Net worth shows the assets remaining after paying all your debts. Use this net worth calculator to find your personal net worth. You should know your net worth.

Contents

What is net worth?

Net worth is what you own minus what you owe. Net worth is an important number for personal financial health.

The net worth formula is assets minus liabilities.

How do you calculate net worth?

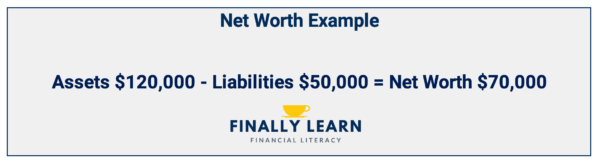

Let’s show a net worth example. Assume William and Olivia have the following personal assets:

| Assets | Value |

| Cash | $ 15,000 |

| Car | $ 20,000 |

| Collectibles | $ 25,000 |

| Retirement Accounts | $ 60,000 |

| Total Assets | $120,000 |

William and Olivia also have the following household debts.

| Liabilities | Value |

| Credit Cards | $ 9,000 |

| Car Loan | $ 16,000 |

| Student Loans | $ 25,000 |

| Total Liabilities | $50,000 |

What is their household net worth? Since the total assets are $120,000 and debts are $50,000, then their net worth is $70,000.

Is $70,000 net worth good or bad? Assume William and Olivia are 35. Look at the average net worth by age table below.

What are assets and liabilities?

Assets are household resources you could sell for cash. Assets are what you own. These include:

- cash

- checking accounts

- savings accounts

- cars, trucks, and other vehicles

- real estate

- stock and fund investments

- retirement accounts like 401k

- collectibles like art, antiques, and coins

Liabilities are debts that you owe. These debts include:

- credit cards

- personal loans

- mortgages

- car loans

- student loans

- medical bills

Net worth calculator

Use the following net worth calculator to estimate your net worth. This net worth calculator lists common household assets and debts.

Does net worth include 401k?

Net worth should include the current market value of retirement accounts (401k and 403b). These can be significant to the net worth of many individuals.

How does your net worth compare?

The average net worth in 2019 for American households is $748,800. However, the average is skewed by the top 1% of households.

The better number for comparison is the 2019 median net worth of $121,700. This net worth number is for all ages.

The best way to compare your net worth is by age. So, a person in their 20s would have a different net worth than someone in their 50s.

Average net worth by age

The following table shows the median and average net worth by age for 2019. Compare yourself to the median.

For example, a 30-year-old with a $70,000 net worth is above the median. That is good!

However, a 50-year-old with a $70,000 net worth is below the median. That is too low.

| Head of Household Age | Median Net Worth | Average Net Worth |

|---|---|---|

| 18-24 | $8,216 | $28,707 |

| 25-29 | $7,512 | $49,388 |

| 30-34 | $35,112 | $122,700 |

| 35-39 | $55,519 | $274,112 |

| 40-44 | $127,345 | $623,694 |

| 45-49 | $164,197 | $761,560 |

| 50-54 | $171,320 | $897,663 |

| 55-59 | $193,549 | $1,165,477 |

| 60-64 | $228,833 | $1,187,730 |

| 65-69 | $271,805 | $1,250,679 |

| 70-74 | $258,531 | $1,173,653 |

| 75-79 | $272,976 | $945,480 |

| 80 + | $235,193 | $973,141 |

Here are 15 tips to increase your net worth:

Remember, net worth is assets minus debts. So, you need to increase assets and decrease debt.

- Make savings a habit.

- Pay off credit cards fast. Avoid credit card debt if you can.

- Pay off all your debts, especially any non mortgage loans.

- Invest in stocks using low-cost index funds

- Investments are better than savings. (Use total stock market index funds like VTSAX or SWTSX.)

- Let your investments grow using compound interest. Remember the Rule of 72.

- You need a plan, so make and follow a budget.

- Invest in a retirement plan at work, like a 401(k) or a Roth IRA.

- When you increase your income, increase your investments.

- Control spending so you can save and invest more.

- Track your net worth and update it annually.

- Compare your net worth to your age.

- Increase your skills to improve your income. Learn to earn.

- Owning a home is an investment. Homeowners typically have higher net worth

- Be patient because net worth grows with age and income.

Here are more net worth articles on Finally Learn:

What is Net Worth and Why Does it Matter?

How to Build Wealth: 10 Tips for Financial Freedom