Debits and credits in accounting are used to record every business transaction. This guide explains debit and credit rules using the acronym “DEALER.”

This is Chapter 2 in Principles of Accounting. This chapter includes:

- Recording Business Transactions

- Debits and Credits Explained: An Illustrated Guide

- What is the Accounting Equation?

- Financial Statements: A Beginner’s Guide

- Recording Business Transactions YouTube playlist

For all the chapters, see The Ultimate Guide to Learn Accounting.

Contents

What are debits and credits?

In accounting, all transactions are recorded in a company’s accounts. The basic system for entering transactions is called debits and credits. This seems hard, but it is a simple system that you can learn.

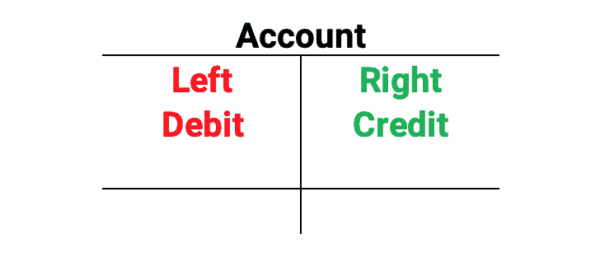

Every account is shown using a picture called a t-account. T-accounts show the left and right sides of the account. Here is a sample account:

The two sides of the account show the pluses and minuses in the account. Accounting uses debits and credits instead of negative numbers.

Debit is left and credit is right

So, here are the definitions for debits and credits:

- Debit means to put an entry on the left side of the account.

- Credit means to put an entry on the right side of the account.

However, some debits increase and some debits decrease. Also, some credits increase and some decrease. It depends on the account!

Why use debits and credits?

When you first start learning accounting, debits and credits are confusing. Why not just use left and right? Good question. In accounting, debits and credits are used as verbs. It is an action. To debit something means to place it on the left. Also, if you credit an account, you place it on the right.

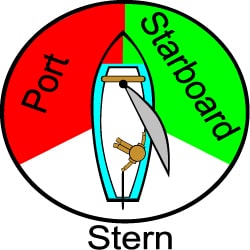

Let’s look at another situation that uses different terms for left and right, shipping.

When you are on a ship, the terms left and right would be confusing. Left or right would change if you were looking forward or behind. Miscommunication could be dangerous so at sea they use port and starboard.

Look at this example of a boat. Port is on the left and always red. So, starboard is on the right and always green.

One way to remember is the question, “Is there any red port wine left in the bottle?” You can now remember that the port is red and on the left side.

So, in the examples below, debits are in red and credits are in green. You need to learn the debit and credit rules. First, we need to understand double-entry accounting. This is why we have two sides for each account.

Double-entry accounting

Accounting uses a system called double-entry accounting where:

- Every transaction affects at least two accounts

- There must be at least one debit

- There must be at least one credit

- The debits must always equal the credits

So, to add or subtract from each account, you must use debits and credits.

5 types of accounts

In accounting, the five types of accounts are:

- assets: resources owned by a business; what the company owns

- liabilities: debts of the company; what the company owes

- equity: claim on the assets by the owners; calculated as equity = assets – liabilities; equity is the net worth of the company

- revenues: when a business receives assets from selling products and services

- expenses: when a business uses or consumes assets to create revenues

Assets

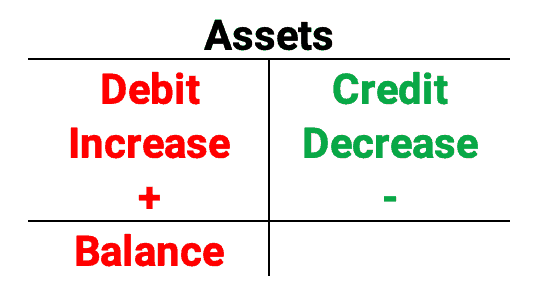

Assets are resources owned by the business. These include cash, receivables, inventory, equipment, and land.

Assets increase with debits and decrease with credits. The normal balance of assets is a debit balance. Here are the rules for assets:

Liabilities

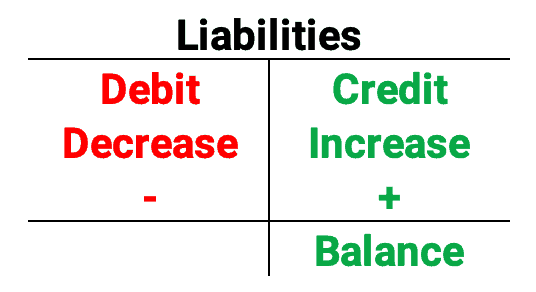

Liabilities are debts owed by the business. These debts are called payables and can be short term or long term.

Liabilities increase with credits and decrease with debits. The normal balance of liabilities is a credit balance. Here are the rules for liabilities:

Equity

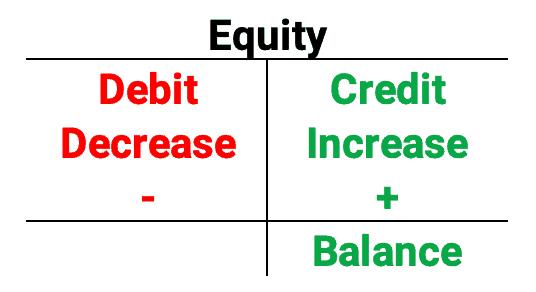

Equity can be explained in two ways:

- Assets – Liabilities

- Net Worth or the owners’ claim on the business

Equity increases with credits and decreases with debits. The normal balance of equity is a credit balance. Here are the rules for equity:

Revenues

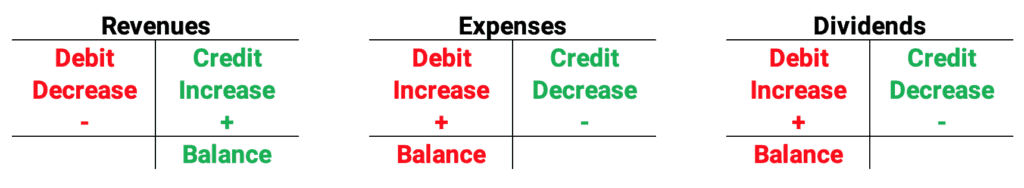

So, let’s look at revenues and expenses. We will also add a very common account called dividends as the final piece to the debits and credits puzzle.

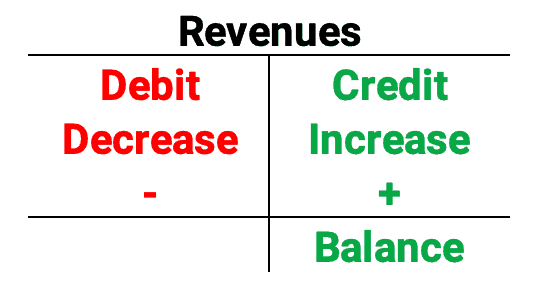

Revenues occur when a business sells a product or a service and receives assets. Other names for revenue are income or gains.

Revenues increase with credits and decrease with debits. The normal balance of revenues is a credit balance. Here are the rules for revenues:

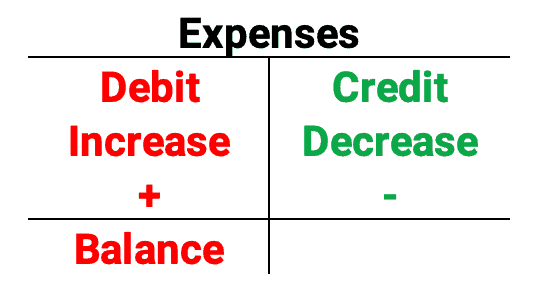

Expenses

Expenses consume assets. Common expenses include wages expense, salary expense, rent expense, and income tax expense. Also, losses are included in the expenses category.

Expenses increase with debits and decrease with credits. The normal balance of expenses is a debit balance. Here are the rules for expenses:

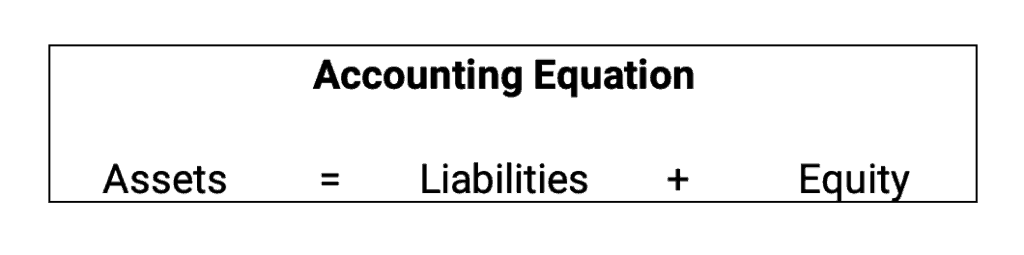

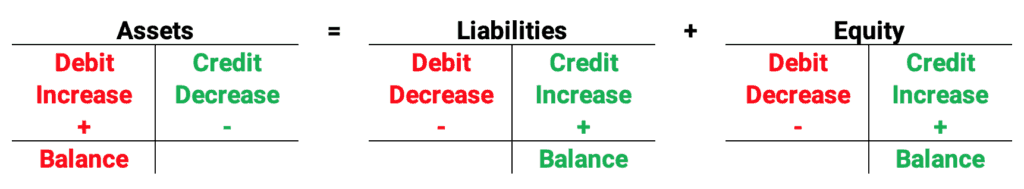

Accounting equation

Assets, liabilities, and equity form the accounting equation. The accounting equation is:

Here is the accounting equation shown with t-accounts. Assets are on one side of the equation and liabilities and equity are opposite.

These accounts appear on the company’s balance sheet. The balance sheet shows that assets = liabilities and equity.

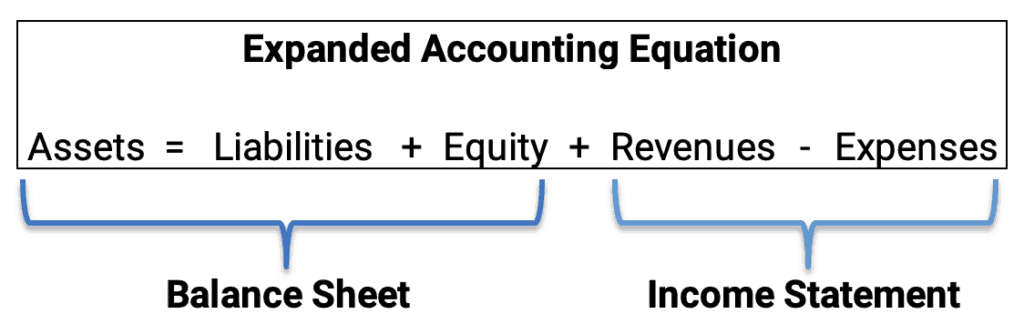

The remaining two accounts are revenues and expenses. We can add these to the accounting equation. Revenues increase equity and expenses decrease equity.

This is the expanded accounting equation:

So, the five types of accounts are used to record business transactions. The first three, assets, liabilities, and equity all go on the company balance sheet. The last two, revenues and expenses, show up on the income statement.

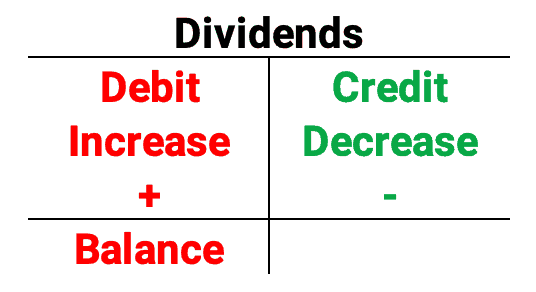

Dividends (reduces equity)

Dividends are a special type of equity account. They are the distribution of earnings to the owners that reduce equity.

Dividends are a special type of account called a contra account. Contra accounts reduce another related account. In this case, dividends reduce the equity account.

Dividends increase with debits and decrease with credits. The normal balance of dividends is a debit balance. Here are the rules for dividends:

Revenues, expenses, and dividends

To review the revenues, expenses, and dividends accounts, see the following example.

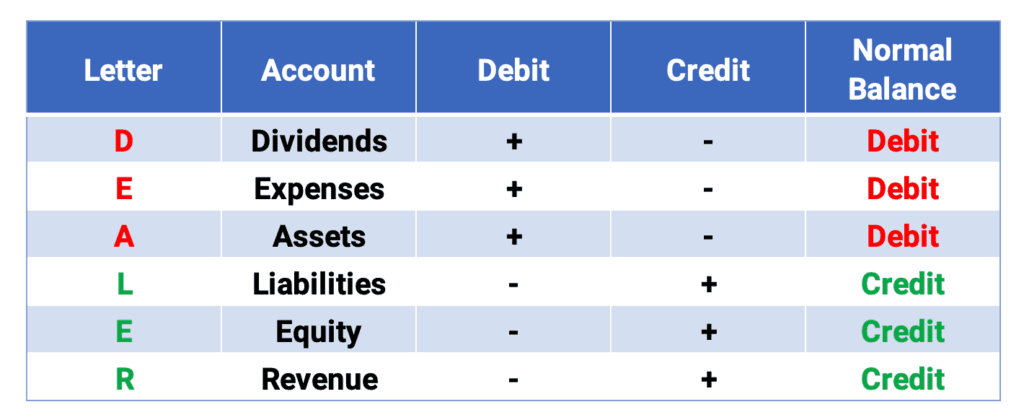

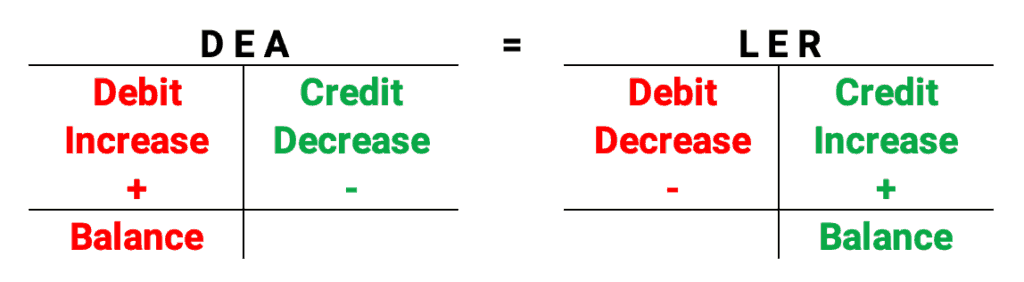

You need to memorize these accounts and what makes them increase and decrease. The easiest way to memorize them is to remember the word DEALER.

Remember “DEALER”

You should memorize these rules using the acronym DEALER. They are always true to record every transaction. DEALER is the first letter of the five types of accounts plus dividends.

DEA is for dividends, expenses, and assets that increase with debits.

LER is for liabilities, equity, and revenue that increase with credits.

The DEALER rules show how to increase and decrease every account:

Hint: if an account takes a debit to increase, it has a normal debit balance. So, accounts with credit balances take credits to increase.

Debits and Credits Explained Tutorial

Journal entry examples

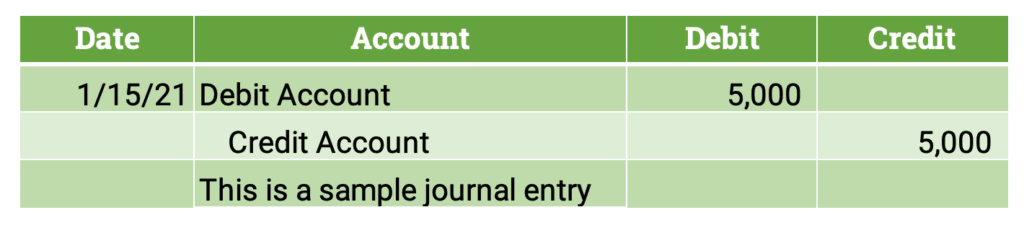

We use the debit and credit rules in recording transactions. All the transactions are recorded in a journal. A journal shows all the transactions.

Each transaction is recorded using a format called a journal entry.

Sample journal entries

So, a journal entry is a way to record a business transaction. The following example shows a sample journal entry:

Here are some tips to make journal entries. First, put today’s date in the date column. Second, all the debit accounts go first before all the credit accounts. Third, indent and list the credit accounts to make it easy to read. Last, put the amounts in the appropriate debit or credit column. Also, you can add a description below the journal entry to help explain the transaction.

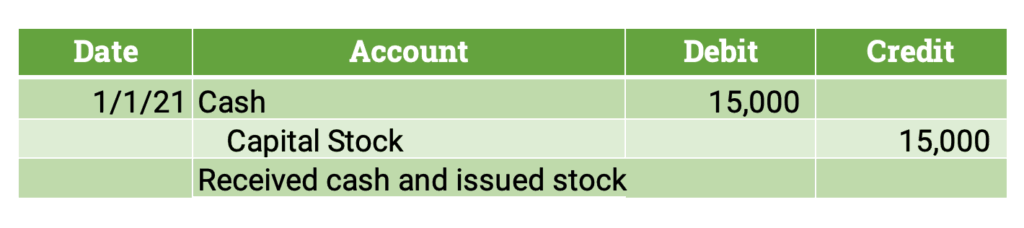

1. Issuing stock for cash

To begin, let’s assume John Andrew starts a new corporation Andrews, Inc. He give the company $15,000 cash. Andrew receives shares of stock from the company.

Remember, a transaction always affects at least two different accounts. What accounts should we include in this transaction?

First, cash is an asset and capital stock is equity. So, we need to follow the rules for assets and equity. So, cash increases for the business. Also, the equity increases for Andrews, Inc. See the journal entry below:

Because cash increases, it takes a debit because it is an asset. Since stock is equity, it increases with a credit.

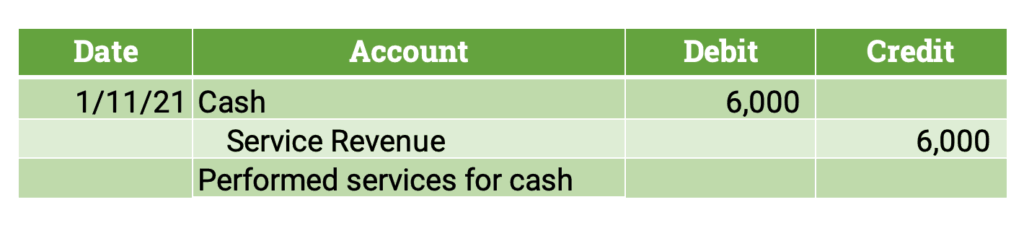

2. Cash revenue

Andrews, Inc. performs services for clients. The company receives cash of $6,000. What two accounts should we use?

The business receives an asset, cash. Also, it earns revenue because it sold a service. So, we need to use cash and service revenue. For example, see below:

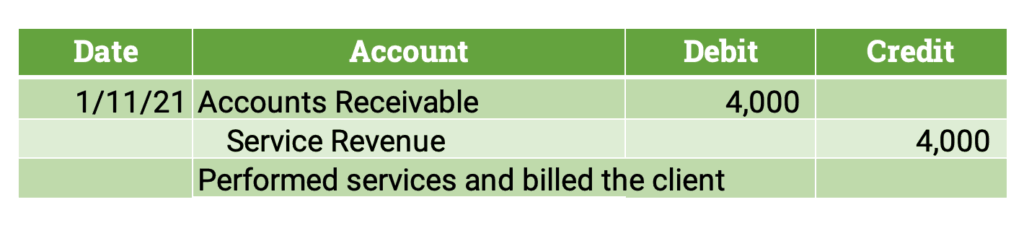

3. Credit revenue

Next, Andrews, Inc. performs more services for clients. The company bills the clients $4,000. What two accounts should we use now?

The business receives an asset, accounts receivable. Also, it earns revenue because it sold a service. So, we need to use accounts receivable and service revenue. Assets go up with a debit and revenues go up with a credit. Therefore, the journal entry is:

So, here is a question. What is the total revenue for Andrews? It is a total of $10,000. However, only $6,000 is in cash because the other $4,000 is still owed to Andrews.

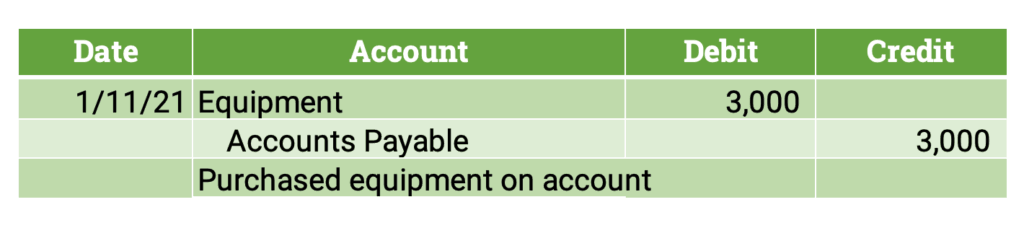

4. Buying an asset on account

Next, assume Andrews purchased equipment for $3,000. However, it did not pay cash but instead purchased on credit. The debt is owed in 30 days. So, what two accounts are affected?

First, equipment is an asset. Also, the debt is a liability. The liability is called accounts payable. So, any payable is a liability.

Assets increase with a debit. Also, liabilities increase with credits. So, the entry is easy:

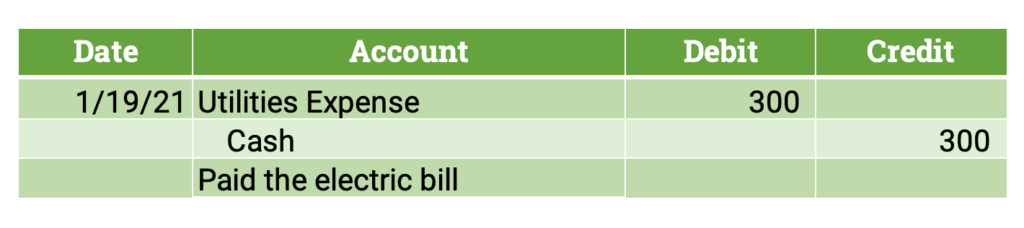

5. Paying an expense

Next, assume Andrews received an electric bill for $300. When it pays the bill, what accounts are affected?

Of course, cash goes down. Also, the other account is an expense. Remember, expenses consume assets. So, this is an expense. Cash is an assets that decreases. Let’s call the expense Utilities Expense. It is an expense that goes up.

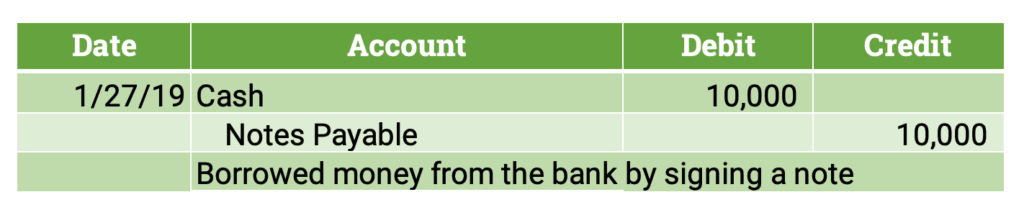

6. Borrowing from the bank

Last, assume Andrews borrowed $10,000 from the bank. The company signed a note for 3 years. What accounts are affected?

First, cash is an asset that goes up. That requires a debit. Second, the debt is recorded in notes payable. That is a liability that also goes up. This requires a credit.

Journal entries explained tutorial

The goal: financial statements

Debits and credits are the system to record transactions. However, this is just the beginning of the accounting system. The goal of accounting is to produce financial statements. These financial statements summarize all the many transactions into a useful format.

The following shows the order of the accounts in the accounting system.

- Assets

- Liabilities

- Equity

- Revenues

- Expenses

The balance sheet includes assets, liabilities, and equity. It shows the accounting equation. Remember dividends would reduce the equity shown on the balance sheet.

The income statement includes revenues and expenses. Revenues minus expenses equals either net income or net loss. If revenues are higher, the company enjoys a net income. If the expenses are larger, the company has a net loss.

Use debits and credits

When you start to learn accounting, debits and credits are confusing. Accounting is the language of business and it is difficult. However, these are rules that you need to memorize. Use the DEALER method and you will do well.

Finally, here is a way to remember the DEALER rules. If you make two t-accounts, the D E A accounts have debit balances. So, debits would increase these accounts. Also, credits would decrease these accounts.

The L E R accounts have credit balances. So, credits increase and debits decrease these accounts.

D E A accounts are dividends, expenses, and assets. These accounts have debit balances.

L E R accounts are liabilities, equity, and revenues. These accounts have credit balances.

Accounting Chapters

Here are the accounting chapters in The Ultimate Guide to Learn Accounting:

- Introduction to Accounting

- Recording Business Transactions

- Adjusting Entries and the Accounting Cycle

- Merchandising Activities

- Inventory and Cost of Goods Sold

- Time Value of Money

- Cash and Internal Control

- Receivables

- Long-Term Assets

- Current Liabilities

- Long-Term Liabilities

- Corporations

- Statement of Cash Flows

- Financial Statement Analysis

- Managerial Accounting

- Job Order Costing

- Process Costing

- Activity Based Costing

- Cost Volume Profit Analysis

- Variable Costing

- Master Budgets

- Standard Costing

- Performance Measurement

- Relevant Costing

- Capital Budgeting

See also Accounting Sample Exams.