Here is a glossary of financial terms S. These financial terms begin with the letter S, including S&P 500, SEC, and SWOT analysis.

Contents

S&P 500

The S&P 500 is a U.S. stock market index composed of the 500 largest U.S. companies. The S&P 500 is the proxy for the U.S. large-cap stock market.

There are many S&P 500 index funds that use the S&P 500 index as their benchmark. The S&P 500 is the most common benchmark for both the U.S. large-cap market and the U.S. stock market.

See the current quote for the S&P 500 index here.

S&P 500 index fund

An S&P 500 index fund is an index fund that tracks the S&P 500. These funds buy and hold the stocks in the S&P 500. Popular S&P 500 index funds include:

- Vanguard 500 Index Fund Admiral Shares (VFIAX)

- Fidelity 500 Index Fund (FXAIX)

- Schwab S&P 500 Index Fund (SWPPX)

SEC

See Securities and Exchange Commission.

Securities and Exchange Commission

The Securities and Exchange Commission (SEC) is a federal agency that administers the Securities Exchange Act of 1934 and regulates the financial markets. Companies that issue securities to the public or are listed on an exchange are required to file audited financial statements with the SEC. In addition, the SEC has broad powers to prescribe accounting practices and standards in the U.S.

Shrinkage

Shrinkage is the loss of inventory due to employee theft, shoplifting, fraud, errors, or damage. Shrinkage is the difference between the inventory on the company’s balance sheet and the actual inventory.

Shrinkage is recorded as a loss and reduces the profits of the company. For retailers, managing shrinkage is important to managing profitability.

Simple interest

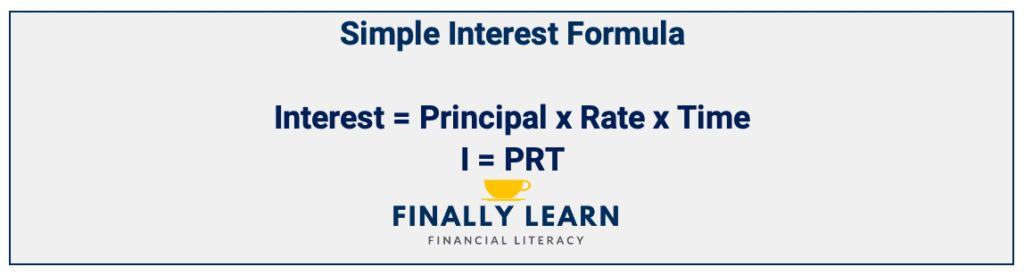

Simple interest is interest that accrues on only the principal and not the accrued interest. Simple interest always grows slower than compound interest. Simple interest = principal x rate x time. Compound interest earns interest on both the principal and the previous interest.

Sole proprietor

A sole proprietorship is an unincorporated business. The owner of the proprietorship is a sole proprietor. A sole proprietorship has only one owner and is the simplest form of business.

Sole proprietorship

A sole proprietorship is an unincorporated business with one owner, the sole proprietor.

Standard & Poor’s

Standard & Poor’s (S&P) is a credit rating service that grades credit risks for companies and governments. S&P uses an ABC scale for its credit ratings. Investment grade securities are rated AAA to BBB.

S&P investment grade:

- AAA

- AA

- A

- BBB

BB or below are considered speculative with higher risk. These securities are called junk bonds.

Speculative grade:

- BB

- B

- CCC

- CC

- C

- D

S&P also provides the famous S&P 500 index of the largest U.S. companies. This is the most famous investment benchmark.

In index investing, S&P 500 index funds are the largest and most well-known, including the Vanguard 500 Index Fund VFIAX.

Statement of cash flows

See the cash flow statement.

SWOT analysis

SWOT analysis, or SWOT matrix, is a strategic exercise to analyze an organization’s competition. SWOT helps a company identify its competitive advantage.

SWOT stands for the four areas of the matrix:

- strengths

- weaknesses

- opportunities

- threats

See the Financial Terms Dictionary

Jeff Mankin teaches financial literacy and Excel. He is the founder of Finally Learn.