The average American household’s net worth is $748,800. However, a better comparison is the median net worth of $121,700.

This article shows the average and median net worth by age.

Contents

Key concepts

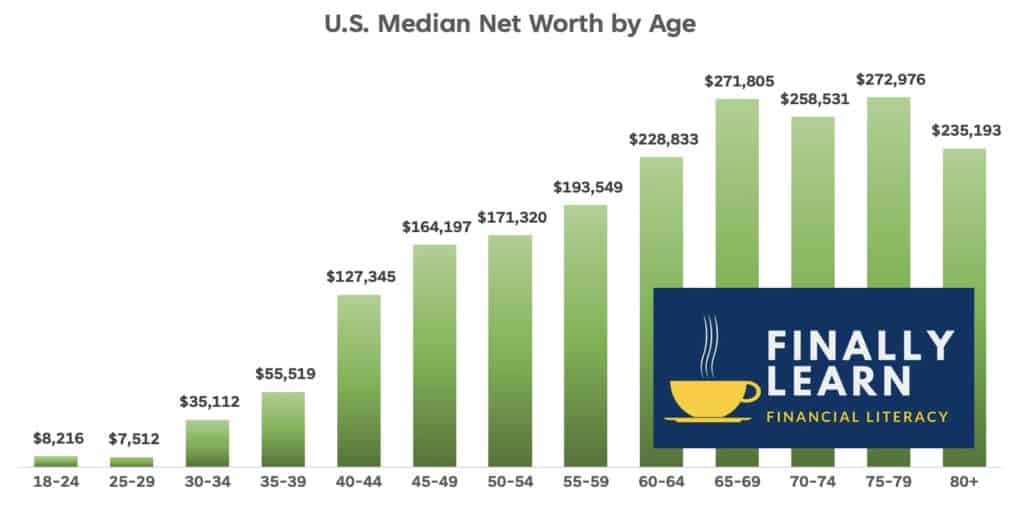

Your net worth grows over your lifetime. It is helpful to compare your net worth to the median of your age group.

- The median net worth for all households is $121,700.

- The median net worth starts at around $8,000 for people in their 20s.

- The median net worth peaks at about $270,000 for people in their 60s and 70s.

What is net worth?

Net worth is an important personal financial number. It is the value of all personal assets minus any debts. Net worth is what you own minus what you owe.

The net worth formula is: Net Worth = Total Assets minus Total Liabilities.

To calculate your net worth, see the Net Worth Calculator: What’s Your Net Worth?

Tracking your net worth is the best way to build wealth. Typically, net worth grows with age. Workers make less money early in their careers, so their net worth is lower. Over time, household income and net worth typically grow.

Tracking your net worth is an important step to build wealth.

Net worth is a combination of a household’s income, savings, and investments. Growing your net worth takes years. Since age and net worth are related, comparing your net worth by age to your peer group is helpful.

We used net worth by age from two sources:

- Federal Reserve Board’s Survey of Consumer Finances with income and net worth numbers from 2019. This is the latest information available from the Federal Reserve.

- Net Worth by Age Calculator for the United States from the excellent financial site DQYDJ.

What is the average U.S. net worth?

The most recent data is from 2019, which shows the U.S. average net worth is $748,800. However, a better number for comparison is the median net worth of $121,700.

What’s the difference between average and median?

A few ultra-wealthy households make the average net worth much higher than the median net worth. The median net worth is not affected by either negative numbers at one end or huge numbers on the other side.

The median net worth is the middle value, so half the households are above and half below. The median net worth is the better number to compare for the typical American. The median net worth is also the 50th percentile. So, half of the households are below $121,700, with the other half above.

Since net worth grows with age, net worth by age is a good measure to compare for individuals.

Average net worth by age

The following table shows the 2019 U.S. household median and average net worth by age.

It’s not what you make, it’s what you save.

The Fed published the numbers in 2019. It is the most recent year that net worth and income numbers are available. The Federal Reserve publishes this report every three years. The next report will be released in 2023.

| Head of Household Age | Median Net Worth | Average Net Worth |

|---|---|---|

| 18-24 | $8,216 | $28,707 |

| 25-29 | $7,512 | $49,388 |

| 30-34 | $35,112 | $122,700 |

| 35-39 | $55,519 | $274,112 |

| 40-44 | $127,345 | $623,694 |

| 45-49 | $164,197 | $761,560 |

| 50-54 | $171,320 | $897,663 |

| 55-59 | $193,549 | $1,165,477 |

| 60-64 | $228,833 | $1,187,730 |

| 65-69 | $271,805 | $1,250,679 |

| 70-74 | $258,531 | $1,173,653 |

| 75-79 | $272,976 | $945,480 |

| 80 + | $235,193 | $973,141 |

Let’s focus on the median instead of the average. The median better represents the average household.

Here is a graph of the median net worth by age. Net worth tends to increase over a person’s lifetime.

Net worth in your 20s

Americans in their 20s are just starting their work careers. Some are going to college and graduate schools. People in their 20s should start a 401(k) plan at work if it is available.

So, people in their 20s usually have lower earnings, lower assets, and more student debt. This means that a significant number of people in their 20s have negative net worth.

According to the DQYDJ Net Worth by Age Calculator up to 29% of people in their 20s have a negative net worth.

- Ages 18–24: 28% have negative net worth

- Ages 25-29: 29% have negative net worth

Here is the median net worth by age 30 sorted by percentiles:

| Percentile | Ages 18-24 | Ages 25-29 |

|---|---|---|

| 25th | ($1,415) | ($3,664) |

| 50th | $8,216 | $7,512 |

| 75th | $24,791 | $61,568 |

| 90th | $93,732 | $152,063 |

Net worth by age 25

Here are net worth goals by age 25:

- Below average net worth: below $8,216

- Average net worth: above $8,216

- Good net worth: above $24,791

- Great net worth: above $93,732

Net worth by age 30

Here are net worth goals by age 30:

- Below average net worth: below $7,512

- Average net worth: above $7,512

- Good net worth: above $61,568

- Great net worth: above $152,063

Here are the net worth goals for people in their 20s:

| Net Worth | Ages 18-24 | Ages 25-29 |

|---|---|---|

| Below Average | Below $8,216 | Below $7,512 |

| Average | Above $8,216 | Above $7,512 |

| Good | Above $24,791 | Above $61,568 |

| Great | Above $93,732 | Above $152,063 |

Net worth in your 30s

Americans in their 30s have more stable careers and higher earnings. They may have some student loans, car loans, and mortgages.

People in their 30s need to focus on building wealth by saving and investing every month. They should maximize their 401k contributions if a plan is available through their employer.

Here is the net worth by age 40 sorted by percentiles:

| Percentile | Ages 30-34 | Ages 35-39 |

|---|---|---|

| 25th | $2,761 | $5,177 |

| 50th | $35,112 | $55,519 |

| 75th | $117,134 | $228,275 |

| 90th | $258,741 | $601,341 |

Net worth by age 35

Here are net worth goals by age 35:

- Below average net worth: below $35,112

- Average net worth: above $35,112

- Good net worth: above $117,134

- Great net worth: above $258,741

Net worth by age 40

Here are net worth goals by age 40:

- Below average net worth – below $55,519

- Average net worth – above $55,519

- Good net worth – above $228,275

- Great net worth – above $601,341

Here are the net worth goals for people in their 30s:

| Net Worth | Ages 30-34 | Ages 35-39 |

|---|---|---|

| Below Average | Below $35,112 | Below $55,519 |

| Average | Above $35,112 | Above $55,519 |

| Good | Above $117,134 | Above $228,275 |

| Great | Above $258,741 | Above $601,341 |

Net worth in your 40s

Americans in their 40s should focus on increasing earnings and assets. They also should reduce debts. They should eliminate credit card debts and pay down mortgages and car loans.

They should continue maximizing their 401(k) contributions through their employer.

Here is the net worth by age 50, sorted by percentiles:

| Percentile | Ages 40-44 | Ages 45-49 |

|---|---|---|

| 25th | $18,518 | $19,872 |

| 50th | $127,345 | $164,197 |

| 75th | $351,292 | $452,226 |

| 90th | $848,815 | $1,354,761 |

Net worth by age 45

Here are net worth goals by age 45:

- Below average net worth: below $127,345

- Average net worth: above $127,345

- Good net worth: above $351,292

- Great net worth: above $848,815

Net worth by age 50

Here are net worth goals by age 50:

- Below average net worth: below $164,197

- Average net worth: above $164,197

- Good net worth: above $452,226

- Great net worth: above $1,354,761

Here are the net worth goals for people in their 40s:

| Net Worth | Ages 40-44 | Ages 45-49 |

|---|---|---|

| Below average | Below $127,345 | Below $164,197 |

| Average | Above $127,345 | Above $164,197 |

| Good | Above $351,292 | Above $452,226 |

| Great | Above $848,815 | Above $1,354,761 |

Net worth in your 50s

Americans in their 50s should focus on paying off all debts. They should eliminate credit card debts, mortgages, and car loans.

They should continue maximizing their 401(k) contributions through their employer.

Here is the net worth by age 60, sorted by percentiles:

| Percentile | Ages 50-54 | Ages 55-59 |

|---|---|---|

| 25th | $38,973 | $38,885 |

| 50th | $171,320 | $193,549 |

| 75th | $493,928 | $644,806 |

| 90th | $1,440,829 | $2,506,118 |

Net worth by age 55

Here are net worth goals by age 55:

- Below average net worth: below $171,320

- Average net worth: above $171,320

- Good net worth: above $493,928

- Great net worth: above $1,440,829

Net worth by age 60

Here are net worth goals by age 60:

- Below average net worth: below $193,549

- Average net worth: above $193,549

- Good net worth: above $644,806

- Great net worth: above $2,506,118

Here are the net worth goals for people in their 50s:

| Net Worth | Ages 50-54 | Ages 55-59 |

|---|---|---|

| Below average | Below $171,320 | Below $193,549 |

| Average | Above $171,320 | Above $193,549 |

| Good | Above $493,928 | Above $644,806 |

| Great | Above $1,440,829 | Above $2,506,118 |

Net worth in your 60s

Americans in their 60s should focus on paying off all debts to prepare for retirement. They should eliminate all credit card debts, mortgages, and car loans.

They should plan on when to receive Social Security benefits.

Here is the net worth for people in their 60s, sorted by percentiles:

| Percentile | Ages 60-64 | Ages 65-69 |

|---|---|---|

| 25th | $48,565 | $44,125 |

| 50th | $228,833 | $271,805 |

| 75th | $735,348 | $808,183 |

| 90th | $1,995,238 | $1,939,467 |

Net worth by age 65

Here are net worth goals by age 65:

- Below average net worth: below $228,833

- Average net worth: above $228,833

- Good net worth: above $735,348

- Great net worth: above $1,995,238

Net worth by age 70

Here are net worth goals by age 70:

- Below average net worth: below $271,805

- Average net worth: above $271,805

- Good net worth: above $808,183

- Great net worth: above $1,939,467

Here are the net worth goals for people in their 60s:

| Net Worth | Ages 60-64 | Ages 65-69 |

|---|---|---|

| Below average | Below $228,833 | Below $271,805 |

| Average | Above $228,833 | Above $271,805 |

| Good | Above $735,348 | Above $808,183 |

| Great | Above $1,995,238 | Above $1,939,467 |

Net worth in your 70s

Many Americans in their 70s have retired and are living off their investments, pensions, and Social Security.

Here is the net worth by age 80, sorted by percentiles:

| Percentile | Ages 70-74 | Ages 75-79 |

|---|---|---|

| 25th | $70,081 | $83,500 |

| 50th | $258,531 | $272,976 |

| 75th | $816,274 | $611,857 |

| 90th | $1,966,166 | $1,541,480 |

Net worth by age 75

Here are net worth goals by age 75:

- Below average net worth: below $258,531

- Average net worth: above $258,531

- Good net worth: above $816,274

- Great net worth: above $1,966,166

Net worth by age 80

Here are net worth goals by age 80:

- Below average net worth: below $272,976

- Average net worth: above $272,976

- Good net worth: above $611,857

- Great net worth: above $1,541,480

Here are the net worth goals for people in their 70s:

| Net Worth | Ages 70-74 | Ages 75-79 |

|---|---|---|

| Below average | Below $258,531 | Below $272,976 |

| Average | Above $258,531 | Above $272,976 |

| Good | Above $816,274 | Above $611,857 |

| Great | Above $1,966,166 | Above $1,541,480 |

Net worth in your 80s

Here is the net worth at age 80, sorted by percentiles:

| Percentile | Ages 80+ |

|---|---|

| 25th | $ 107,664 |

| 50th | $ 235,193 |

| 75th | $ 589,233 |

| 90th | $ 1,655,537 |

Here are net worth goals for people over age 80:

- Below average net worth: below $235,193

- Average net worth: above $235,193

- Good net worth: above $589,233

- Great net worth: above $1,655,537

Here are the net worth goals for people over age 80:

| Net Worth | Ages 80+ |

|---|---|

| Below average | Below $235,193 |

| Average | Above $235,193 |

| Good | Above $589,233 |

| Great | Above $1,655,537 |

Here are 15 tips to increase your net worth:

Remember, net worth is assets minus debts. So, you need to increase assets and decrease debt.

- Make savings a habit.

- Pay off credit cards fast. Avoid credit card debt if you can.

- Pay off all your debts, especially any non mortgage loans.

- Invest in stocks using low-cost index funds

- Investments are better than savings. (Use total stock market index funds like VTSAX or SWTSX.)

- Let your investments grow using compound interest. Remember the Rule of 72.

- You need a plan, so make and follow a budget.

- Invest in a retirement plan at work, like a 401(k) or a Roth IRA.

- When you increase your income, increase your investments.

- Control spending so you can save and invest more.

- Track your net worth and update it annually.

- Compare your net worth to your age.

- Increase your skills to improve your income. Learn to earn.

- Owning a home is an investment. Homeowners typically have higher net worth

- Be patient because net worth grows with age and income.

Here are more net worth articles on Finally Learn:

What is Net Worth and Why Does it Matter?

How to Build Wealth: 10 Tips for Financial Freedom

Jeff Mankin teaches financial literacy and Excel. He is the founder of Finally Learn.