Here is a glossary of financial terms G. These financial terms begin with the letter G, including GAAP, gain, and gross profit.

GAAP

See generally accepted accounting principles.

Gain

A gain is an increase in the value of an asset, such as stocks, bonds, or other property. The opposite of a gain is a loss, where the value of the asset is less than its cost. A gain increases the profit of a company.

If the market price of an asset rises above its cost, there is an unrealized gain. If the asset is sold for more than its cost, it is a realized gain.

In taxation, a gain can be classified as a short-term gain or a long-term gain. Short-term gains occur when the asset is held for one year or less. A long-term gain is for holding periods longer than one year.

Generally accepted accounting principles

Generally accepted accounting principles (GAAP) are the financial reporting standards in the United States. GAAP is developed by the FASB under the supervision of the United States Securities and Exchange Commission.

Gross profit

Gross profit is a company’s profit after deducting the cost of sales. It is before operating expenses and taxes. Gross profit is also called gross margin. Gross profit is sales revenue minus the cost of sales (cost of goods sold). Gross profit is found on the income statement.

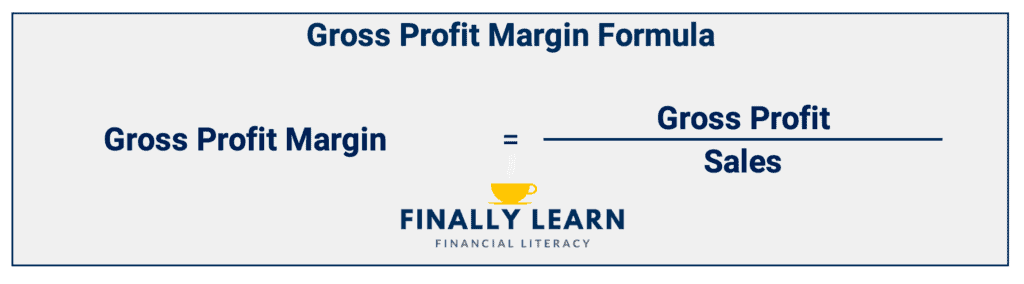

Gross profit margin

Gross profit margin is a company’s gross profit margin as a percent. Gross profit is after deducting the cost of sales but before operating expenses and taxes. Gross profit is sales revenue minus the cost of sales (cost of goods sold). Gross profit appears on the income statement.