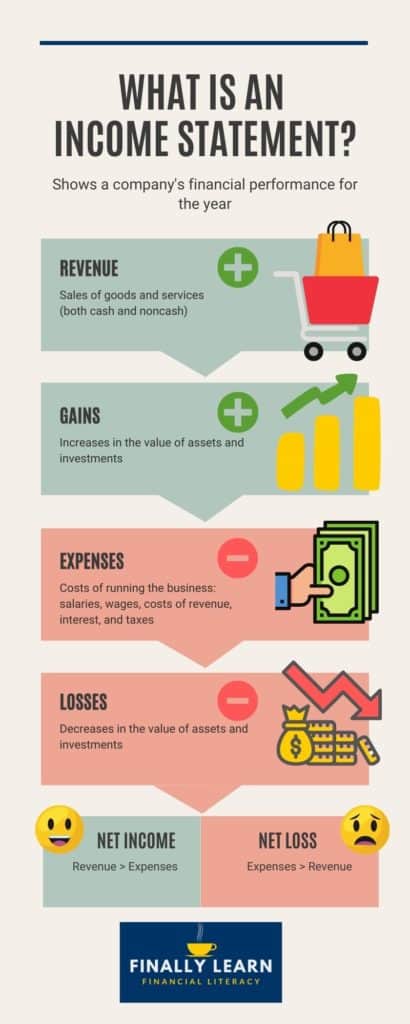

The income statement shows the performance of a company over a period. The format is revenue minus expenses. If revenues are higher, the company has earned a net profit or net income. If the expenses are higher, the company has earned a net loss.

The income statement is for a period of time. It can be for a month, a quarter, or a year. Alternate names are:

- profit and loss (P&L) statement

- earnings statement

- statement of operations

This is Intermediate Accounting Chapter 4. For more Intermediate Accounting topics, see Intermediate Accounting Study Guide.

Contents

What is an Income Statement?

The income statement is one of the primary financial statements for a company. The primary financial statements are:

- income statement

- balance sheet

- cash flow statement

The income statement is made up of the following elements:

- revenues

- expenses

- gains

- losses

Revenues involve selling goods and services and receiving assets. Revenues are for normal operations in a company. These revenues can be sales, rent, fees, or interest.

Expenses occur when assets are consumed in the business. Expenses include cost of sales, rent, depreciation, wages, salaries, and taxes.

Gains are increases in equity, or net assets, because of a non-owner transaction. Examples of gains include selling land for more than its book value.

Losses are decreases in equity, or net assets, because of a non-owner transaction. Examples of losses include selling a building for less than its book value.

Usefulness of the income statement

The income statement helps investors and creditors estimate amounts, timing, and uncertainty of company cash flows.

The income statement provides the following benefits:

- Evaluate the company’s past performance

- Help to estimate the company’s future performance

- Assess the risk and uncertainty of future cash flows

The income statement has some limitations:

- Companies omit items that cannot be measured reliably

- Income numbers are affected by the accounting methods used

- Income measurement uses judgment and estimates

- Earnings management may reduce the quality of earnings

Income statement sections

Operating income

Operating income shows the results of a company’s normal operations. This includes selling products and services, cost of sales, and operating costs.

- revenue or sales

- cost of goods sold (COGS), cost of sales, or cost of revenue

- selling expenses

- general & administrative (G&A) expenses

- research & development (R&D) expenses

Revenue or sales includes selling products and services and receiving assets. The assets include both cash and non-cash assets. The revenue would include any sales discounts or sales returns. So, revenue minus returns and discounts equal net revenue or net sales.

Cost of goods sold (COGS) or cost of sales is the cost of providing the product or service.

Selling expenses are the costs to generate additional sales. These include marketing and advertising costs.

General and administrative (G&A) expenses are the costs of running the company. This includes salaries, rent, and wages.

Research and development (R&D) expenses are the costs of creating new products.

Nonoperating income

Nonoperating income is revenue and expenses from other company activities. There are usually two types of nonoperating income:

- other revenues and gains

- other expenses and losses

Income tax

Income tax includes taxes owed to countries and states. This is a tax on a company’s profit is an income tax.

Discontinued operations

Discontinued operations include gains and losses from closing a business segment. There are two components of discontinued operations:

- gain or loss from operation of discontinued operations

- gain or loss from the disposal of the division

Noncontrolling interest

If there are noncontrolling shareholders, their share of income is allocated. For example, if a company owns 90% of a subsidiary, other stockholders own the remaining 10%. The parent company would receive 90% of the profits and losses. The other stockholders would receive the remaining 10%.

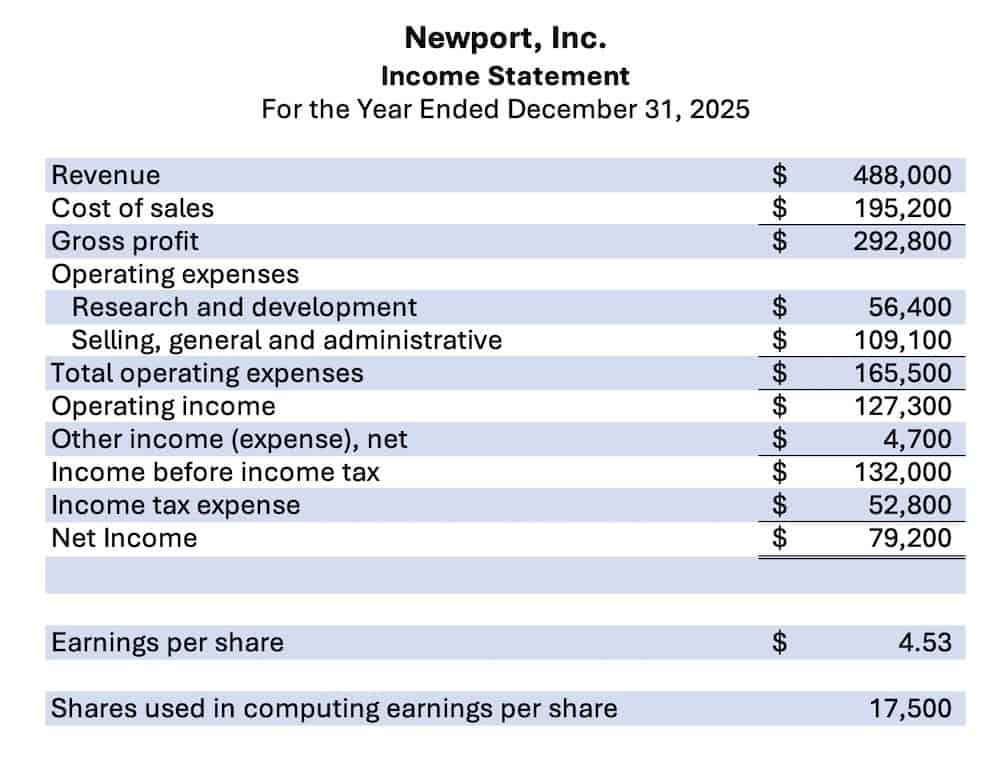

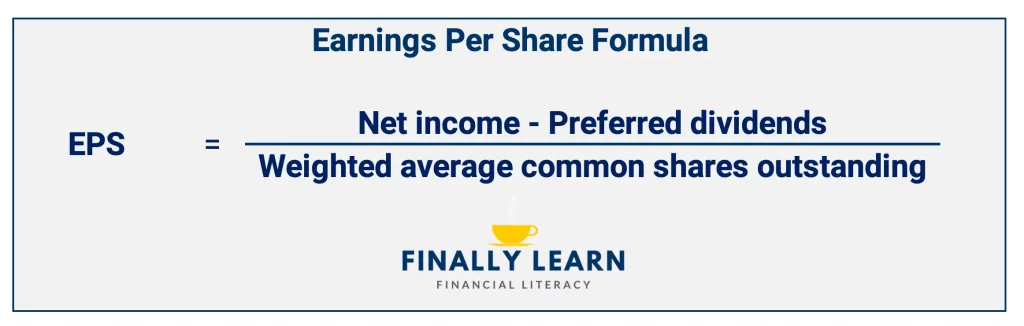

Earnings per share

Earnings per share (EPS) is a measure of performance. It is income divided by shares. Earnings per share is a required disclosure on a company’s income statement.

The formula for earnings per share (EPS) is net income minus preferred dividends (earnings available to common stockholders) divided by the weighted average of common shares outstanding.

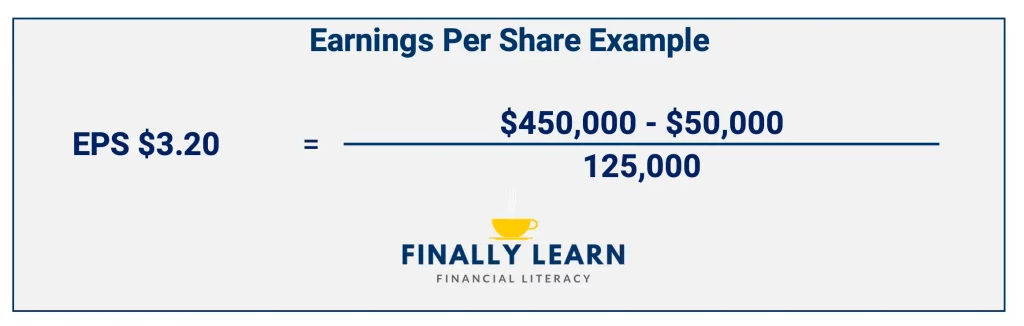

To calculate EPS, assume a company has net income of $450,000 and preferred dividends of $50,000. Assume the weighted average common shares outstanding are 125,000. The EPS is $3.20 as shown below:

Income statement example

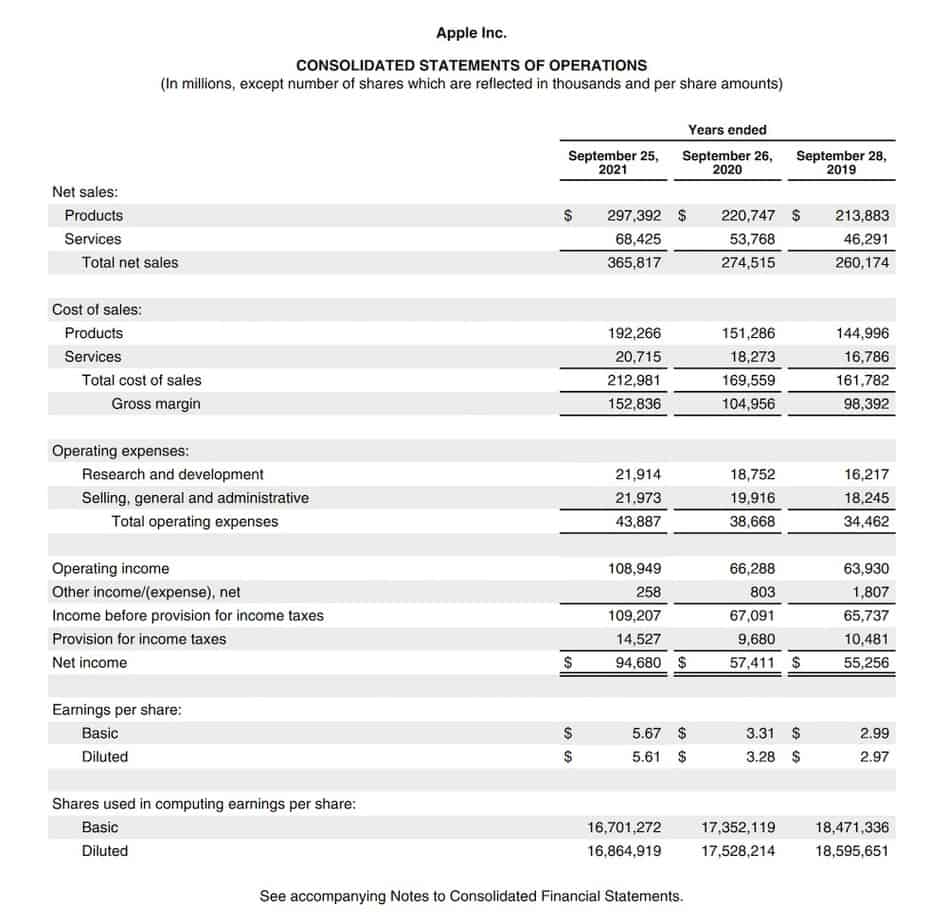

Apple income statement 2021

This example shows Apple, Inc.’s earnings statement for 2021. These financial statements are usually in the investor section on company websites (Apple Investors link). This is a comparative statement that shows three years.

Income Statement Video

Intermediate Accounting Study Guide

For all the Intermediate Accounting topics, see Intermediate Accounting Study Guide.

- Financial Accounting Standards

- Conceptual Framework for Financial Reporting

- Accounting Information System

- Income Statement

- Balance Sheet

- Accounting and the Time Value of Money

- Cash and Receivables

- Inventories: Cost Basis

- Inventories: Additional Valuation Issues

- Property, Plant, and Equipment

- Depreciation, Impairment, and Depletion

- Intangible Assets

- Current Assets and Contingencies

- Long-Term Liabilities

- Stockholders’ Equity

- Dilutive Securities and Earnings Per Share

- Investments

- Revenue Recognition

- Accounting for Income Taxes

- Accounting for Pensions

- Accounting for Leases

- Accounting Changes and Error Analysis

- Statement of Cash Flows

- Full Disclosure in Financial Reporting