The U.S. median net worth is $35,112 for 30-34 year olds and $55,519 for 35-39 year olds. So, the median net worth by age 40 is over $56,000.

This article shows the American median net worth by age percentile for people in their 30s.

Contents

What is net worth?

Net worth is the value of all assets minus all debts. It is what you own minus what you owe. Net worth is a measure of wealth.

The formula for net worth is: Net Worth = Total Assets minus Total Liabilities.

To calculate your net worth, see the Net Worth Calculator: What’s Your Net Worth?

What is the average U.S. net worth?

The most recent data shows the U.S. average net worth is $748,800. However, a better comparison is the median net worth of $121,700.

For people in their 30s, the median net worth is $35,112 for 30-34 year olds and $55,519 for 35-39 year olds.

| Age | Average Net Worth | Median Net Worth |

|---|---|---|

| Ages 30-34 | $122,700 | $35,112 |

| Ages 35-39 | $274,112 | $55,519 |

The median is a better number to compare than the average. The median is the 50th percentile. Half of the families are above, and half are below. The average is increased by large net worths in the top 1%.

For example, the average net worth of $274,112 for ages 35–39 is in the 78th percentile. 78% of households are below, and only 22% are higher.

Since net worth increases with age, it’s a great number to compare for individuals. Younger people have less wealth, so it is important to compare net worth by age.

Our U.S. net worth by age data comes from two sources:

- Federal Reserve Board’s Survey of Consumer Finances with income and net worth numbers from 2019. This is the latest information available from the Federal Reserve.

- Net Worth by Age Calculator for the United States from the excellent financial site DQYDJ.

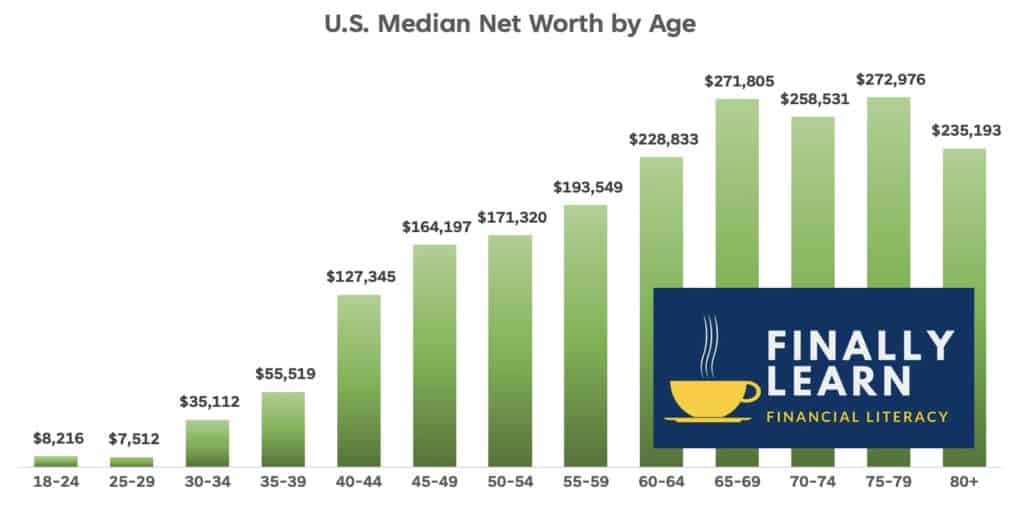

Net worth by age

The following graph shows the 2019 U.S. household median net worth by age. The Federal Reserve publishes this report every three years. The next report will be released in 2023.

Net worth by age 40

Americans in their 30s have a lower net worth than the median.

Tips for people in their 30s include:

- start saving for retirement if you haven’t started yet

- pay off credit card debt

- increase saving rate in retirement plans

- pay off any non mortgage loans

- make a budget to plan your savings

People in their 30s usually have growing earnings and assets. However, a large number of people in their 30s have negative net worth.

According to the DQYDJ Net Worth by Age Calculator up to 20% of people in their 30s have negative net worth.

- Ages 30-34: 20% have negative net worth

- Ages 35–39: 15% have negative net worth

Average net worth by age 35

The following table shows net worth by age 35, sorted by percentiles.

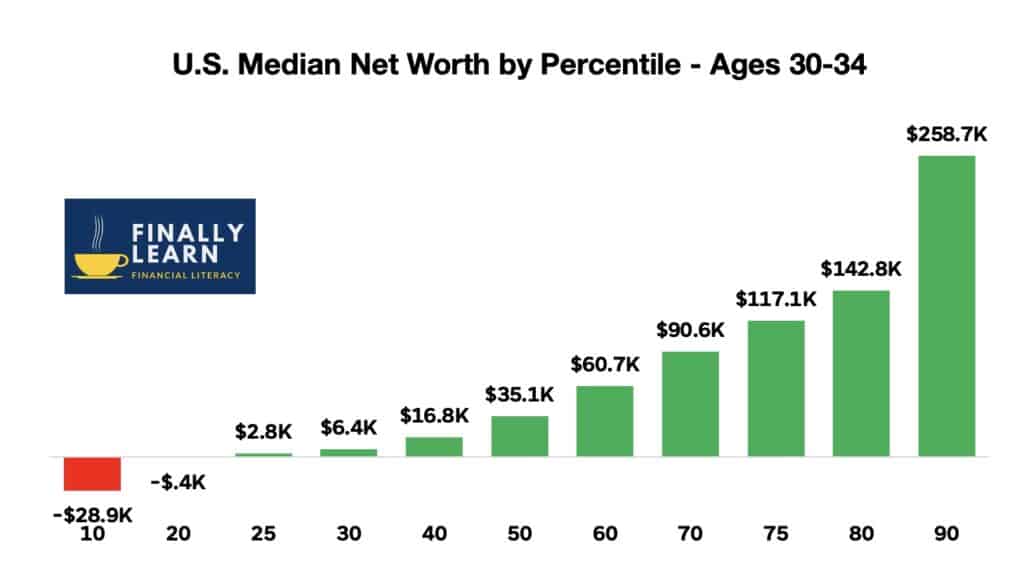

Here is how to understand the percentiles for 30-34 year olds:

- 25th percentile of $2,761 means that 25% are below and 75% are above this net worth.

- 50th percentile of $35,112 is the median. Half are above and half are below this net worth.

- 90th percentile of $258,741 is in the top 10% of net worth. 90% of households are below this net worth.

| Net Worth Percentile | Ages 30-34 |

|---|---|

| 10 | ($28,938) |

| 20 | ($434) |

| 25 | $2,761 |

| 30 | $6,415 |

| 40 | $16,833 |

| 50 | $35,112 |

| 60 | $60,686 |

| 70 | $90,618 |

| 75 | $117,134 |

| 80 | $142,776 |

| 90 | $258,741 |

The 99th percentile, or top 1%, for 30-34 year olds is $956,945.

Here is the graph for net worth for ages 30-34 in percentiles.

What is a good net worth by age 35?

Here are net worth goals for 30-34 year olds. This table is helpful to compare your net worth with your age group.

| Net Worth Goals | Ages 30-34 |

|---|---|

| Below Average | Below $35,112 |

| Average | Above $35,112 |

| Good | Above $117,134 |

| Great | Above $258,741 |

For a good net worth by age 35, aim for the 75th percentile of $117,134 and above.

Average net worth by age 40

The following table shows net worth by age 40, sorted by percentiles.

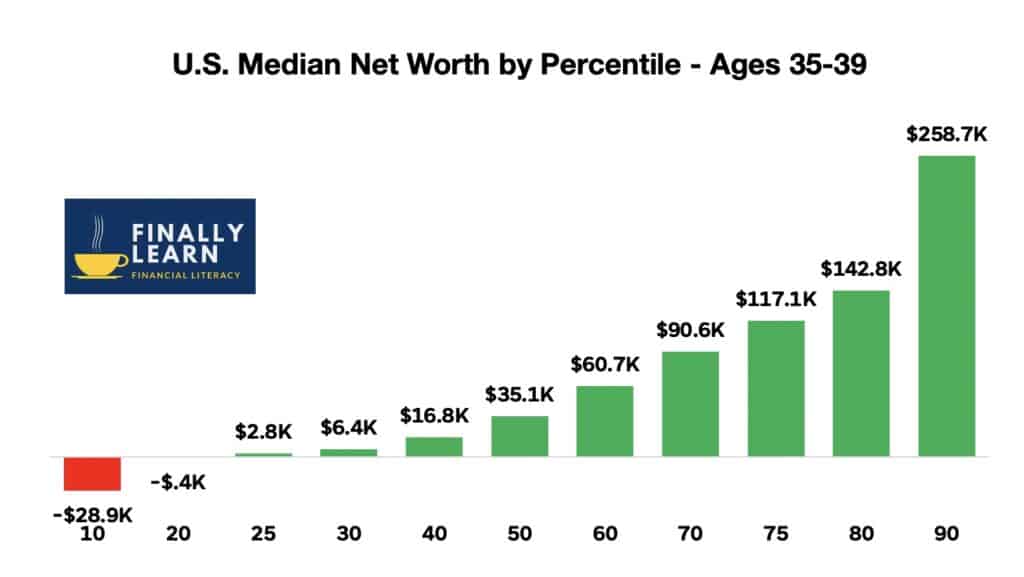

Here is how to understand the percentiles for 35-39 year olds:

- 30th percentile of $9,558 means that 30% are below and 70% are above.

- 50th percentile of $55,519 is the median. Half of 35-39 year olds are above this net worth. The other half is below.

- 90th percentile of $601,341 is in the top 10% of net worth by age group. 90% of households are below this net worth.

| Net Worth Percentile | Ages 35-39 |

|---|---|

| 10 | ($5,626) |

| 20 | $1,312 |

| 25 | $5,177 |

| 30 | $9,558 |

| 40 | $21,967 |

| 50 | $55,519 |

| 60 | $100,807 |

| 70 | $188,106 |

| 75 | $228,275 |

| 80 | $294,026 |

| 90 | $601,341 |

The 99th percentile, or top 1%, for 35–39 year olds is $4,034,486.

Here is the graph for net worth for ages 35–39 in percentiles.

What is a good net worth by age 40?

Here are net worth goals for 35–39 year olds. This table is helpful to compare your net worth with your age group.

| Net Worth Goals | Ages 35-39 |

|---|---|

| Below Average | Below $55,519 |

| Average | Above $55,519 |

| Good | Above $228,275 |

| Great | Above $601,341 |

For a good net worth by age 40, aim for the 75th percentile of $228,275.

Tips to increase your net worth

Here are 15 tips to increase your net worth:

Remember, net worth is assets minus debts. So, you need to increase assets and decrease debt.

- Make savings a habit.

- Pay off credit cards fast. Avoid credit card debt if you can.

- Pay off all your debts, especially any non mortgage loans.

- Invest in stocks using low-cost index funds

- Investments are better than savings. (Use total stock market index funds like VTSAX or SWTSX.)

- Let your investments grow using compound interest. Remember the Rule of 72.

- You need a plan, so make and follow a budget.

- Invest in a retirement plan at work, like a 401(k) or a Roth IRA.

- When you increase your income, increase your investments.

- Control spending so you can save and invest more.

- Track your net worth and update it annually.

- Compare your net worth to your age.

- Increase your skills to improve your income. Learn to earn.

- Owning a home is an investment. Homeowners typically have higher net worth

- Be patient because net worth grows with age and income.

Net worth resources

Here are more net worth articles on Finally Learn:

What is Net Worth and Why Does it Matter?

How to Build Wealth: 10 Tips for Financial Freedom