A balance sheet is a financial statement that shows the financial position of a company. It shows company assets, liabilities, and equity. The balance sheet is a snapshot of what the company owns and owes on a specific date.

The balance sheet is one of the core financial statements. The other financial statements are the income statement and the cash flow statement. The balance sheet is also called the statement of financial position.

This is Intermediate Accounting Chapter 5. For more Intermediate Accounting topics, see Intermediate Accounting Study Guide.

Contents

What is a Balance Sheet?

The balance sheet reports company assets, liabilities, and equity on a specific date. This follows the accounting equation where assets equal liabilities and equity.

The balance sheet has to balance because of the accounting equation. The accounting equation is assets = liabilities + equity.

There are three sections of the balance sheet: 1. assets, 2. liabilities, and 3. equity.

1 Assets

An asset is a resource owned by a company or entity. Assets provide probable future economic benefits. Assets appear first on a company’s balance sheet. As assets increase, the value of the company increases.

Assets are classified on the balance sheet as either current or noncurrent (long-term). There are four categories of assets on the balance sheet:

- Current Assets

- Fixed Assets

- Investments

- Intangible Assets

Current assets

Current assets are expected to be used within one year or less. Current assets include:

- cash

- accounts receivable

- inventory

- marketable securities

- other current assets

Fixed assets

Fixed assets are assets with long lives used in a company’s operations. They are shown on the balance sheet as property, plant, and equipment (PP&E). Fixed assets can also be called plant assets or capital assets.

Examples of fixed assets include:

- equipment

- machinery

- land

- buildings

- cars

- trucks

- computers

- furniture

Since fixed assets have long lives, the cost of the asset is spread over many years. Depreciation is the allocation of the cost of fixed assets over their life. This annual depreciation causes the asset’s book value to decline over the asset’s life.

Investments

Investments are company investments in stocks, bonds, mutual funds, and other investments. These investments appear on the balance sheet as long-term investments.

Investments are long-term when the company intends on holding for more than a year. So, if the company intends to hold less than a year, they are short-term investments. Short-term investments are also called marketable securities.

Examples of long-term investments include:

- stocks

- bonds

- mutual funds

- exchange traded funds (ETFs)

Intangible Assets

Intangible assets are assets without physical characteristics. They are legal rights owned by the company. They include intellectual property rights and brand awareness assets. Intellectual property includes copyrights, trademarks, and patents.

Intangible assets appear on the balance sheet as noncurrent assets. Intangible assets use amortization rather than depreciation. Amortization is the allocation of the cost of the intangible asset over its life.

Examples of intangible assets include:

- copyright

- trademark

- patent

- goodwill

2 Liabilities

In accounting, a liability is a debt owed to a company or individual. Liabilities are a claim on a company’s assets by the creditors. Liabilities require payment of assets, such as cash, or the performance of a service. A liability occurs from a past transaction that requires a future economic payment.

There are two categories of liabilities on the balance sheet:

- Current Liabilities

- Long-term Liabilities

Current Liabilities

Current liabilities are debts that are due within one year. The current liabilities are shown on the balance sheet before long-term liabilities.

Common current liabilities include:

- accounts payable

- notes payable

- wages payable

- salaries payable

- income tax payable

- interest payable

- dividends payable

- deferred revenue

Current liabilities are paid by using current assets, such as cash, during the year.

Long-term Liabilities

Long-term liabilities are debts that are due in more than one year. These are long-term debts of the company. Examples of long-term liabilities include:

- notes payable

- bonds payable

- mortgage payable

- post-employment benefits liability

- warranty liability

3 Equity

Equity is the assets remaining after the debts are paid. Stockholders’ equity equals assets minus liabilities.

There are several alternate names for equity:

- stockholders’ equity

- shareholders’ equity

- owners’ equity

- owners’ capital

There are five categories of equity on the balance sheet:

- Capital stock & paid-in capital

- Retained earnings

- Comprehensive income

- Treasury stock

- Noncontrolling interest

Capital stock & paid-in capital

Corporations issued common stock to raise capital to grow the business. The common stock shows equity in the company. Common stock represents paid-in capital to the company. This is the money that investors have invested into the company.

All corporations have common stock. Some companies issue a special class of stock called preferred stock. Preferred stock is included in stockholders’ equity.

- common stock

- preferred stock

- additional paid-in capital

Retained earnings

A successful business earns a net profit. The company may pay some of these earnings as dividends to stockholders. The profits that remain are added to the company’s retained earnings. Retained earnings are the net income minus dividends.

So, assume a company earns net income of $15,000 and pays dividends of $3,000. The retained earnings increase by $12,000.

Comprehensive income

Comprehensive income is income that does not appear on the income statement. It is from nonowner transactions. The most common example of comprehensive income is unrealized gains and losses on investments.

For example, assume a company purchased a stock for $100,000. At the end of the year, it has a market value of $133,000. The company has an unrealized gain. The comprehensive income is $33,000 because of the unrealized gain.

Treasury stock

Treasury stock is previously issued shares that have been repurchased by the company. These shares are no longer owned by stockholders and are not outstanding shares. Treasury stock is a reduction of stockholders’ equity.

Noncontrolling interest

Noncontrolling interest is the ownership interest of the stockholders owning less than 50% in a consolidated financial statement. Noncontrolling interest is also called minority interest.

For example, if a parent company owns 90% of a subsidiary, the remaining 10% is the noncontrolling interest.

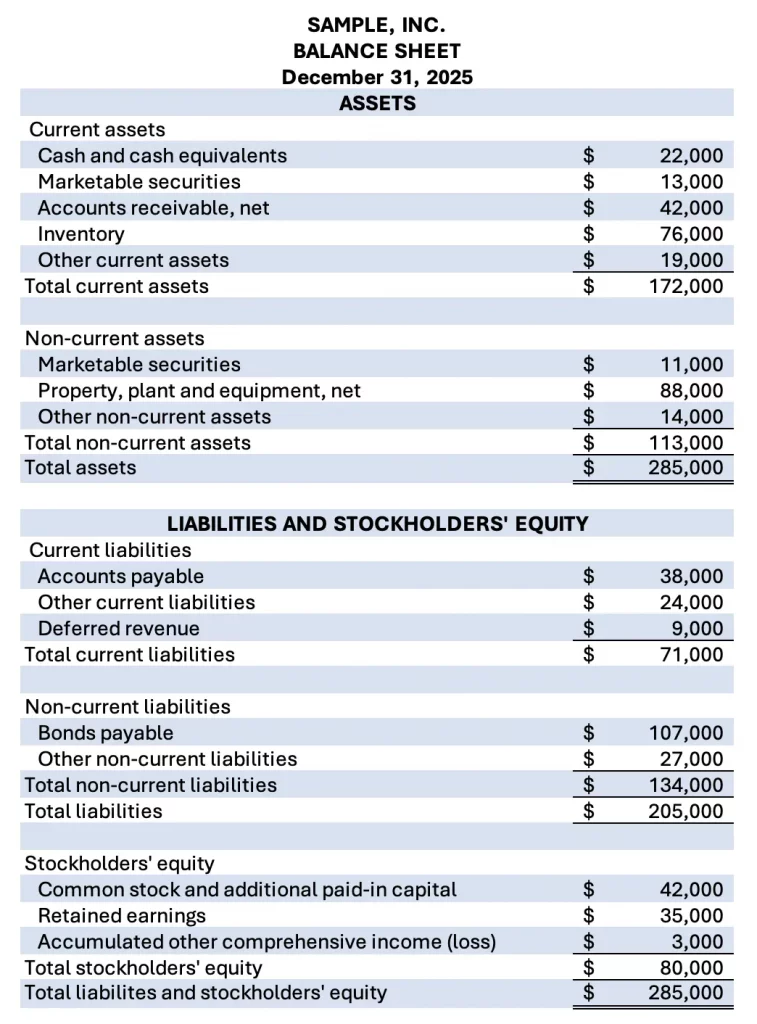

Classified balance sheet example

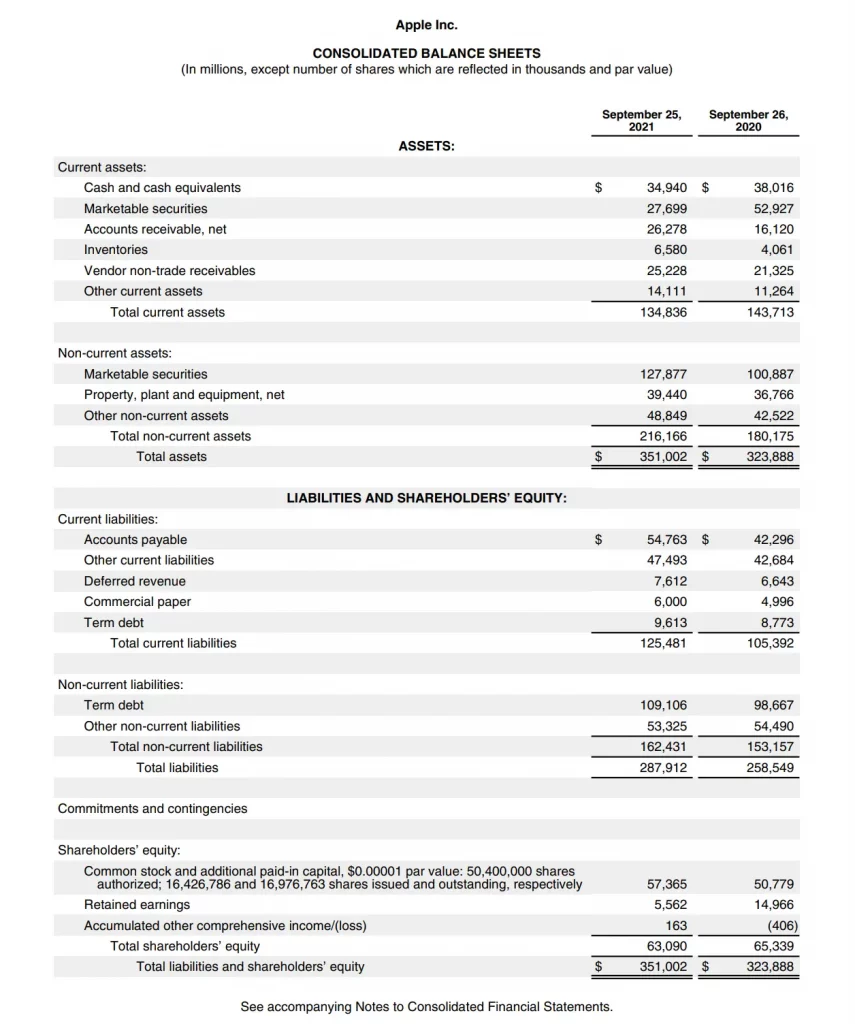

Apple balance sheet

Here is the Apple, Inc. 2021 balance sheet. The Apple financial statements are found in the investor relations section of Apple.com.

Balance sheet video

Intermediate Accounting Study Guide

For all the Intermediate Accounting topics, see Intermediate Accounting Study Guide.

- Financial Accounting Standards

- Conceptual Framework for Financial Reporting

- Accounting Information System

- Income Statement

- Balance Sheet

- Accounting and the Time Value of Money

- Cash and Receivables

- Inventories: Cost Basis

- Inventories: Additional Valuation Issues

- Property, Plant, and Equipment

- Depreciation, Impairment, and Depletion

- Intangible Assets

- Current Assets and Contingencies

- Long-Term Liabilities

- Stockholders’ Equity

- Dilutive Securities and Earnings Per Share

- Investments

- Revenue Recognition

- Accounting for Income Taxes

- Accounting for Pensions

- Accounting for Leases

- Accounting Changes and Error Analysis

- Statement of Cash Flows

- Full Disclosure in Financial Reporting