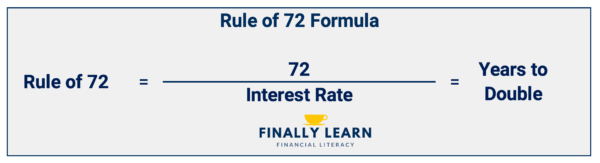

The rule of 72 is an estimate of how quickly an investment doubles. The formula is 72 divided by the interest rate. As returns increase, the years needed to double decrease.

Contents

What is the Rule of 72?

How long does it take for an investment to double at a 10% annual return? 10 years? Wrong! It only takes about 7.2 years. Surprised? You need to know the Rule of 72.

The rule of 72 formula is 72 divided by an interest rate equals the years to double. So, a 9% return doubles an investment in 8 years (72 ÷ 9 = 8 years).

Compound Interest

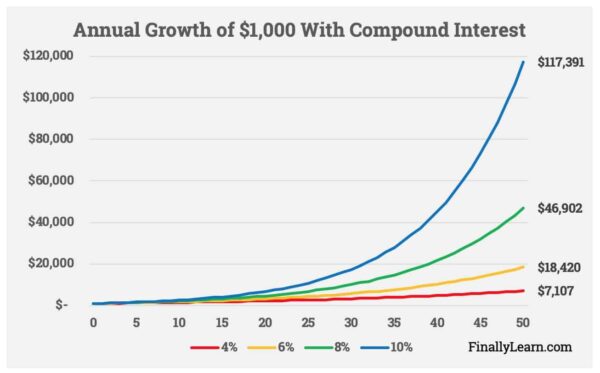

Compound interest is shown in the following graph. It is interest on the principal and the accumulated interest. Compound interest is interest on interest. Compound interest always grows faster than simple interest.

For example, over 50 years $1,000 grows to over $7,000 at 4% but over $117,000 at 10%.

See the graph below for the growth at different interest rates.

Compound Interest Formula

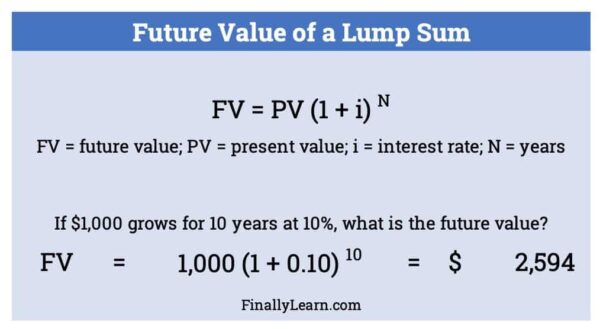

Time value of money (TVM) is the calculation of compound interest. TVM involve the following variables:

- PV – present value

- FV – future value

- I – interest rate

- N – number of periods

- PMT – periodic payments (+ or -)

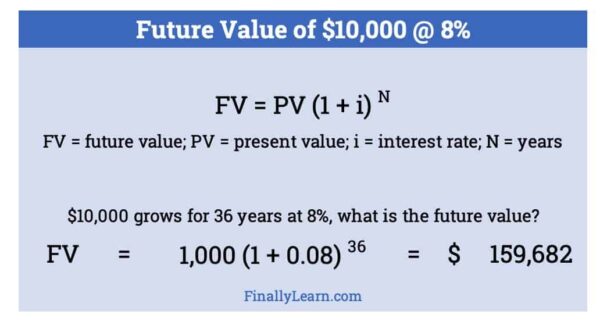

The formula to calculate the growth of an investment over time is called the future value of a lump sum. The formula is below:

This formula shows how $1 or $1,000 can grow with interest over time. This is called exponential or logarithmic growth. You can see this with the steep upward sloping curve.

The rule of 72 is an estimate for a complex interest problem. Investing is based on compound interest. The rule of 72 is helpful when a calculator or spreadsheet is not available.

See Financial Functions in Excel to calculate the rule of 72 in Excel.

Rule of 72 Formula

How do you use the Rule of 72? You need to know the interest rate to calculate the years to double. Also, you can use the years to find the interest rate.

If you know the interest rate, you can calculate the number of years for an investment to double. The Rule of 72 formula to calculate years to double is:

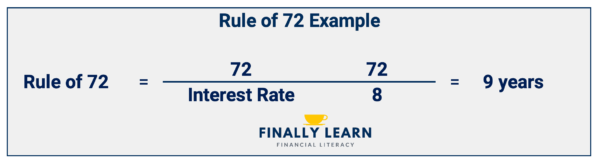

So, if the interest rate is 8%, the investment will double in 9 years. Woo! The interest rate is used as a whole number so 8% is 8 in the formula. If the 8% continues, the account will double every 9 years.

The investment would double in Year 9, Year 18, and Year 27!

What if the interest rate is 12%? How many years will it take for an investment to double?

At 12%, 72 / 12 = 6 years

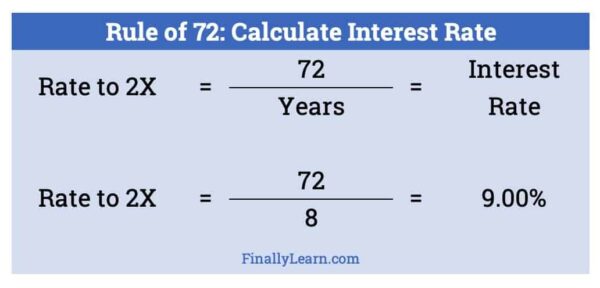

Solving for the interest rate

What if you want an investment to double in 8 years? The formula can be flipped to calculate the interest rate needed. The Rule of 72 formula to calculate interest rate is:

If an investment doubles in 8 years, the annual interest rate is 9%. If an investment is expected to double in 10 years, it needs a 7.2% interest rate.

An investment doubled in 12 years. What was the rate of return?

At 12 years, 72 / 12 = 6% interest rate.

Rule of 72 Calculator

Use the following Rule of 72 calculator to estimate the number of years to double an investment. Enter the rate and it will estimate the years.

For example, if you receive a 10% return, enter the interest rate as 10. The calculator will show the Rule of 72 answer, 7.2 years.

Rule of 72 with different interest rates

The table below shows the percents and the years for money to double. The higher the rate the fewer years to double. The following table shows the Rule of 72 years compared to actual years.

At 6%, the Rule of 72 estimates 12 years. The actual years is 11.9. Close enough. The estimate for 10% is 7.2 years and the actual years are 7.3. The Rule of 72 is a good estimate!

The Rule of 72 is a good estimate in 3-12% range. When the rates get larger, the estimate is not as good.

Rule of 72 over time

How can you use the Rule of 72? Investing is a long-term game. Making 6% or 8% for one year doesn’t make much difference. This difference grows dramatically over time. This is compound interest.

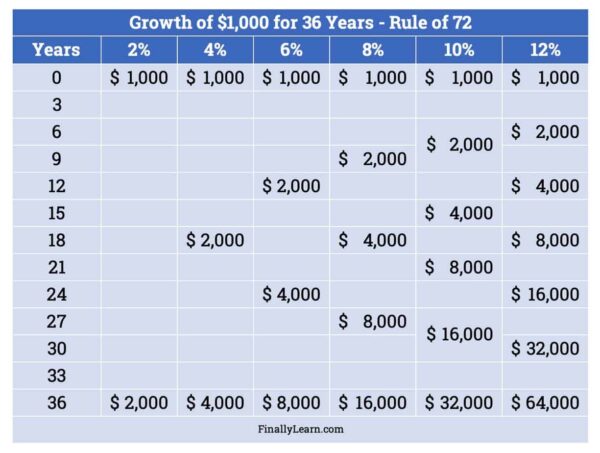

If an account starts at $1,000 and earns 6%, it doubles every 12 years. For 36 years, it doubles three times. The $1,000, grows to $8,000 in 36 years. Thats good!

If that same account earns 8%, it doubles every 9 years. In 36 years, it doubles four times. The $1,000 becomes $16,000 over the 36 years. That is even better!

Look at the following chart. If an investment grows 2% more, the investment doubles in 36 years. Wow!

An account with a 4% rate grows to $4,000 but a 6% rate grows to $8,000. If the account earns 8%, it grows to $16,000. At 10%, the account has $32,000 at the end of 36 years. Investing is a long game. Even 2% makes a big difference.

Rule of 115

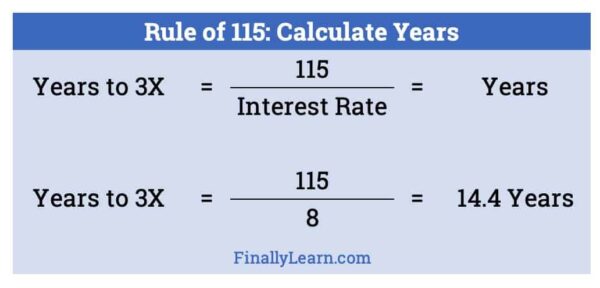

Now you know how to double, what about growing 3 times or 4 times? There are rules for those too.

Rule of 72: Double an investment (2X)

Rule of 115: Triple an investment (3X)

Rule of 144: Quadruple an investment (4X)

The rule of 115 estimates how quickly an investment will triple. If you earn 8% on an investment, it triples in 14.4 years. The formula is similar to the Rule of 72.

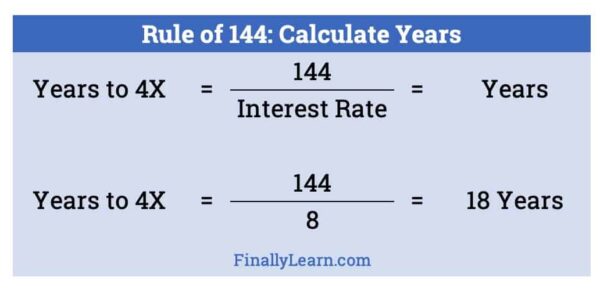

Rule of 144

The rule of 144 estimates how an investment will quadruple. If you earn 8% on an investment, it is worth 4X in 18 years. The formula is shown below.

So, if you earn 8% on an account with $1,000, it grows to $2,000 in 9 years. It reaches $3,000 in 14.4 years. It climbs to $4,000 in 18 years.

Investing Example

Question: Assume Abby is 30 and has $10,000 invested in an account earning 8%. She has 36 years to invest until age 66. How much would she have at age 66? Hint: use the rule of 72.

Answer 1: Using the rule of 72, Abby’s money would double every 9 years. So, 36 / 9 = 4 times to double. So, $10,000 doubles to $20,000, $40,000, $80,000, and finally $160,000. So, we estimate $160,000.

Answer 2: Using the rule of 144, her money would 4X every 18 years. So, 36 / 18 = 2 times to 4X. So, $10,000 quadruples to $40,000 and then again to $160,000. Our estimate is again $160,000.

Answer 3: Using the compound interest formula, Abby’s account would be exactly $159,682. The $160,000 estimate was excellent. The Rule of 72 is useful!

Use the Rule of 72 to help estimate the growth of investments. This helps you think long term.

Investing is a long game. Investing is planting a tree today to enjoy the shade in the future.

See Top 10 Investing Rules to Build Wealth for more investing content.

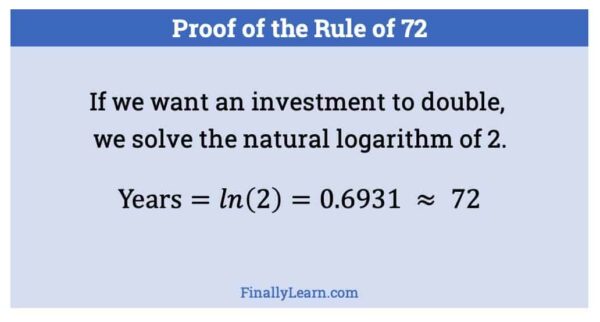

Rule of 72 Proof

So, how did we get the Rule of 72 formula? Well, it is a little bit of math. We need to use the natural logarithm which is the inverse of the exponential function. Compound interest is exponential growth.

Here is the Rule of 72 proof:

Yes, the closest answer is 69.3. There are some people who use the Rule of 69.3 or the Rule of 70. Remember, this is just an estimate. Using 69.3 or 70 would be closer to the actual number, but harder to use. The rule of 72 is the best estimate.

Using 72 is still accurate but easier to divide by more numbers. Also, using 72 means the estimate at 4%, 5%, or 6% is a little higher than the actual. So, 72 is a more convenient and conservative estimate.

If you want to learn about a financial calculator, see The Best Financial Calculator.

Jeff Mankin teaches financial literacy and Excel. He is the founder of Finally Learn.