Equity is owners’ investment in a company. Stockholders’ equity equals assets minus liabilities and it appears on the balance sheet.

Contents

What is Equity?

Equity appears on a company’s balance sheet. As equity increases, the value of the owners’ investment increases.

There are several alternate names for equity:

- stockholders’ equity

- shareholders’ equity

- owners’ equity

- owners’ capital

- net worth

Equity is one of the five types of accounts in the accounting system.

In accounting, the five types of accounts are:

- assets: resources owned by a business; what the company owns

- liabilities: debts of the company; what the company owes

- equity: claim on the assets by the owners; calculated as equity = assets – liabilities; equity is the net worth of the company

- revenues: when a business receives assets from selling products and services

- expenses: when a business uses or consumes assets to create revenues

Equity on the Balance Sheet

There are usually three categories of equity on the balance sheet:

- Stock

- Retained Earnings

- Comprehensive Income

Stock

Corporations issued common stock to raise capital to grow the business. The common stock shows equity in the company. Common stock represents paid-in capital to the company. This is the money that investors have invested into the company.

All corporations have common stock. Some companies issue a special class called preferred stock. Preferred stock is included in stockholders’ equity.

Retained Earnings

A successful business earns a net profit. The company may pay some of these earnings as dividends to stockholders. The profits that remain are added to the company’s retained earnings. Retained earnings are the net income minus dividends.

So, assume a company earns net income of $15,000 and pays dividends of $3,000. The retained earnings increases by $12,000.

Comprehensive Income

Comprehensive income is income that does not appear on the income statement. It is from non-owner transactions. For example, assume a company purchased a stock for $100,000 and it has a market value of $133,000. The company has an unrealized holding gain. The comprehensive income is $33,000 because of the unrealized gain.

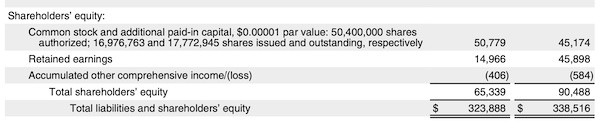

Example: Apple

Here is the equity section of the Apple 2020 balance sheet. Apple lists three sections of equity. Common stock is the first. Then, Apple lists retained earnings and comprehensive income.

Equity on the Accounting Equation

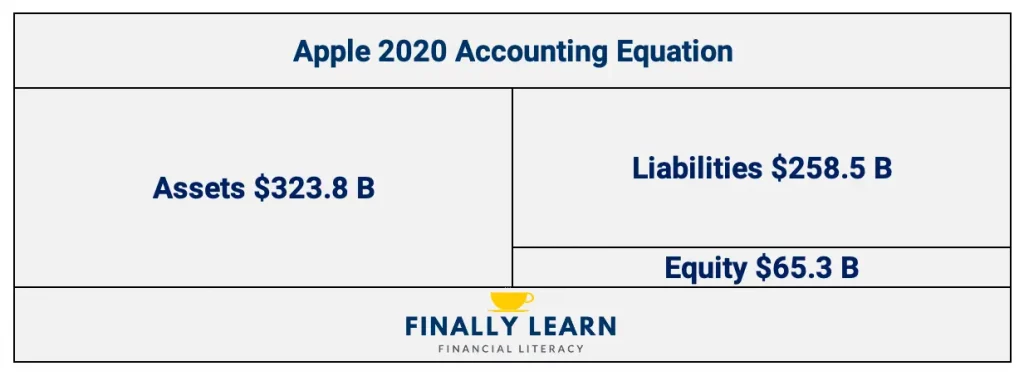

The accounting equation is a basic concept in accounting. The accounting equation is Assets = Liabilities + Equity. This is always true. The accounting equation must always balance. The accounting equation is shown on the balance sheet.

In 2020, Apple had total assets of $323.8 B and total liabilities of $258.5 B. So, using the accounting equation, the total equity was $65.3 B.

For more financial terms, see the Financial Terms Dictionary.

Jeff Mankin teaches financial literacy and Excel. He is the founder of Finally Learn.