Here is a glossary of financial terms F. These financial terms begin with the letter F, including financial accounting, FIFO, and future value.

Contents

FASB

See Financial Accounting Standards Board.

FDIC

See Federal Deposit Insurance Corporation.

Federal Deposit Insurance Corporation

The Federal Deposit Insurance Corporation (FDIC) is a U.S. agency that insures consumer deposits in commercial banks. As of 2010, the FDIC insures consumer deposits up to $250,000.

The FDIC insures commercial banks, and the National Credit Union Administration (NCUA) insures credit union accounts.

FIFO

See first in, first out.

Finance

Finance is the study of money and investments. In a business, it is called corporate finance. For individuals, it is called personal finance. Finance broadly includes accounting, financial statements, and investments.

Financial accounting

Financial accounting is the process of recording, analyzing, and summarizing financial transactions. Financial accounting is also called financial reporting. The outcome of financial reporting is issuing the financial statements.

Financial accounting uses the five types of accounts to record all the transactions.

In accounting, the five types of accounts are:

- assets: resources owned by a business; what the company owns

- liabilities: debts of the company; what the company owes

- equity: claim on the assets by the owners; calculated as equity = assets – liabilities; equity is the net worth of the company

- revenues: when a business receives assets from selling products and services

- expenses: when a business uses or consumes assets to create revenues

The goal of financial accounting, or financial reporting, is to issue financial statements.

There are four financial statements that each company prepares. The four financial statements are:

- income statement: revenues minus expenses equal net income or net loss

- balance sheet: lists all the assets, liabilities, and equity of a company

- cash flow statement: cash inflows and cash outflows

- statement of owners’ equity: shows the changes in equity on the balance sheet

Financial Accounting Standards Board

Financial Accounting Standards Board (FASB) sets generally accepted accounting principles (GAAP), the financial reporting standards in the United States.

Financial independence, retire early

Financial independence, retire early (FIRE) is a lifestyle movement to achieve financial independence with the goal of retiring early. This movement encourages high savings rates and aggressive investments in stock index funds to achieve wealth.

Financial Industry Regulatory Authority

The Financial Industry Regulatory Authority (FINRA) is a private organization that regulates brokers and securities exchanges in the United States.

Financial literacy

Financial literacy is the ability to understand and use financial skills. This includes personal finance, debt management, budgeting, and investing.

Financial ratios

Financial ratios are used to evaluate a company. Common examples are the current ratio, return on assets, and debt ratio. The typical categories of financial ratios are

- liquidity ratios

- activity ratios

- debt ratios

- profitability ratios

- valuation ratios

Financial statements

Financial statements report the financial condition of a company and its financial position. The three financial statements are:

- income statement

- balance sheet

- cash flow statement

Financial statement analysis

Financial statement analysis examines the financial statements to make decisions. It uses three basic types of analysis:

- horizontal or trend analysis

- vertical or common-size analysis

- ratio analysis

FINRA

See Financial Industry Regulatory Authority

FIRE

See financial independence, retire early.

First in, first out

First in, first out (FIFO) is an assumption used in inventory valuation and other processes. FIFO assumes that the first products purchases or produced are the first sold or consumed.

The FIFO method is also used in security purchases. If securities are sold, the FIFO method would assume the first securities purchased are the first sold.

Alternatives to the FIFO method are the last in, first out (LIFO) or weighted average methods.

Fraud

Fraud is intentional deceit for the purpose of illegally gaining assets or legal rights. Fraud can be a violation of civil law or criminal law.

Fraud triangle

The fraud triangle is a model to explain the risk of fraud. For a person to commit fraud there are three necessary conditions. These three conditions are:

- motivation

- opportunity

- rationalization

Future value

Future value is a time value of money (TVM) concept. It is a lump sum of money at a date in the future. It can also be calculated as the value of all future cash flows.

Future value uses compound interest. Compounding is the process of growing money into the future. Financial calculators and Excel use the FV function to calculate future value.

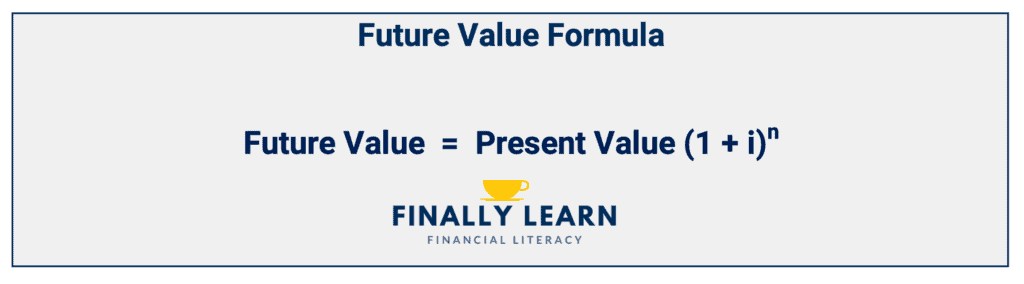

The future value formula uses the following variables: PV = present value, i = periodic interest rate, and n = number of periods.

Jeff Mankin teaches financial literacy and Excel. He is the founder of Finally Learn.