Contents

N

Nasdaq

The Nasdaq is a global electronic market for buying and selling securities. Nasdaq was an acronym for National Association of Securities Dealers Automated Quotations.

The Nasdaq is home to many technology giants such as Apple, Microsoft, and Alphabet, the parent of Google. So, the Nasdaq composite is a tech-heavy index.

The Nasdaq began in 1971 as the first electronic securities market as a subsidiary of the NASD. The NASD was the National Association of Securities Dealers. NASD is now the Financial Industry Regulatory Authority (FINRA).

Nasdaq composite

The Nasdaq composite is the index of all stocks listed on the Nasdaq stock market. It represents over 3,000 stocks. The Nasdaq composite is a tech-heavy index. The Nasdaq composite is widely quoted along with Dow Jones Industrial Average and the S&P 500.

See the Nasdaq composite current quote here.

New York Stock Exchange

The New York Stock Exchange (NYSE) is a stock exchange headquartered in New York City. The NYSE is the largest stock exchange in the world. The NYSE began in 1792 and is also called the Big Board.

The trading hours for the NYSE are Monday – Friday from 9:30 am to 4:00 pm ET.

Net income

Net income is total revenues minus total expenses. If the revenues are larger, the result is net income. If the expenses are larger, the result is a net loss.

Net loss

Net loss occurs when total expenses are larger than total revenues. If the revenues are larger, the result is net income.

Net working capital

Net working capital or working capital is a liquidity ratio. The formula for net working capital is net working capital = current Assets – current Liabilities.

Net working capital shows the amount of current assets the company would have if all current liabilities were paid. Current assets include cash, inventory, and receivables.

Net worth

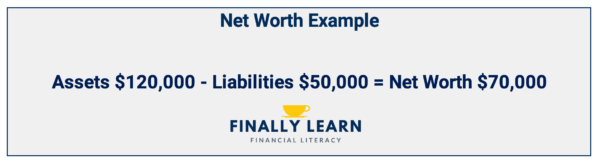

Net worth is a measure of wealth. The net worth of an individual or a household is the total of all assets minus the total of any debts. Net worth usually increases with age and income levels.

For a company, net worth is called equity or stockholders’ equity. The formula for net worth is net worth = total assets – total liabilities (debt).

Assume Maria has a savings account of $25,000 and investments of $75,000. Her car has a fair value of $20,000. Her debts total $50,000. Maria’s net worth is $70,000. See the example below.