Contents

What is a Liability?

In accounting, a liability is debt owed to company or individual. Liabilities are a claim on a company’s assets by the creditors. Liabilities require a payment of assets, such as cash, or a performance of a service. A liability occurs from past transaction that requires a future economic payment.

Many liability accounts are called payables. This includes accounts payable, notes payable, and wages payable.

Liabilities are shown on a company’s balance sheet. They are classified as either current or long-term.

Liabilities are one of the five types of accounts in the accounting system.

In accounting, the five types of accounts are:

- assets: resources owned by a business; what the company owns

- liabilities: debts of the company; what the company owes

- equity: claim on the assets by the owners; calculated as equity = assets – liabilities; equity is the net worth of the company

- revenues: when a business receives assets from selling products and services

- expenses: when a business uses or consumes assets to create revenues

Liabilities on the Balance Sheet

There are two categories of liabilities on the balance sheet:

- Current Liabilities

- Long-term Liabilities

Current Liabilities

Current liabilities are debts that are due within one year. The current liabilities are shown on the balance sheet before long-term liabilities.

Here is a list of typical current liabilities:

- accounts payable

- notes payable (1 year or less)

- wages payable

- salaries payable

- income tax payable

- interest payable

- dividends payable

- deferred revenue

Current liabilities are paid by using current assets, such as cash, during the year.

Long-term Liabilities

Long-term liabilities are debts that are due in more than one year. These are long-term debts of the company. Examples of long-term liabilities include:

- notes payable (more than 1 year)

- bonds payable

- mortgage payable

- post-employment benefits liability

- warranty liability

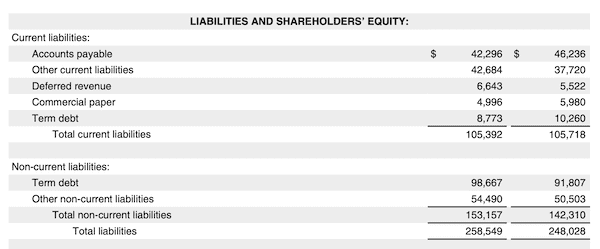

Example: Apple Liabilities

Here is the liability section of the Apple 2020 balance sheet. Apple lists current liabilities and noncurrent liabilities. The current liabilities section shows accounts payable, notes payable and deferred revenue.

The noncurrent liabilities lists notes payable and other long-term debts. The sum of the current and noncurrent liabilities are total liabilities. The total liabilities for Apple in 2020 was $258.5 B.

Liabilities on the Accounting Equation

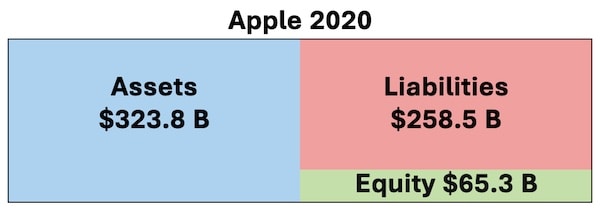

The accounting equation is a basic concept in accounting. The accounting equation is Assets = Liabilities + Equity. This is always true.

The accounting equation is shown on the balance sheet. The balance sheet always must balance because of the accounting equation.

For Apple in 2020, the total assets were $323.8 B and total liabilities were $258.5 B. So, using the accounting equation, the total equity was $65.3 B.

For more financial terms, see the Financial Terms Dictionary.