Net worth is one of the most important metrics in personal finance. Net worth is the sum of total assets minus total debts. So, net worth is the value of the assets remaining after all debts are paid.

Contents

Net worth definition

Net worth is a measure of wealth. It is the sum of the assets owned by a person or household, minus any debts. If assets are higher than debts, the net worth is positive. If the liabilities are greater than the assets, the person has a negative net worth.

Net worth is important because it is a measure of financial health. If a person has a negative net worth, they owe more than the sum of their assets. This indicates poor financial health.

As net worth grows, the person’s financial health improves. Tracking net worth over time can show how much a person’s financial health has improved.

The formula for net worth is: net worth = total assets – total liabilities.

Net worth is also called wealth or net assets because it shows the assets remaining after the debts have been paid.

Assets are resources owned by a person or a household. Liabilities are debts the household owes to creditors.

For example, assume John’s assets are $120,000 and his debts are $50,000. So his net worth is $70,000. See the example below.

To calculate net worth, you need a list of personal assets and liabilities.

Assets

The following are typical personal assets:

- cash in bank or money market accounts

- value of cars and other vehicles

- retirement accounts such as a 401k, IRA, and Roth IRA

- investment accounts with stocks and mutual funds

- value of a house or other real estate

- collectibles, antiques, or jewelry

- value of ownership in a business

Liabilities

The following list shows a list of personal liabilities:

- car loans

- student loans

- mortgage loans

- credit card balances

- other personal loans

From the total assets, subtract the total liabilities to calculate the net worth.

Net worth example

Assume Mary, age 35, wants to calculate her net worth. First, she needs a list of her assets. Her assets are:

| Assets | Amount |

|---|---|

| Checking and savings | $ 10,000 |

| Value of car | $ 20,000 |

| Investments | $ 35,000 |

| Retirement account | $ 55,000 |

| Home | $ 200,000 |

| Total Assets | $ 320,000 |

Second, Mary needs a list of her personal liabilities. She has the following debts:

| Debts | Amount |

|---|---|

| Credit card balance | $ 5,000 |

| Student loan | $ 30,000 |

| Car loan | $ 15,000 |

| Home loan | $ 175,000 |

| Total Debts | $.225,000 |

What is Mary’s net worth? Since total assets are $320,000 and total debts are $225,000, Mary’s net worth is $95,000.

Mary’s net worth calculation is below.

| Net Worth | Amount |

|---|---|

| Total Assets | $ 320,000 |

| Total Debts | $ 225,000 |

| Net Worth | $ 95,000 |

Average net worth vs. median net worth

In the U.S., the average net worth is shown in two ways: the mean and the median.

The average net worth in the U.S. is $748,800. This is from the Federal Reserve 2019 data, the most recent year the data is available.

However, the median net worth in the U.S. is $121,700. So, which one should we use?

One issue with calculating a mean is that large numbers skew the mean. In this case, large net worth numbers would increase the mean significantly. So, $748,800 does not show the typical household.

The median is unaffected by large or small numbers, in contrast to the mean. The median is the middle number of the data set. So, the median is more representative of a typical household than the mean. The median shows the middle value. 50% of the households are above the median and 50% below it.

So, use the median for financial metrics like income and net worth.

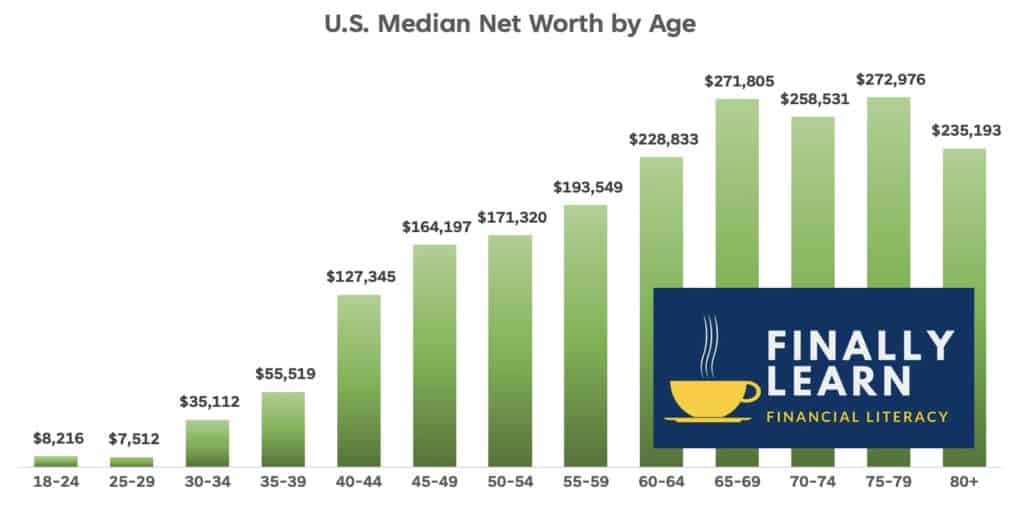

Median net worth by age

In 2019, the median U.S. household net worth was $121,700. This is the overall median for all ages. For most people, that number isn’t very helpful.

Net worth increase over a person’s lifetime. So, compare your net worth by your age. So, what is the median net worth by age?

The following table and graph show the median by age. The youngest age bracket, 18-24, has the lowest median net worth. One reason is young people are just starting their careers. Another reason is that some young people have negative net worth because of student loans early in their careers.

| Age | Median Net Worth | Average Net Worth |

|---|---|---|

| 18-24 | $ 8,216 | $ 28,707 |

| 25-29 | $ 7,512 | $ 49,388 |

| 30-34 | $ 35,112 | $ 122,700 |

| 35-39 | $ 55,519 | $ 274,112 |

| 40-44 | $127,345 | $ 623,694 |

| 45-49 | $164,197 | $ 761,560 |

| 50-54 | $171,320 | $ 897,663 |

| 55-59 | $193,549 | $1,165,477 |

| 60-64 | $228,833 | $1,187,730 |

| 65-69 | $271,805 | $1,250,679 |

| 70-74 | $258,531 | $1,173,653 |

| 75-79 | $272,976 | $ 945,480 |

| 80 + | $235,193 | $ 973,141 |

To understand the chart, find the median for the age category. In the previous example, Mary is 35 years old and has a $95,000 net worth. The median for her age is $55,519. This means half of the households are above $55,519 and half are below.

Mary is in the top half of her age category. She has a higher net worth than the typical household. So, she is doing better than most households.

The following graph shows the same information as the previous table. As people get older, the median net worth increases until the retirement years of 75+.

Can you have a negative net worth?

Yes, negative net worth is when the debts are greater than the household assets. To eliminate negative net worth:

- save more money

- pay off debts

- increase assets

Does every person or household have a net worth?

Every household has assets and/or debts. So, yes, every household has a net worth. It could be negative or positive, but it would still be net worth.

Adults who own assets and debts would have a net worth. Typically, minor children do not own assets and do not have a net worth.

What is a millionaire?

A millionaire is a person with a net worth of at least $1 million dollars. So, their assets exceed their liabilities by at least one million. Technically, households determine net worth. However, the term millionaire usually refers to individuals.

What is a high net worth individual (HNWI)?

A millionaire is also called a high net worth individual (HNWI). Some definitions of HNWI require at least $1 million of liquid investments not including home equity.

There are additional categories of high net worth individuals:

- High net worth individuals (HNWI) have liquid assets between $1 – $5 million.

- Very high net worth individuals (VHNWI) have liquid assets between $5 – $30 million.

- Ultra high net worth individuals (UHNWI) have liquid assets greater than $30 million.

What is a billionaire?

A billionaire has a net worth of at least $1 billion. So, their assets exceed their debts by at least one billion. There are an estimated 2,700 billionaires worldwide.

What is another name for net worth?

Net worth for an individual is also called wealth, or net assets.

Net worth for a company is called stockholders’ equity, equity, or net assets.

Net worth calculator

Knowing your net worth is a great habit to start.

See the Net Worth Calculator to estimate your net worth.

Sources:

Federal Reserve: Changes in U.S. Family Finances from 2016 to 2019

Here are more net worth articles on Finally Learn:

What is Net Worth and Why Does it Matter?

How to Build Wealth: 10 Tips for Financial Freedom

Jeff Mankin teaches financial literacy and Excel. He is the founder of Finally Learn.