Adjusting entries are made at the end of a period to update accounts. An adjusting entry affects the income statement and balance sheet accounts.

This is Chapter 3 in Financial Accounting. The chapter includes:

- Adjusting Entries and the Accounting Cycle

- Adjusting Entries and the Accounting Cycle YouTube playlist

For all the chapters, see The Ultimate Guide to Learn Accounting.

Contents

The accounting period

Companies prepare financial statements for months, quarters, and years. An annual financial statement is also called an annual report.

Companies can select their accounting years or fiscal years. So, Walmart has a year ending on January 31 rather than December 31.

Cash basis vs. accrual basis

Business transactions are recorded using journal entries. There are two methods to record transactions in accounting:

- Cash basis accounting

- Accrual basis accounting

Cash basis accounting

Cash basis accounting records revenue when cash is received from customers. Expenses are recorded when cash is paid. Cash basis net income is cash revenues minus cash expenses.

The benefit of the cash basis is that it is simpler and easier to understand. The cash basis is only appropriate for small businesses. In the United States, C corporations cannot use the cash basis and must use the accrual basis.

Accrual basis accounting

Accrual basis accounting records revenue when products and services are delivered to customers. Expenses are recorded when they are incurred. The expenses are matched with the revenues that they produce. This is called the matching principle.

Accrual accounting better shows the performance of the company than the cash basis. Accrual basis net income is less dependent on the timing of cash flows.

| Issue | Accrual Basis | Cash Basis |

|---|---|---|

| Revenue | when earned | when cash is received |

| Expense | when incurred | when cash is paid |

Accounting Cycle

The goal of financial accounting is to prepare financial statements. This process is called the accounting cycle.

The accounting cycle shows the steps to prepare financial statements. Steps 1–3 are completed during the accounting period. Steps 4–9 are made at the end of the period.

Here are the steps in the accounting cycle:

- Analyze transactions

- Journal entries

- Post to the ledger

- Unadjusted trial balance

- Adjusting entries

- Adjusted trial balance

- Financial statements

- Closing entries

- Post-closing trial balance

Adjusting entries example

At the end of the accounting period, the company makes adjusting entries. These adjusting entries update the accounts to their proper balance.

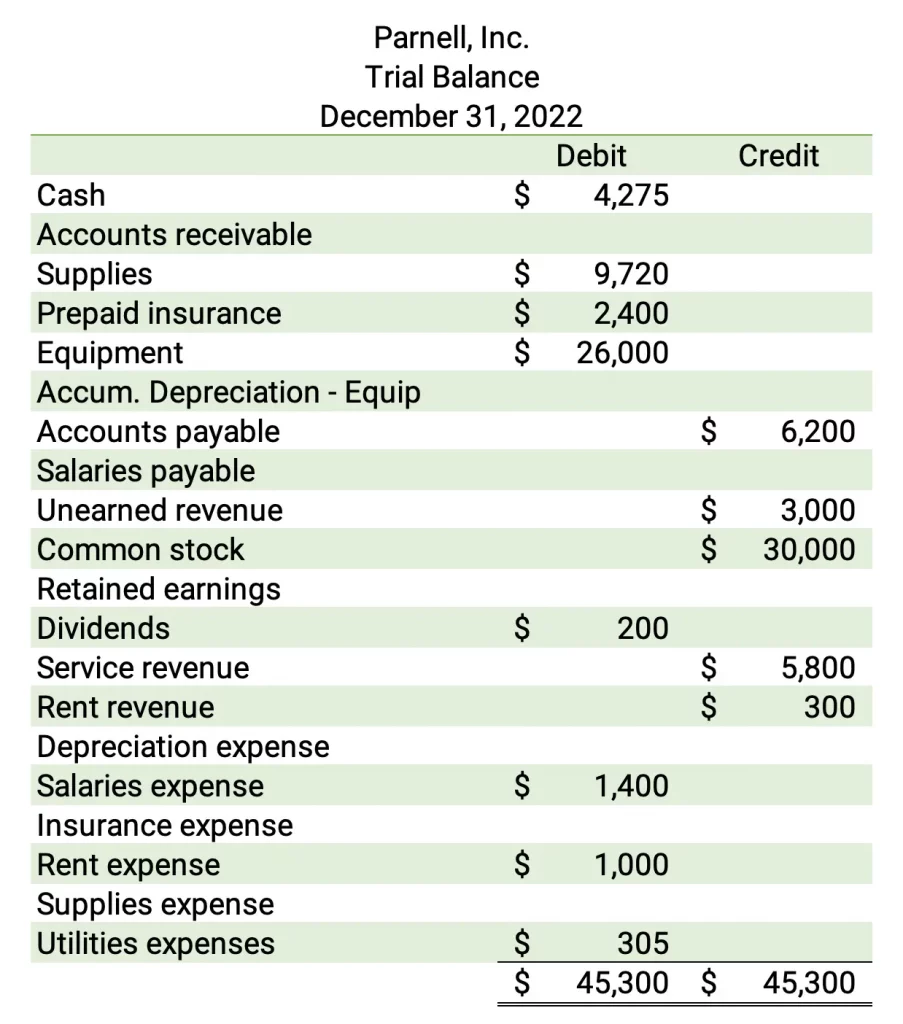

Assume Parnell, Inc. has the following accounts and account balances for 2022. It will make the necessary adjusting entries for the end of the year.

Trial Balance

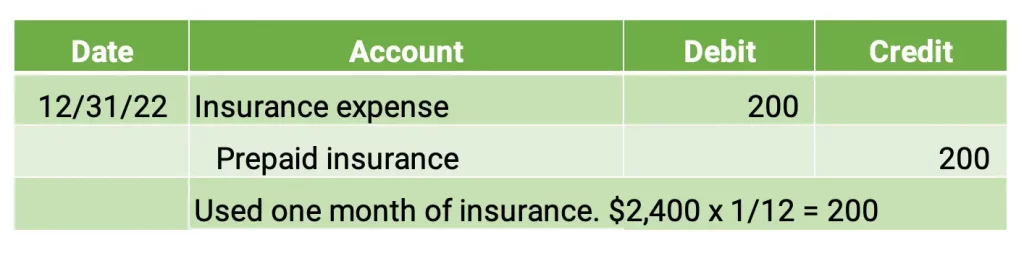

1. Insurance expense

On December 1, Parnell paid for a 12-month insurance policy for $2,400. Make the adjusting entry for December 31.

The balance of prepaid insurance will be $2,400 minus $200, or $2,200. The balance of the insurance expense is $200.

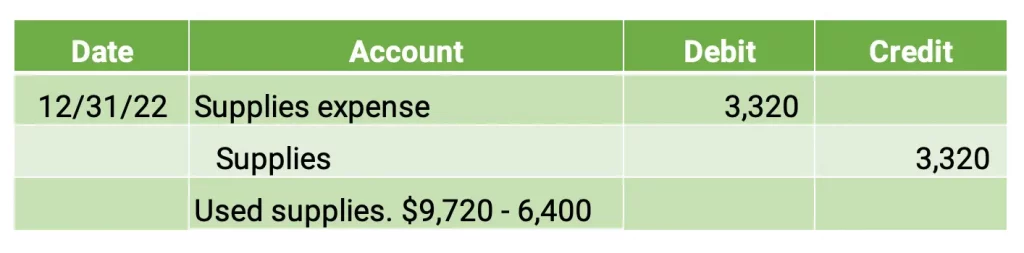

2. Supplies expense

During the year, the company purchased supplies worth $9,720. At the end of the year, the company had an ending balance of $6,400. Record the adjusting entry for the supplies that were used.

The ending balance of supplies is now $6,400. The supplies expense has a $3,320 balance.

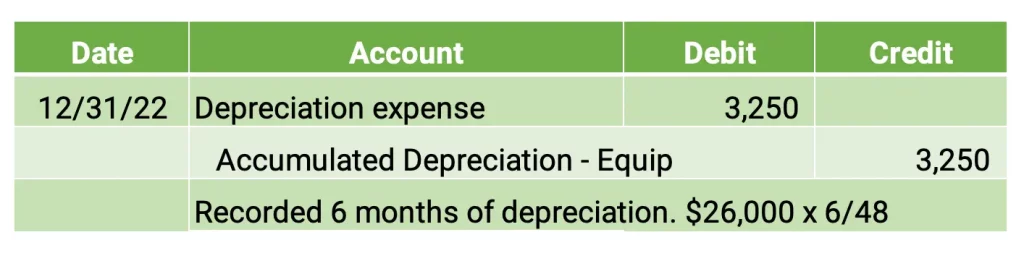

3. Depreciation expense on equipment

On July 1, the company purchased equipment for $26,000. It has an expected useful life of 4 years.

Make the required adjusting entry for the equipment for 2022. Hint: the company used the equipment for six months in 2022.

The depreciation expense balance is $3,250. The balance of equipment remains $26,000, but the balance of accumulated depreciation is $3,250.

Accumulated depreciation is a contra account that reduces the balance of the equipment account. So, the net equipment shown on the balance sheet equals $26,000 minus accumulated depreciation of $3,250, or $22,750.

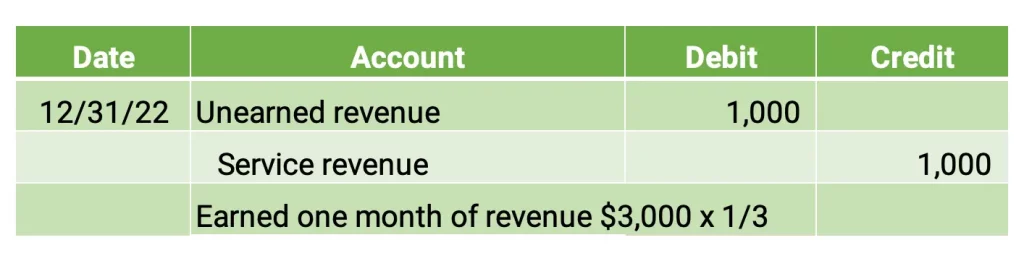

4. Unearned revenue

On December 1, customers paid Parnell, Inc., $3,000 in advance for a 3-month contract for consulting. One month has expired on December 31.

Make the adjusting entry to record earning one month’s revenue.

The service revenue balance increases by $1,000 to $6,800. Unearned revenue decreases to $2,000. Remember, unearned revenue is a liability.

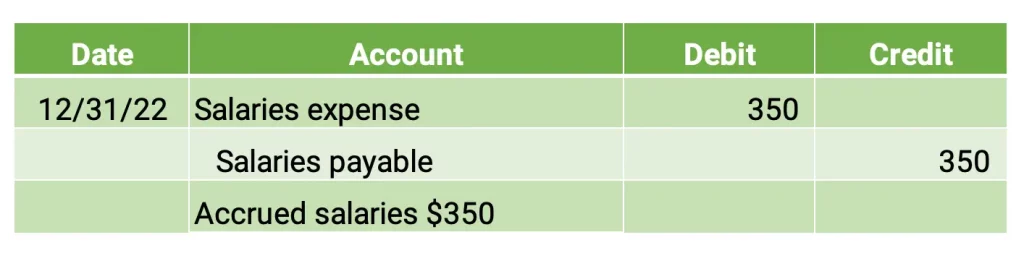

5. Salaries expense

At the end of December, employees had earned an additional $350. They will be paid in January next year. Make the adjusting entry.

Salaries expense balance is now $1,750. Salaries payable balance is $350.

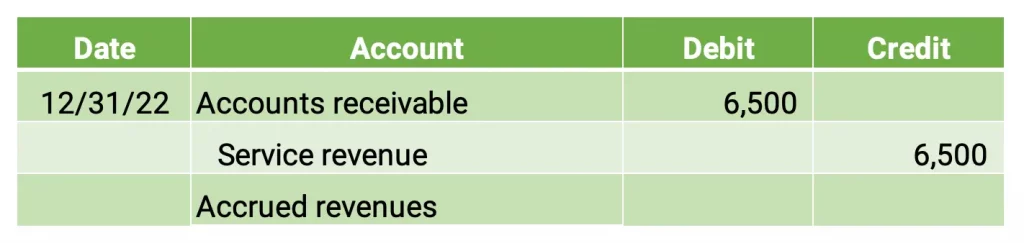

6. Accrued service revenue

During December, the company performed services for clients and sent invoices of $6,500. The clients will pay in January.

Accounts receivable increases from $0 to $6,500. Service revenue increases by $6,500.

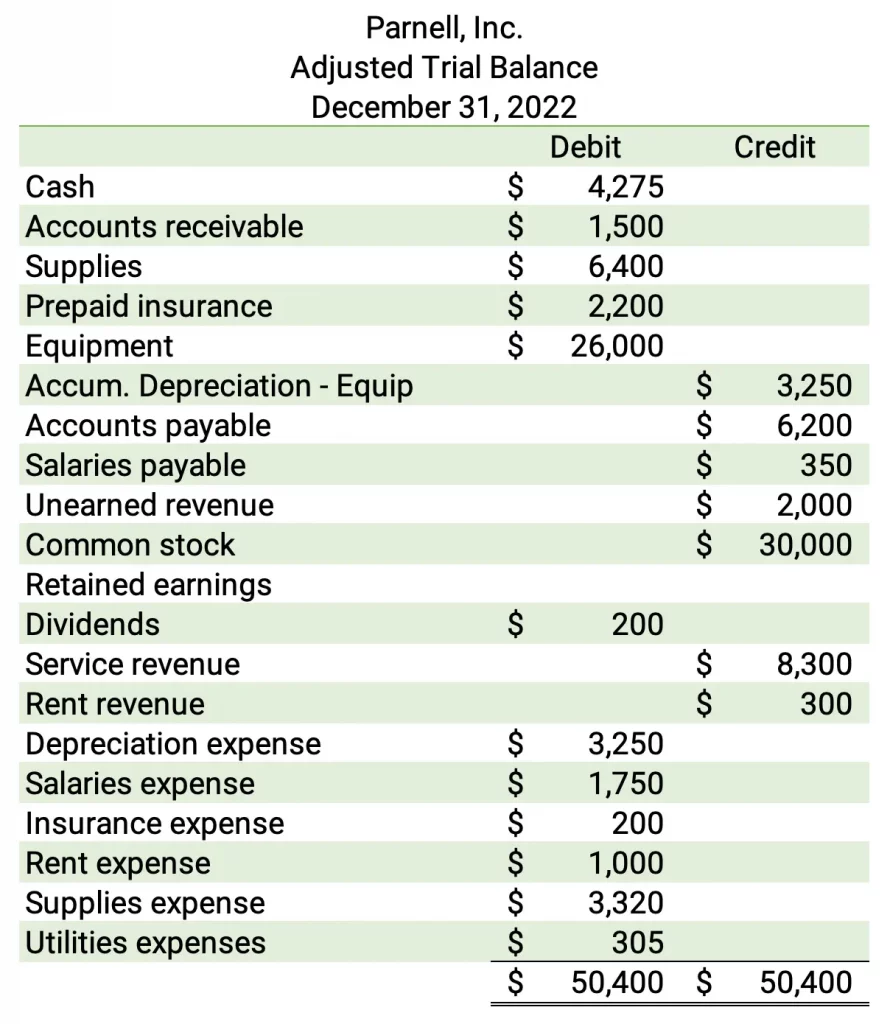

Adjusted Trial Balance

After the adjusting entries are made, an adjusted trial balance will list all the accounts with their new balances.

The financial statements are prepared based on the adjusted trial balance.

Comprehensive problem: Ace Consulting

To show a comprehensive example of the accounting cycle, we use the Ace Consulting problem.

Adjusting entries tutorial: Ace Consulting

This tutorial shows the adjusting entries and the adjusted trial balance.

Financial Statements

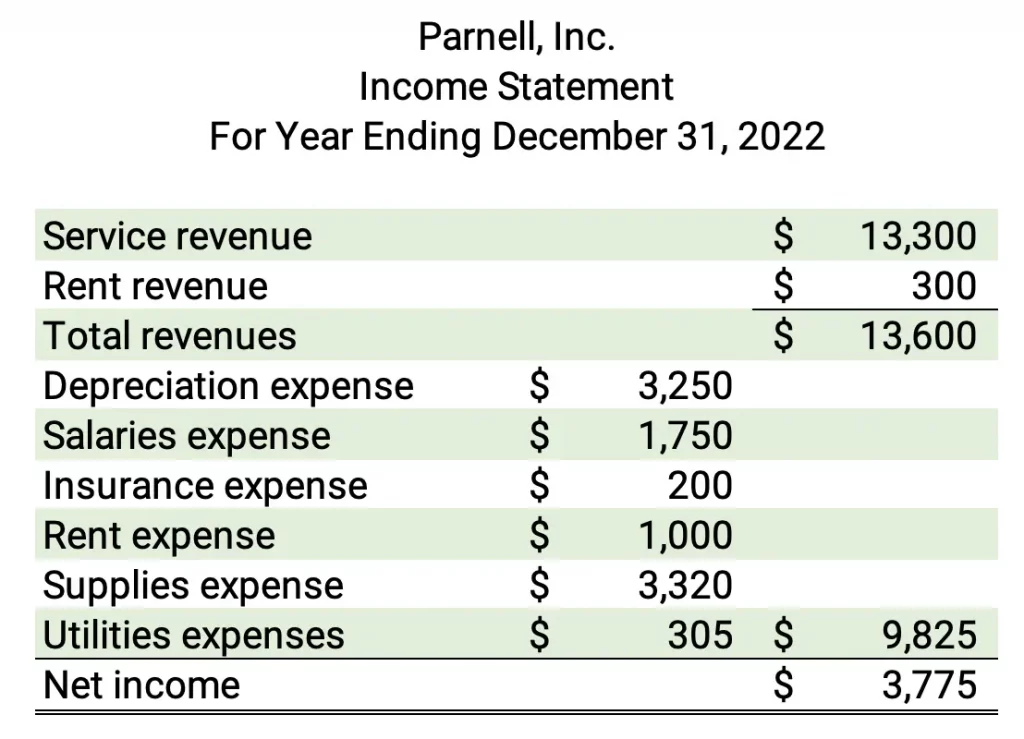

Based on the Parnell, Inc. adjusted trial balance, the financial statements will be:

- income statement

- retained earnings statement

- balance sheet

- cash flow statement

The financial statements for Parnell, Inc. are:

Income statement

The format for the income statement is revenues minus expenses. Revenues and expenses are called income statement accounts.

Parnell has total revenues of $13,600 and total expenses of $9,825. The net income for 2021 is $3,775.

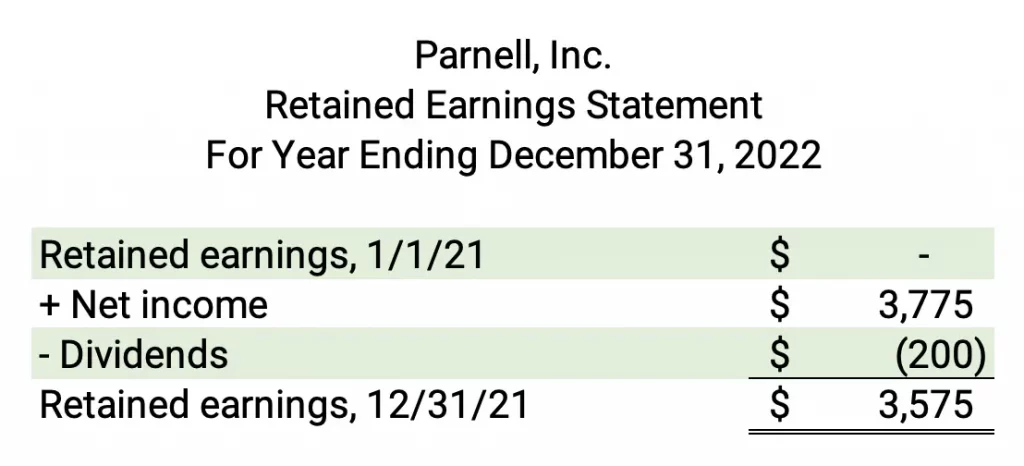

Retained earnings statement

Retained earnings statement shows the change in retained earnings over the period. The format of the retained earnings statement is:

Beginning retained earnings + net income – dividends = ending retained earnings

Since Parnell was a new company in 2022, beginning retained earnings was $0. The ending retained earnings was $3,575.

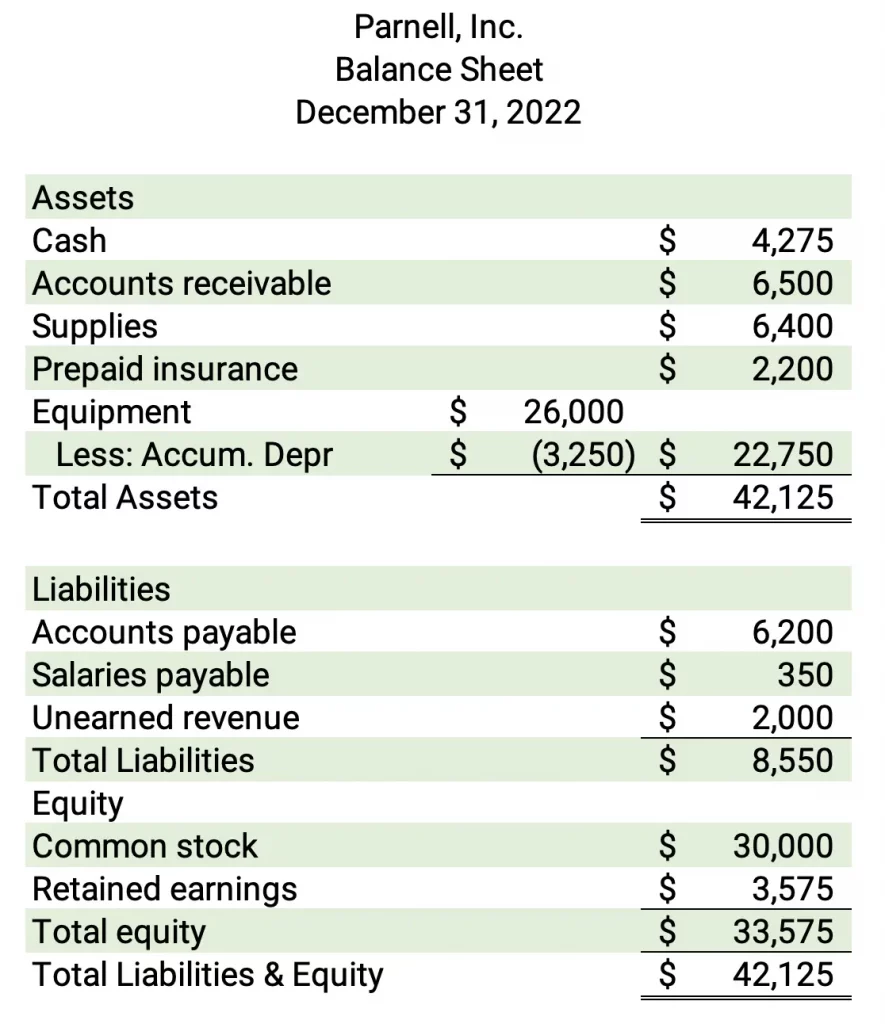

Balance sheet

The format for the balance sheet is assets = liabilities + equity. This is the accounting equation. Assets, liabilities, and equity are called balance sheet accounts.

The total assets for 2022 were $42,125. Total liabilities were $8,550. The total equity was $33,575.

Cash flow statement

The cash flow statement is one of the basic financial statements. Because the cash flow statement is more complicated than the other financials, it will be shown in a later lesson.

Closing entries

At the end of the accounting period, companies make closing entries. The closing entries close the books on the previous period to begin another period.

The steps in the closing process are:

- Close revenue accounts

- Close expense accounts

- Close income summary

- Close dividends

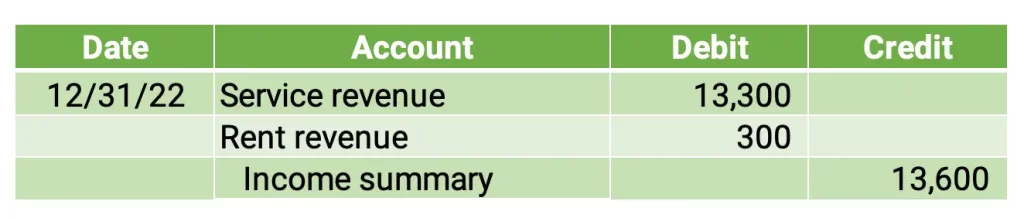

1. Close revenues

Revenues have a credit balance. Debiting revenues closes them. So, service revenue was debited for $13,300. This makes the balance of service revenue zero.

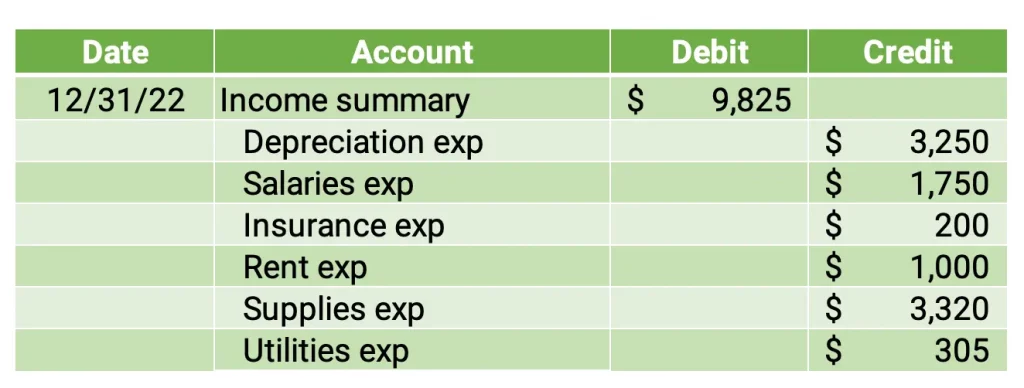

2. Close expenses

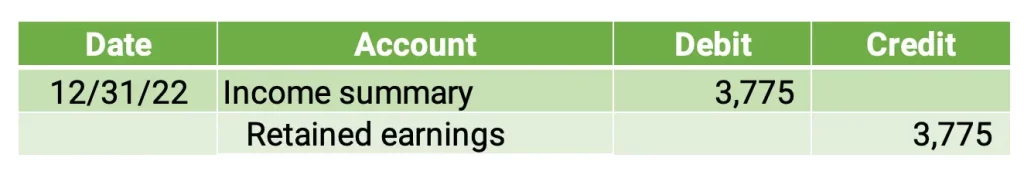

3. Close income summary

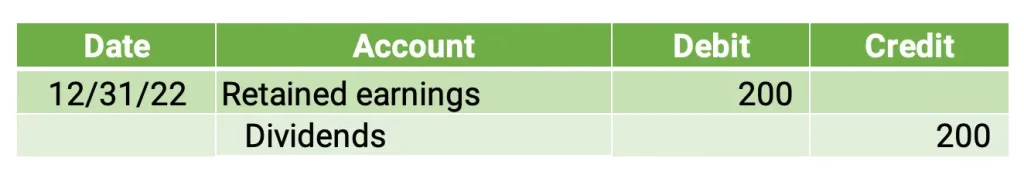

4. Close dividends

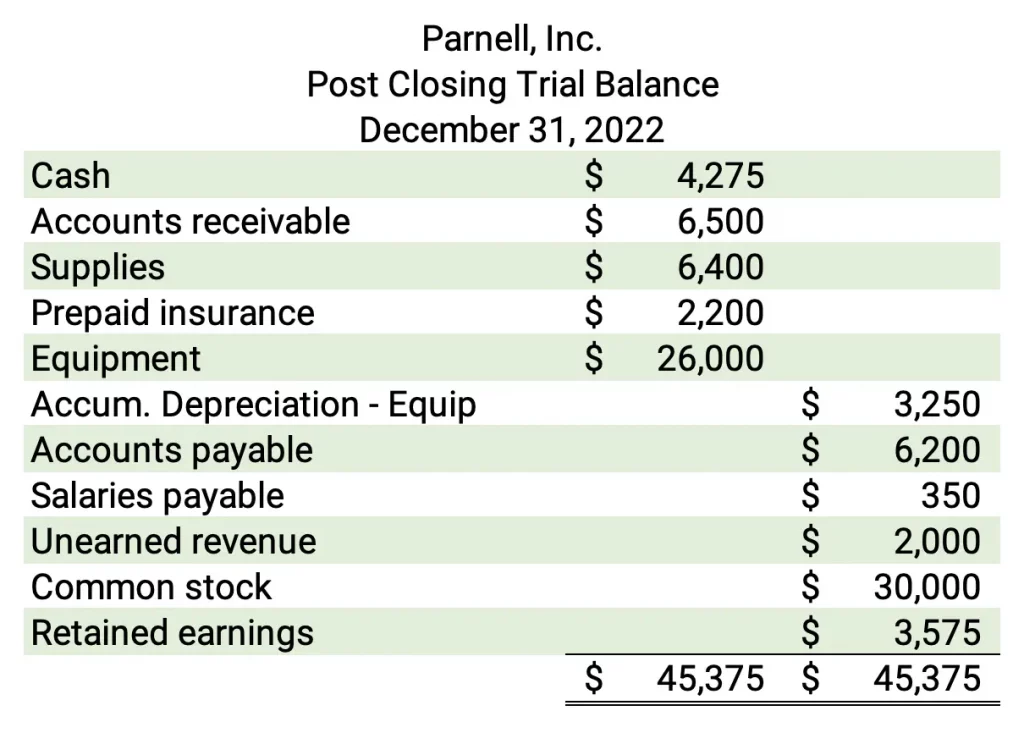

Post closing trial balance

After the closing entries, only assets, liabilities, and equity remain. The ending balance of retained earnings is $3,575.

After the closing process is complete, the company can start the new year in January 2023.

Accounting Chapters

Here are the accounting chapters in The Ultimate Guide to Learn Accounting:

- Introduction to Accounting

- Recording Business Transactions

- Adjusting Entries and the Accounting Cycle

- Merchandising Activities

- Inventory and Cost of Goods Sold

- Time Value of Money

- Cash and Internal Control

- Receivables

- Long-Term Assets

- Current Liabilities

- Long-Term Liabilities

- Corporations

- Statement of Cash Flows

- Financial Statement Analysis

- Managerial Accounting

- Job Order Costing

- Process Costing

- Activity Based Costing

- Cost Volume Profit Analysis

- Variable Costing

- Master Budgets

- Standard Costing

- Performance Measurement

- Relevant Costing

- Capital Budgeting

See also Accounting Sample Exams.