from revenue to calculate net income or net loss. Net income is called the bottom line.

What is the Revenue Formula?

The revenue formula is Revenue = Units x Sales Price. This equals total revenue. Any discounts and returns are subtracted to arrive at net revenue.

For example, assume a company sold 1,500 products. If the sales price was $40 each, the total revenue would be $60,000. See the example below.

Revenues are one of the five types of accounts in the accounting system.

In accounting, the five types of accounts are:

- assets: resources owned by a business; what the company owns

- liabilities: debts of the company; what the company owes

- equity: claim on the assets by the owners; calculated as equity = assets – liabilities; equity is the net worth of the company

- revenues: when a business receives assets from selling products and services

- expenses: when a business uses or consumes assets to create revenues

See Introduction to Accounting.

Types of Revenue

Revenue can come from several sources. Here are common types of revenue:

Service revenue comes from providing a service. It may be based on a flat fee or an hourly rate. Service revenue can also be called fee revenue.

Sales revenue or sales is earned by selling a product.

Interest revenue is earned on investments like bonds and money market accounts.

Rent revenue is recorded when assets are leased to customers.

Sales returns is a contra account that reduces net revenue. Revenue minus sales returns equals net revenue. Sales discounts is another contra account that reduces net revenue. Revenue minus sales discounts equals net revenue.

Revenues on the Income Statement

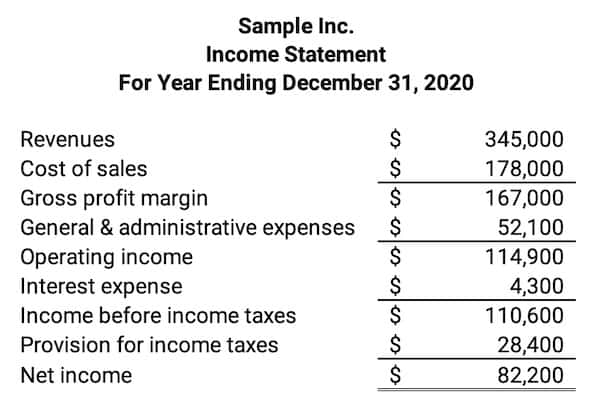

Revenues are the top line on the income statement. The income statement includes revenues minus expenses.

The largest expense for most companies is cost of sales or cost of good sold. This is the cost of providing the products sold by the company. Sales revenue minus cost of sales equals gross profit or gross margin.

Other important categories of expenses include

- general & administrative expenses

- selling expenses

- interest expense

- income tax expense

When all the expenses are subtracted from revenues, the company has either net income or net loss. Net income occurs when the revenues are larger than expenses. When expenses are larger, the company experiences a net loss.

The format of the income statement is:

Apple Revenues

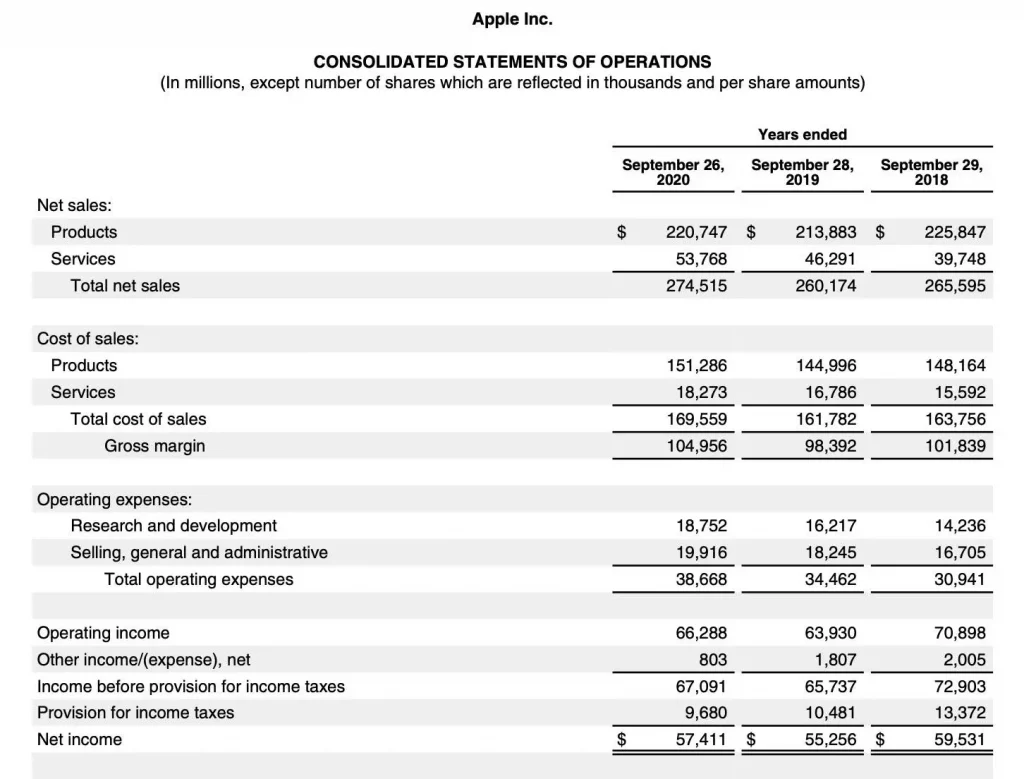

Below is the Apple 2020 income statement. Apple lists two types of sales revenues to calculate total sales. The total revenue is split into two categories: product revenues and service revenues.

Apple 2020 total revenues were $274.5 billion. The product revenues were $220.7 billion. This would include selling Mac computers, iPads, and iPhones.

The remaining $53.8 billion was from service revenue. This would be selling software and services like Apple Music and iCloud.

Revenues vs. Profit

Revenues are the top line of the income statement. They show all the company’s income before any expense is deducted.

Profit, or earnings, is revenue minus expenses. There are several different profit calculations:

Gross profit or gross margin is total revenue minus cost of sales.

Operating profit or operating income is gross profit minus operating expenses.

Earnings before interest and taxes (EBIT) is similar to operating profit. It is the profit before subtracting interest expense and income tax expense.

Earnings before taxes (EBT) is the profit before subtracting income tax expense.

Net income, also called net earnings or net profit is the profit after subtracting all expenses. Net income is the bottom line on the income statement.

For Apple, the cost of sales totaled $169.6 billion. The gross profit was $105.0 billion.

After all expenses were paid, Apple had a 2020 net income of $57.4 billion.

For more financial terms, see the Financial Terms Dictionary.

Jeff Mankin teaches financial literacy and Excel. He is the founder of Finally Learn.