Net worth shows the assets remaining after paying all your debts. Here are 15 tips to increase your net worth.

Contents

What is net worth?

Net worth is what you own minus what you owe. Net worth is an important personal finance number.

The net worth formula is assets minus liabilities.

For example, assume Hannah has personal assets of $120,000 with $50,000 of student loans. Hannah’s net worth is $70,000.

To calculate your net worth, see Net Worth Calculator: What’s Your Net Worth?

What are assets and liabilities?

Assets are household resources you could sell for cash. Assets are what you own. These include:

- cash

- checking and savings accounts

- cars, trucks, and other vehicles

- real estate

- investments

- retirement accounts like 401k

- collectibles like art or coins

Liabilities are debts that you owe. These debts include:

- credit cards

- personal loans

- mortgages

- car loans

- student loans

- medical bills

Here

1. Make savings a habit

Pay yourself first. Save every month.

Pay off credit cards fast. Avoid credit card debt if you can.

Pay off all your debts especially any non mortgage loans.

Invest in stocks using low-cost index funds

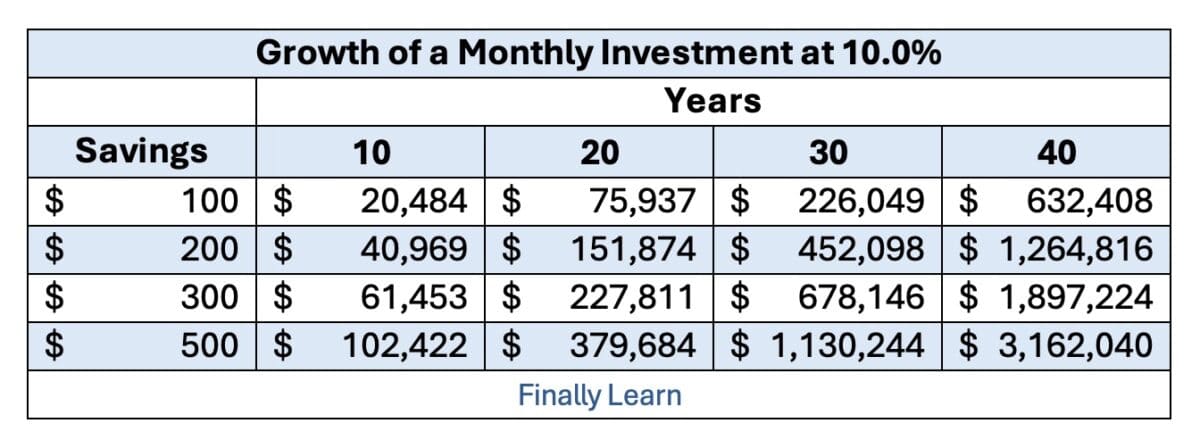

Investments are better than savings. (Use total stock market index funds like VTSAX or SWTSX.)

Let your investments grow using compound interest. Remember the Rule of 72.

You need a plan, so make and follow a budget.

Invest in a retirement plan at work like a 401k and a Roth IRA.

When you increase your income, increase your investments.

Control spending so you can save and invest more.

Track your net worth and update it annually.

Compare your net worth to your age.

Increase your skills to improve your income. Learn to earn.

Owning a home is an investment. Homeowners typically have a higher net worth

Be patient because net worth grows with age and income.

Certainly! Here are 20 tips to increase personal net worth:

- Start by creating a budget: A budget helps you track your expenses and income, and prioritize your spending accordingly. Knowing how much money you have coming in and going out is crucial to managing your finances effectively.

- Cut unnecessary expenses: Look at your expenses and see where you can cut back. This could be things like reducing your cable package, eating out less frequently, or canceling subscriptions you don’t use.

- Pay off high-interest debt: Credit card debt or personal loans with high interest rates can be a significant drain on your finances. Focus on paying these off first to avoid accruing more interest.

- Build an emergency fund: Having a savings account with at least three to six months of expenses can help you avoid going into debt during unexpected events like a medical emergency or job loss.

- Increase your income: Consider taking on a side hustle or asking for a raise to increase your income and accelerate your progress toward financial goals.

- Invest in your retirement: Contribute as much as you can to a 401(k) or IRA to build a secure retirement nest egg.

- Consider investing in real estate: Owning property can be a great long-term investment, but it’s important to do your research and make sure you can afford it.

- Avoid lifestyle inflation: As your income increases, it’s easy to start spending more on things like a bigger house, fancier car, or more expensive vacations. Avoid this trap and continue to live below your means.

- Use credit wisely: Pay off your credit card balance in full each month to avoid accruing high-interest debt. Also, be wary of taking on too much debt, even for things like a mortgage or car loan.

- Don’t overlook employer benefits: Your employer may offer benefits like a 401(k) match or health savings account (HSA), which can help you save money on taxes and build your net worth.

- Take advantage of tax breaks: Look for tax-advantaged accounts like IRAs, HSAs, and 529 plans to minimize your tax bill and increase your net worth.

- Be strategic about debt consolidation: Consolidating high-interest debt into a lower-interest loan can save you money on interest, but make sure you’re not just prolonging the debt repayment process.

- Diversify your investments: Don’t put all your eggs in one basket. Spread your investments across different asset classes to reduce risk.

- Consider a financial advisor: A financial advisor can help you create a personalized plan to achieve your financial goals.

- Automate your savings: Set up automatic transfers from your checking account to your savings and investment accounts to make saving easier.

- Negotiate bills: Negotiate with service providers like cable companies and insurance providers to get the best possible rates.

- Take advantage of cash back rewards: Use cash back credit cards or apps like Rakuten to earn money back on purchases you would make anyway.

- Invest in yourself: Take courses or attend workshops to improve your skills and increase your earning potential.

- Don’t follow the herd: Just because everyone else is investing in a certain stock or asset class doesn’t mean it’s the right choice for you.

- Track your progress: Regularly review your net worth and financial goals to ensure you’re on track to achieving them.

Here are 15 ways to increase your net worth:

- Create a budget and stick to it: Knowing how much money you have coming in and going out each month can help you identify areas where you can cut back and save money.

- Reduce your debt: Paying off debt, particularly high-interest debt like credit card debt, can help you save money on interest payments and improve your credit score.

- Increase your income: Consider negotiating a higher salary, taking on a side job, or starting a side business to increase your income.

- Save aggressively: Aim to save a portion of your income each month, and consider automating your savings to make it easier.

- Invest wisely: Consider investing in stocks, bonds, mutual funds, or real estate to grow your wealth over time.

- Start a retirement account: Saving for retirement early can help you take advantage of compound interest and grow your wealth over time.

- Live below your means: Avoid overspending on unnecessary items and focus on living within your means to save money.

- Buy assets that appreciate in value: Consider investing in assets like real estate or stocks that tend to appreciate in value over time.

- Refinance your debts: Consider refinancing high-interest debts like student loans or mortgages to save money on interest payments.

- Monitor your credit score: A good credit score can help you qualify for better interest rates on loans and credit cards.

- Avoid high fees: Look for ways to reduce fees on financial products like bank accounts, credit cards, and investment accounts.

- Minimize taxes: Consider taking advantage of tax-advantaged retirement accounts and investments to reduce your tax bill.

- Get insurance: Protecting your assets with insurance can help you avoid costly emergencies that could set you back financially.

- Avoid lifestyle inflation: As you earn more money, avoid the temptation to increase your spending proportionally.

- Seek professional financial advice: Consider working with a financial advisor to develop a personalized plan for growing your net worth.

Is $70,000 net worth good or bad? Assume William and Olivia are 35. Look at the average net worth by age table below.

Net worth calculator

Use the following net worth calculator to estimate your net worth. This net worth calculator lists common household assets and debts.

Does net worth include 401k?

Net worth should include the current market value of retirement accounts (401k and 403b). These can be significant to the net worth of many individuals.

How does your net worth compare?

The average net worth in 2019 for American households is $748,800. However, the average is skewed by the top 1% of households.

The better number for comparison is the 2019 median net worth of $121,700. This net worth number is for all ages.

The best way to compare your net worth is by age. So, a person in their 20s would have a different net worth than someone in their 50s.

Average net worth by age

The following table shows the median and average net worth by age for 2019. Compare yourself to the median.

For example, a 30-year-old with a $70,000 net worth is above the median. That is good!

However, a 50-year-old with a $70,000 net worth is below the median. That is too low.

| Head of Household Age | Median Net Worth | Average Net Worth |

|---|---|---|

| 18-24 | $8,216 | $28,707 |

| 25-29 | $7,512 | $49,388 |

| 30-34 | $35,112 | $122,700 |

| 35-39 | $55,519 | $274,112 |

| 40-44 | $127,345 | $623,694 |

| 45-49 | $164,197 | $761,560 |

| 50-54 | $171,320 | $897,663 |

| 55-59 | $193,549 | $1,165,477 |

| 60-64 | $228,833 | $1,187,730 |

| 65-69 | $271,805 | $1,250,679 |

| 70-74 | $258,531 | $1,173,653 |

| 75-79 | $272,976 | $945,480 |

| 80 + | $235,193 | $973,141 |

Here are 15 tips to increase your net worth:

Remember, net worth is assets minus debts. So, you need to increase assets and decrease debt.

- Make savings a habit.

- Pay off credit cards fast. Avoid credit card debt if you can.

- Pay off all your debts, especially any non mortgage loans.

- Invest in stocks using low-cost index funds

- Investments are better than savings. (Use total stock market index funds like VTSAX or SWTSX.)

- Let your investments grow using compound interest. Remember the Rule of 72.

- You need a plan, so make and follow a budget.

- Invest in a retirement plan at work, like a 401(k) or a Roth IRA.

- When you increase your income, increase your investments.

- Control spending so you can save and invest more.

- Track your net worth and update it annually.

- Compare your net worth to your age.

- Increase your skills to improve your income. Learn to earn.

- Owning a home is an investment. Homeowners typically have higher net worth

- Be patient because net worth grows with age and income.

Here are more net worth articles on Finally Learn:

What is Net Worth and Why Does it Matter?

How to Build Wealth: 10 Tips for Financial Freedom

Jeff Mankin teaches financial literacy and Excel. He is the founder of Finally Learn.