Do you want to build wealth? Here are nine tips for increasing your net worth and achieving financial freedom. Start your journey to financial prosperity here.

Wealth can provide financial security, so it is an important financial goal.

Contents

Key concepts

10 Tips to Build Wealth

- Know your net worth

- Set financial goals

- Build an emergency fund

- Increase your income

- Pay off high interest debt

- Save automatically

- Invest monthly

- Spend carefully

- Protect your wealth

- Seek professional advice

1. Know your net worth

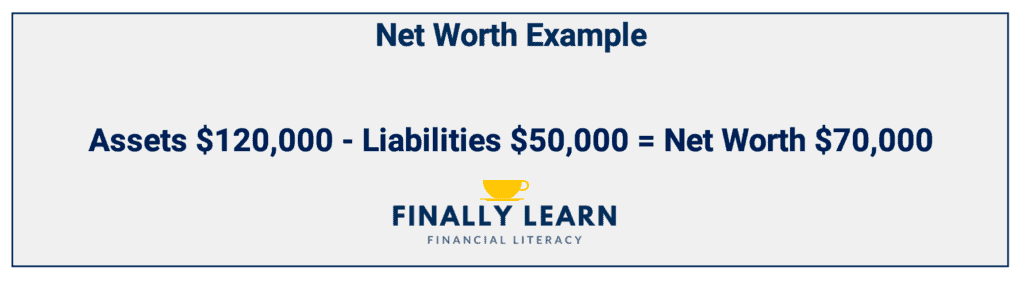

Knowing your net worth is a crucial first step in your journey to build wealth. Net worth is the difference between your assets and your debts. Assets are what you own. Debts, or liabilities, are what you owe.

Net worth shows a snapshot of your financial position. It helps you understand how close you are to achieving your financial goals.

Calculate your net worth

The formula for net worth is assets – liabilities = net worth.

To calculate your net worth, list all of your assets, including cash, investments, real estate, vehicles, and any valuables.

Next, list all of your debts, such as mortgages, student loans, credit card debt, and any other outstanding loans.

Wealth is also called net worth.

If your assets are larger, you have a positive net worth. If you have more debts, your net worth is negative.

Knowing your net worth allows you to evaluate where you currently stand financially. Knowing what causes an increase or decrease in net worth can help guide future financial decisions.

By tracking changes in your net worth over time, it becomes easier to measure progress towards achieving your financial goals such as:

- retirement

- buying a home

- financial independence

Once you know your net worth, reassess it once or twice a year. This helps you reevaluate and continue your progress.

Compare your net worth

Your net worth will vary over time, so it is important to compare your net worth by age category. Generally, net worth grows over a person’s life.

In 2019, the median U.S. household net worth was $121,700. This is the median for all ages.

The following table shows the median by age. The youngest age bracket, 18–24, has the lowest median net worth. One reason is that young people are just starting their careers. Some young people have a negative net worth because of student loans early in their careers.

Here is the median net worth by age:

| Age Bracket | Median Net Worth |

|---|---|

| 18-24 | $ 8,216 |

| 25-29 | $ 7,512 |

| 30-34 | $ 35,112 |

| 35-39 | $ 55,519 |

| 40-44 | $127,345 |

| 45-49 | $164,197 |

| 50-54 | $171,320 |

| 55-59 | $193,549 |

| 60-64 | $228,833 |

| 65-69 | $271,805 |

| 70-74 | $258,531 |

| 75-79 | $272,976 |

| 80 + | $235,193 |

So, if Mary is 35 years old and has a $95,000 net worth, she is above the median for her age of $55,519. The median means that half of the households are above $55,519 and half are below.

See all our resources at Average Net Worth by Age

2. Set financial goals

Setting financial goals is a crucial step towards building wealth and increasing net worth. By clearly defining your goals, you have a roadmap to follow with a sense of purpose.

Set goals with both short-term and long-term objectives. Short-term goals can be achieved within a year or less. Short-term goals include:

- saving for a vacation

- saving for a new purchase

- paying off credit card debt

- saving for an emergency fund

Long-term goals are more focused on larger things that require longer periods of time to accomplish. Long-term goals include:

- buying a home

- funding retirement accounts

- starting your own business

- becoming debt-free

- achieving financial independence

Goal setting requires creating a following a budget. A budget lets you spend on your priorities. You can save more and pay off debt faster when you have a plan.

A free budgeting tool that we recommend is from Ramsey Solutions: the EveryDollar app.

Setting well-defined financial goals serves as a foundation for building wealth and increasing net worth.

Remember, goals provide direction and motivation, so periodically review and adjust them as needed. A budget is an important step on the way to building wealth.

3. Build an emergency fund

Sometimes, unexpected expenses or financial hardships occur. You need to plan for these bumps in the road. You need an emergency fund.

An emergency fund is a safety net that is created by saving at least $1,000 in a savings account. The purpose of the emergency fund is to provide a cushion when unexpected expenses occur.

The sad reality is that most Americans cannot afford an emergency $1,000 expense.

The emergency fund is important so you don’t have to borrow money for a small emergency. As your net worth improves, a larger emergency fund of 3-6 months of expenses is more better.

The $1,000 starter emergency fund is step 1 of Dave Ramsey’s Baby Steps.

You should quickly get your first $1,000 in your emergency fund.

Here are some tips to save your first $1,000:

- reduce your current expenses

- include savings in your budget

- start a side hustle to make extra income

- sell unwanted items

- save any extra refunds or income

- automate savings into the emergency fund

- cut back on luxury items

- reduce grocery costs

- eat out less

- have no-spend days

Each of these tips can help you build up your emergency fund quickly, giving you a financial cushion for unexpected situations.

Setting a monthly savings goal can help build an emergency fund quickly.

Good options for an emergency fund:

- high-yield savings account

- money market account

- savings account

Set up automatic transfers from your checking account into your emergency fund account each month.

By being disciplined with your saving habits and building an emergency fund, you are preparing for financial security and peace of mind. Building an emergency fund is a key to building wealth.

4. Increase your income

Increasing your income is important for building wealth.

Here are some ideas to increase your income:

- seek career advancement opportunities

- add responsibilities in your current job

- apply for promotions with your current employer

- explore job opportunities with higher compensation

- develop new skills: professional development, certifications, or learn Excel

- start a side business

- freelance where you have expertise: writing, graphic design, or consulting

Also, investing can play a significant role in increasing income over time. If you invest in assets that generate regular returns, such as stocks and mutual funds, this can increase your income.

Increasing your income is an integral part of building wealth. It is easier to build wealth as your income grows.

5. Pay off high-interest debt

High-interest debt means credit cards. Pay credit cards off as soon as possible. Credit cards are a huge burden when you carry credit card debt.

The average U.S. credit card debt per family was $6,568 in 2023. The average credit card interest rate is close to 20%. The annual interest on these debts is about $1,300. Ouch!

Paying off credit card debt is crucial to build wealth.

High-interest debts, such as credit cards or personal loans, can quickly accumulate and harm your financial progress.

By eliminating these high interest debts, you can save a significant amount of money in the long run and free up more funds to invest or save.

Snowball method

One effective strategy for paying off high interest debt is the snowball method:

- list all your debts from the smallest to the largest balance, except for your mortgage

- make minimum payments on all the loans except for the smallest balance

- on the smallest loan, make larger payments until it is paid off

- after the smallest debt is paid, add that amount to the next smallest loan

- as you pay each smaller debt, you gain momentum on the larger debts

Paying off high-interest debt requires discipline and commitment. To achieve this goal, cut unnecessary expenses so that you can allocate more funds towards debt repayment each month.

Paying off your debt is key to securing your financial future and long-term wealth accumulation.

6. Save automatically

One of the best ways to build wealth is by saving automatically. By setting up automated savings, you “pay yourself first“.

Automating savings removes the temptation to spend that money and helps to make consistent progress towards your financial goals.

“Set it and forget it”

Ron Popeil

To save automatically, set up automatic transfers from your checking account to a savings account. You can do this at your bank. Allocate a portion of your income each month. The key benefit is: you won’t miss it, and you can’t spend it.

A key benefit is that you create a habit of saving that becomes effortless over time.

Find a way to automate your monthly savings, and you will be on your way to building wealth.

7. Invest monthly

Wealthy individuals invest their money in investments that grow. So, investing is a crucial component of building wealth and securing a stable financial future.

While saving money is important, you also need to invest it to grow over time. This requires investments like stocks, mutual funds, and real estate.

Investments grow at a compounded rate of return, but this takes years. To estimate how fast your money can double, see the Rule of 72.

To build wealth, invest monthly. Creating a disciplined approach can yield substantial returns in the long run.

3 fund portfolio

Investing involves several types of investments:

- stocks

- bonds

- real estate

The easiest way to start investing is in index funds or exchange-traded funds (ETFs). Index funds are low-cost and diversified.

Index funds invest in a market index such as the S&P 500 at a very low cost. ETFs are funds that trade like stocks on the stock market.

One of the best ways to do index investing is with the 3 Fund Portfolio. The 3 Fund Portfolio allocates investments to only 3 index funds:

- U.S. stock market fund

- International stock market fund

- U.S. bond fund

Fidelity, Vanguard, and Schwab each have several low-cost index funds that are good for individual investors.

Investing in the stock market has risks and rewards. The long-term annual returns for the S&P 500 are around 10%. However, the volatility of the stock market means losses do occur frequently.

The following video shows the risk and return for stocks in the S&P 500, bonds, and treasury bills:

Another potential investment is real estate. Real estate offers potential for both regular cash flow through rental income and long-term appreciation of property values.

Investing monthly is a key element in building lasting wealth and financial security. You will maximize your potential for compounding returns and capitalize on long-term growth opportunities.

401(k) plans

Take advantage of any employer-sponsored retirement plans such as 401(k)s or individual retirement accounts (IRAs). These plans allow you to contribute a percentage of your pre-tax income into investment accounts.

Since the contributions are deducted automatically from your paycheck, it ensures consistent saving while also offering potential tax advantages.

401(k) plans allow for pre-tax dollars to grow for years before taxes are paid. A 401(k) plan has several advantages:

- employee can contribute with pretax income

- employers may match the employee contribution

- the money grows tax deferred: it is taxed when withdrawn

Make sure you are both saving and investing automatically.

8. Spend carefully

When building wealth, you must spend money carefully.

Adopting a mindful and strategic approach to spending, you can take control of your finances and pave the way towards financial freedom.

“Beware of little expenses. A small leak will sink a great ship.”

Benjamin Franklin

First, creating a well-thought-out budget is essential in managing your expenses effectively.

Second, track all your income and expenses. This will give you a clear picture of where your money is going and help identify areas where you can cut back.

Third, differentiate between needs and wants. Needs are required but wants are not.

Fourth, make more intentional choices that align with your long-term goals and contribute to building wealth.

Ultimately, the journey to build wealth requires discipline and a clear understanding of the value of money.

4% rule

If you are in retirement and you are living off your investments, how much can you spend? This is called the safe withdrawal rate.

Typically, a household can spend 4% of the investment assets each year. This is called the 4% rule The idea is that the portfolio can fluctuate but over time, the portfolio return will cover the 4% withdrawal.

So, the safe withdrawal rate is usually estimated to be 4% of the portfolio’s value.

The following video shows the problem of estimating How Long Will My Money Last?:

9. Protect your wealth

Protecting your wealth is an essential aspect of building and preserving your net worth. Once you accumulate wealth, it becomes crucial to safeguard it from potential risks.

There are three key strategies to protect your wealth:

- insurance coverage

- estate planning

- diversification

One of the fundamental ways to protect your wealth is through adequate insurance coverage. Various types of insurance policies can shield you from financial losses caused by accidents, illnesses, natural disasters, or unexpected events.

- health insurance ensures that medical expenses are covered

- life insurance provides financial security for your loved ones in the event of your death

- property and casualty insurance safeguard against damage or loss of assets: homeowners insurance, renters insurance, and car insurance

Obtaining appropriate coverage for yourself and your assets, you can reduce potential financial setbacks that could erode your wealth.

Another vital aspect of protecting your wealth is estate planning. This involves creating a plan to manage and distribute assets in the event of incapacitation or death.

Estate planning allows you to dictate how your wealth should be transferred to beneficiaries while minimizing tax liabilities and legal complications. Tools for estate planning include:

- a well-crafted will ensures that assets are distributed according to your wishes

- a trusts can provide additional protection by allowing for more control over asset distribution and potentially reducing estate taxes

- advance healthcare directive (more comprehensive than a living will) for your medical care wishes

- power of attorney for someone to make decisions if you become incapacitated

By engaging in proper estate planning, you not only protect the value of your estate but also ensure a smooth transition for future generations.

Furthermore, diversification is a key strategy for safeguarding wealth against market volatility or economic downturns.

Diversifying investments across various asset classes mitigates risk by reducing exposure to any single investment or sector. Using the 3 fund portfolio diversifies investments across many stocks and bonds.

One mistake is holding a large portion of your investments in a single stock. For example, if you hold more than 5% of your portfolio in one company, that is too risky.

Protecting your wealth is a vital component of the overall process of building and maintaining financial well-being.

With careful planning, you can protect yourself against unexpected events, preserve assets for future generations, and navigate market volatility. You can ensure a secure financial future for yourself and your family.

10. Seek professional advice

Sometimes you need professional financial advice. Here are areas where financial experts can be helpful:

- asset protection: insurance agents and attorneys

- financial planning: financial planners

- tax planning: attorneys and CPA’s

Asset protection involves a range of strategies aimed at safeguarding your assets against potential risks such as lawsuits or bankruptcy.

Financial planners possess comprehensive knowledge of investment strategies aligned with market trends and risk appetite. They can assist in creating tailored portfolios by diversifying investments across various asset classes like stocks, bonds, real estate, or mutual funds.

Tax planning is an area of expertise for some CPA’s and attorneys. These can help plan and reduce taxes. Tax planning can be very beneficial when transactions and estates are complex.

Use financial professionals when you need them and you can help to protect and grow your wealth.

Conclusion

Building wealth requires dedication, discipline, and smart decision-making.

By following the ten tips in this article, you can start on a path towards financial freedom.

You can build wealth if you set clear goals and develop a roadmap to achieve them. Regularly reviewing and adjusting this plan is essential to success.

Recommended resources

Books

Total Money Makeover by Dave Ramsey

The Richest Man in Babylon by George S. Clason

I Will Teach You To Be Rich by Ramit Sethi

Articles

How to Build Wealth When You Don’t Come from Money

How to Build Wealth at Any Age