A merchandising company sells merchandise inventory to customers. Accounting for companies that sell inventory is more complex than for service companies.

This is Chapter 4 in Financial Accounting. The chapter includes:

For all the chapters, see The Ultimate Guide to Learn Financial Accounting.

Contents

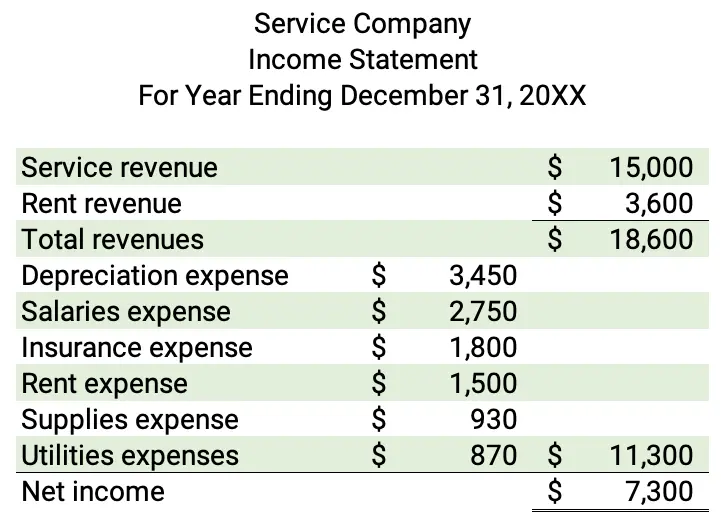

Income statement for a service company

A service company sells services for a fee. They do not sell any products. The income statement shows only revenues and expenses.

The income statement for a service company shows the following format:

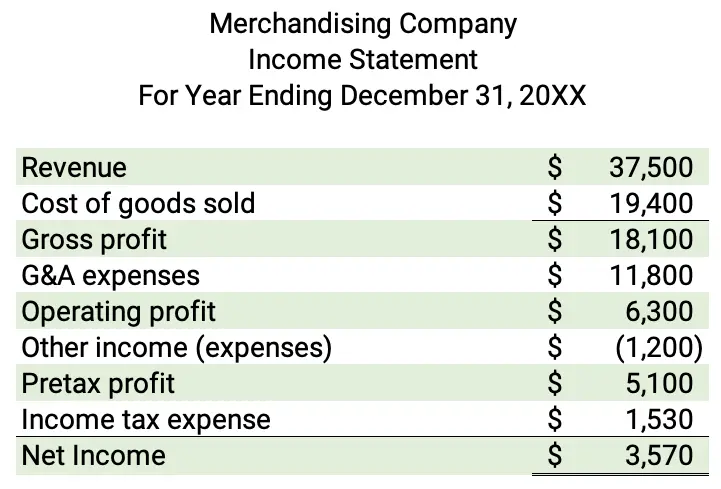

Income statement for a merchandising company

A merchandising company sells merchandise inventory to customers. Merchandisers can be manufacturers, wholesalers, or retailers.

- A manufacturer buys raw materials to produce products for sale to customers.

- A wholesaler buys inventory from manufacturers and sells it to retailers.

- A retailer buys inventory to sell to customers.

The income statement for a merchandising company has the following format:

The income statement for a merchandising company shows several categories of expenses:

- Cost of sales

- Operating expenses

- Other expenses

- Income tax expenses

Cost of goods sold

Cost of goods sold (COGS) is the cost of selling the products to customers. For most companies, the cost of goods sold is the largest expense on the income statement. The cost of goods sold is also called:

- cost of goods

- cost of sales

- cost of revenue

Operating expenses

Operating expenses are used to run the company. Operating expenses can also be called:

- selling, general and administrative expenses (SG&A)

- general and administrative expenses (G&A)

Typical operating expenses include:

- wages expense

- salary expense

- rent expense

- insurance expense

- depreciation expense

Other income and expenses

Other income and expenses are any nonoperating costs for the period. They are subtracted at the bottom of the income statement. These other expenses include the following items:

- interest expense

- interest revenue

- currency gains/losses

- write-offs

Note that other expenses can also include gains and revenue. So, if interest revenues are $40,000 and interest expenses are $25,000, other income is $15,000. If the interest expenses are $47,000, the other expense would be $7,000.

Income tax expense

Income tax expense is the last expense on the income statement. It is the cost of paying income taxes to state and federal governments.

Cost of goods sold and income statement tutorial

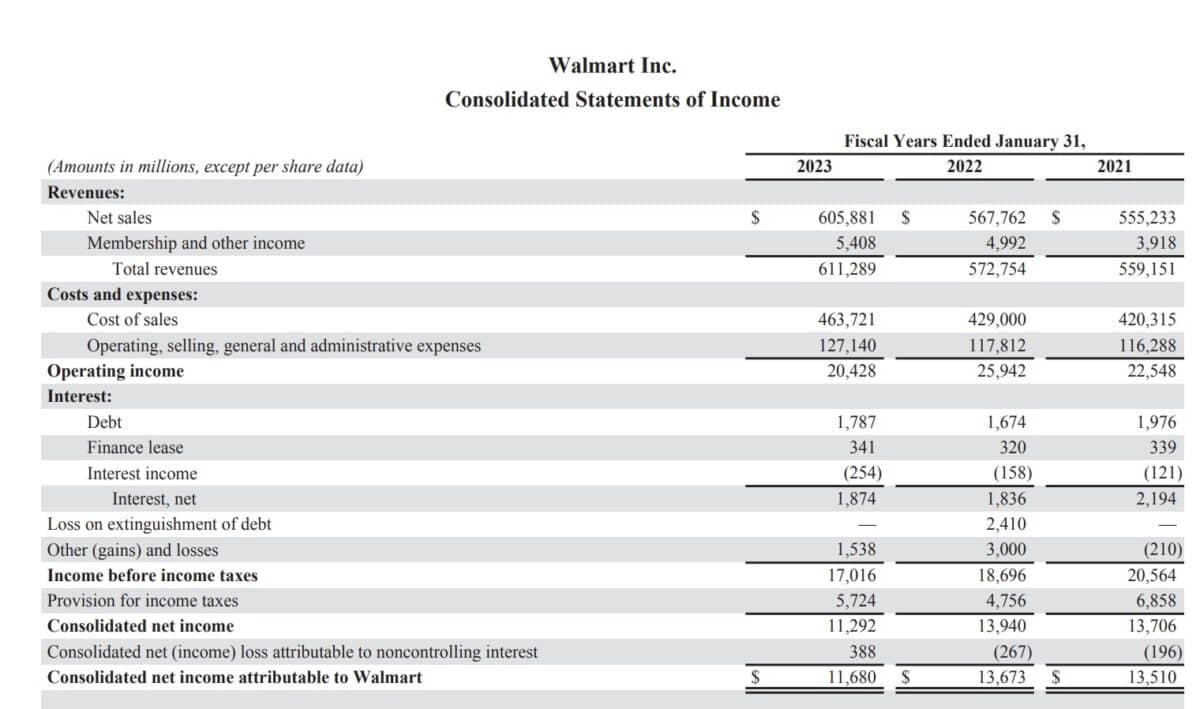

Walmart income statement

Here is Walmart’s income statement for 2023:

Here is a summary of the 2023 income statement:

| Walmart | 2023 |

|---|---|

| Total revenues | $611,289 |

| Cost of sales | $463,721 |

| Gross profit | $147,568 |

| SG&A expenses | $127,140 |

| Other income and expenses | $ 3,412 |

| Income tax expense | $ 5,724 |

| Net income | $11,680 |

Merchandise Inventory Cycle

Inventory, or merchandise inventory, is a current asset for a company. The inventory cycle for a company is:

- Purchase inventory

- Pay cash on payables

- Sell inventory

- Receive cash on receivables

Inventory systems

There are two systems used to account for inventory:

- periodic inventory system

- perpetual inventory system

Periodic inventory records the cost of goods sold at the end of each period.

Perpetual inventory records the cost of goods sold at the time of sale. This method is easier with the increase in technology.

We will use the perpetual inventory system in the examples below.

| Inventory System | When Cost of Sales is Computed |

|---|---|

| Periodic inventory | end of the period |

| Perpetual inventory | at the sale |

Credit terms

Sellers set credit terms when extending credit to customers. Credit terms set the due date and the cash discount period.

For example, credit terms n/30 mean net 30 days. So, the total is due in 30 days.

Credit terms 2/10, n/30 give a 2% discount if paid within the first 10 days. The total is due by day 30.

For the seller, this cash discount is a sales discount. For the buyer, it is a purchase discount.

The following table shows common credit terms:

| Credit Terms | Discount | Total Due |

|---|---|---|

| n/30 | 0% | 30 days |

| n/60 | 0% | 60 days |

| 1/10, n/30 | 1% within 10 days | 30 days |

| 1/15, n/45 | 1% within 15 days | 45 days |

| 2/10, n/30 | 2% within 10 days | 30 days |

| 2/10, n/60 | 2% within 10 days | 60 days |

Shipping terms

The seller sets the shipping terms for the sales transaction. The shipping terms show when the title of goods transfers from the seller to the buyer. The two shipping terms are FOB destination and FOB shipping point.

FOB destination means the title of the goods passes when the goods are shipped. So, the title passes to the buyer before the goods are delivered.

FOB shipping point means the title of the goods passes when the goods are received. The title passes to the buyer only when the goods arrive at their final destination.

The following table explains the shipping terms:

| Shipping Term | Title Passes | Shipping Costs |

|---|---|---|

| FOB destination | when delivered | paid by seller |

| FOB shipping point | when shipped | paid by buyer |

Accounting for merchandising activities tutorial

Inventory purchases

A merchandising company buys inventory for resale. The following shows entries related to buying inventory.

These entries assume perpetual inventory and the gross method.

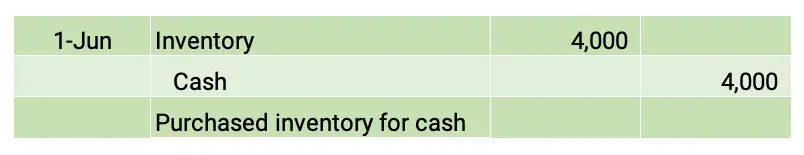

Cash purchase

On June 1, John Company buys inventory and pays cash for $4,000.

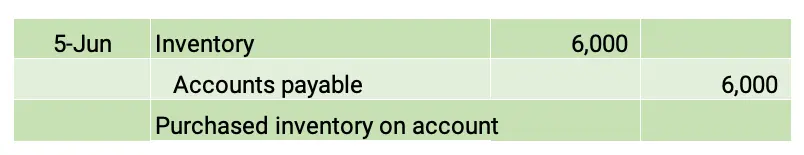

Purchase with cash discount

On June 5, the company buys inventory on account. The credit terms were 2/10, n/30.

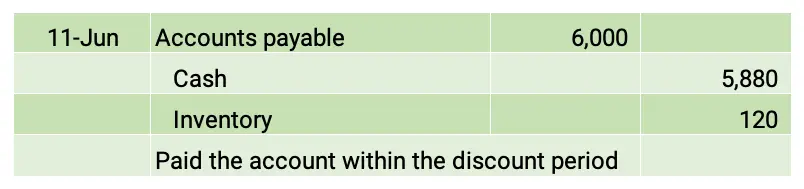

On June 11, John Company pays its account within the discount period. The cash discount is $6,000 x 2% = $120.

Purchase without cash discount

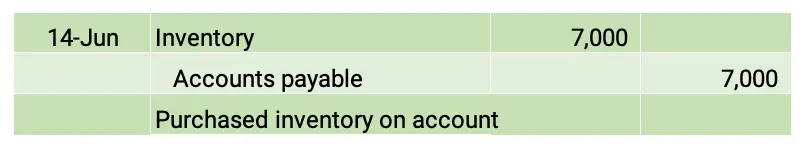

John Company purchased inventory on June 14. The credit terms were 3/10, n/30. The shipping terms were FOB shipping point.

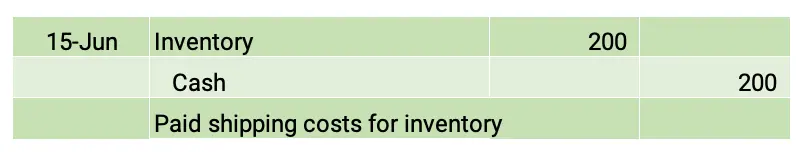

On June 15, John Company paid $200 for delivery costs for inventory.

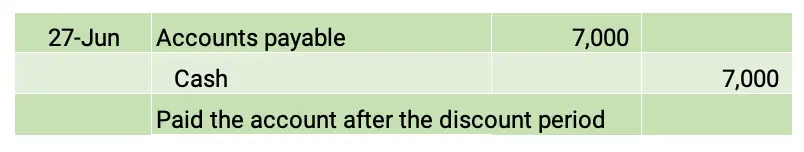

The company paid its account on June 27 from the June 14 purchase. They did not pay within the discount period.

Purchase returns

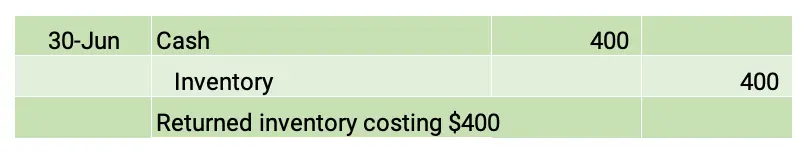

On June 30, John Company returned merchandise inventory costing $400. The company received cash.

Selling inventory

The following shows entries related to selling inventory. These entries assume perpetual inventory and the gross method.

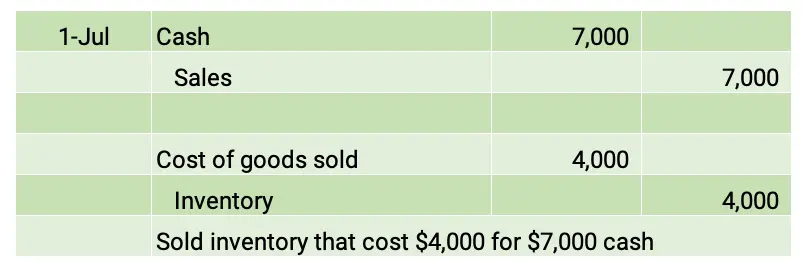

Cash sale

On July 1, Zachary Co. sold inventory costing $4,000 for $7,000 in cash. Hint: There are two entries.

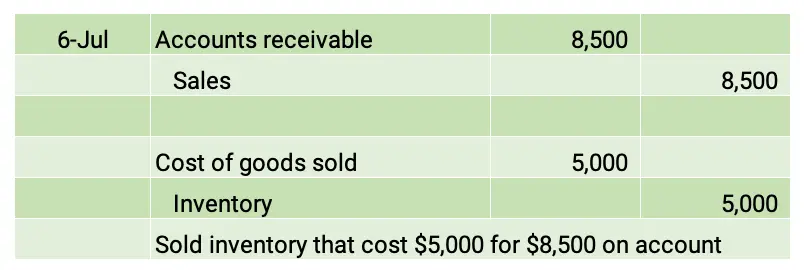

Sale on account with cash discount

On July 6, the company sold inventory on account for $8,500. The inventory cost $5,000. The credit terms were 2/20, n/30.

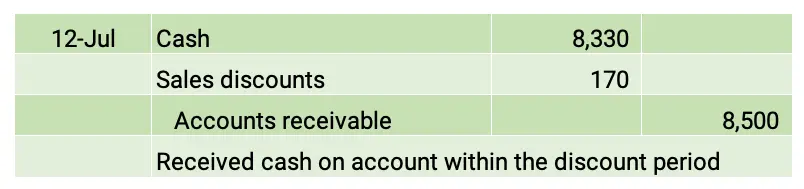

Zachary Co. collected cash on account from customers from the July 6 entry. The payment was within the discount period. The cash discount is $8,500 x 2% = $170.

For Zachary Co., net sales were $8,330 (sales $8,500 – sales discounts $170).

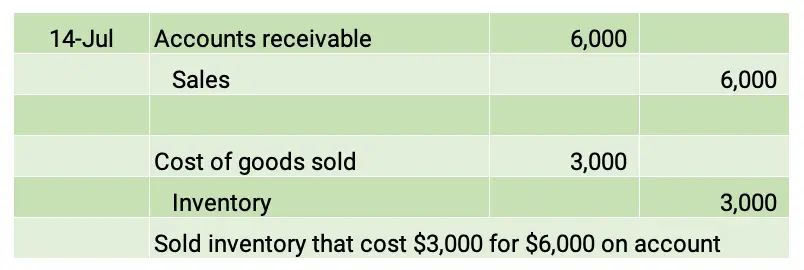

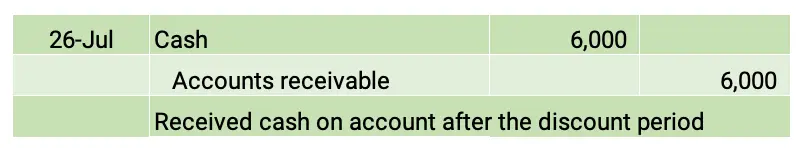

Sale on account without cash discount

On July 14, Zachary sold inventory on account for $6,000. The inventory cost $3,000. Zachary offered credit terms of 2/10, n/30.

Zachary collected cash on account from customers from the July 14 sale. The customers missed the discount period.

Sales returns

On July 31, Zachary refunded $600 to customers who returned inventory. The inventory cost $300.

Sales journal entries tutorial

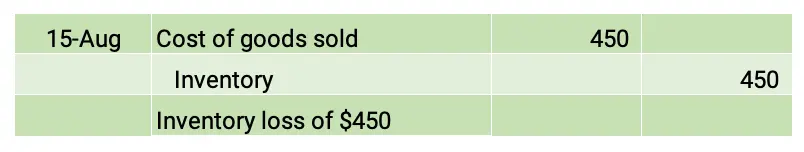

Inventory shrinkage

When a merchandising company counts inventory, there can be a loss of inventory. This is because of damage, theft, or obsolescence. The loss is termed inventory shrinkage.

Assume Link Co. has an inventory account with a $12,500 balance. The physical count of inventory showed $12,050. So, the company recorded a loss of $450. This is a write-off of inventory.

This entry reduces the balance of inventory from $12,500 to $12,050.

Accounting Chapters

Here are the accounting chapters in The Ultimate Guide to Learn Accounting:

- Introduction to Accounting

- Recording Business Transactions

- Adjusting Entries and the Accounting Cycle

- Merchandising Activities

- Inventory and Cost of Goods Sold

- Time Value of Money

- Cash and Internal Control

- Receivables

- Long-Term Assets

- Current Liabilities

- Long-Term Liabilities

- Corporations

- Statement of Cash Flows

- Financial Statement Analysis

- Managerial Accounting

- Job Order Costing

- Process Costing

- Activity Based Costing

- Cost Volume Profit Analysis

- Variable Costing

- Master Budgets

- Standard Costing

- Performance Measurement

- Relevant Costing

- Capital Budgeting

See also Accounting Sample Exams.